EU dairy product availability Q2 2024: fats supplies remain tight

Thursday, 10 October 2024

Key points:

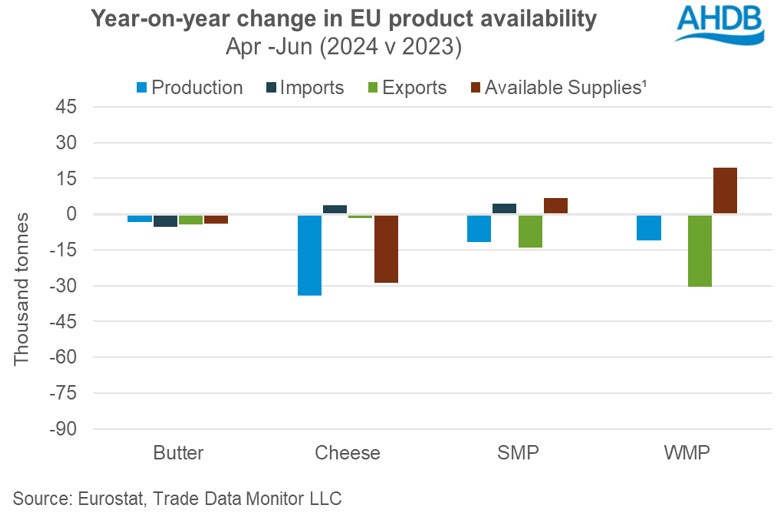

- Available supplies of EU’s dairy products are a mixed bag in Q2 2024

- Lower production drags down available supplies of butter and cheese

- Supplies of milk powders edge up

- Poor performance of exports across all categories

Availability of butter and cheese in the EU continued to be tight in Q2 2024 while supply of milk powders edge up. Available supplies have been challenged by trade dynamics and supply. Despite 1% growth in milk deliveries in the third quarter year-on-year, production of dairy products remained lower. Consumers are hesitant to buy at higher prices and keep large stocks.

Demand on the continent remained subdued both on the domestic and global front. In domestic markets, consumers are wary of their spending. Higher prices of European dairy products in the global market, made it less lucrative thereby weighing on export demand. Exports declined to China, followed by Middle East and North Africa (MENA).

Butter stocks decline as processors churn less

The available supplies of butter fell primarily due to lower production. Processors are producing more cream rather than churning into butter as domestic and export demand for cream looks firm and butter export volumes lowered during the period. Good demand from the bakery sector supported prices around higher levels coupled with tight supply.

Cheese production declined

Cheese supplies also trended lower compared to Q2 last year. Although imports grew, production was lower year-on-year. Exports also remained marginally lower during the period with less going to the UK, Middle East and North Africa. Limited availability of milk weighed on production.

Supplies of powders trend up

Available supplies of SMP increased 3.1% year-on-year in Q2 2024. Whilst exports were lower by 6.5%, imports increased by 43.8% and production fell by 2.8% year-on-year as less butter was churned. Exports declined majorly to China followed by South Africa and Asian countries.

WMP saw a year-on-year increase in availability following a large drop in exports due to low production and uncompetitive prices compared to Oceania. As a result, demand was less from Algeria, China, Middle East and Asian countries.

1Available supplies = production + imports – exports

In 2024, the European Commission expects milk deliveries to increase 0.5% year-on-year according to the latest short-term outlook report following fine balance between milk yields and decline in the dairy herd. Coupled with this, demand will be a major driver for the direction of the market. Though there are signs of recovery in domestic demand, much depends on the acceptance of the consumers around higher price levels. Food inflation remains higher than the general inflation and retail prices of certain dairy products have increased notably according to the European Commission.

The recent EU/China dispute is a key watchpoint and whether it will it be an opportunity for UK producers is yet to be seen. Bluetongue is spreading in EU, and this coupled with growing pressure of environmental regulations, labour shortage and high interest rates are a matter of concern for the industry. Going forward, global economic and geopolitical developments will also influence the flow of trade and available supplies of dairy products.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.