EU/China Trade dispute – an opportunity for UK producers?

Thursday, 3 October 2024

Trade tensions between the EU and China have intensified over the past few weeks and months.

Following the US imposition of 100% tariffs on Chinese electric vehicles (EV’s), the EU imposed tariffs on individual manufactures range from 17.4% to 37.6%, which is on top of a 10% duty that was already in place for all electric cars imported from China. These tariffs are currently provisional while the investigation into Chinese state support for the country's EV makers continues. They are not likely to be imposed until later this year.

China wasted no time in responding and initiated an anti-dumping investigation into exports of pork and its by-products from the EU. There is concern in the EU that the dispute could escalate to include other sectors.

With the prospect of additional tariffs being placed on EU exports to China, does this create an opportunity for UK producers and exporters?

On the face of it, the additional tariffs make the EU product more expensive, which will favour other suppliers to China, including the UK. In theory, the UK can step in to fill the gap and benefit from the additional demand for its products to displace the now more expensive EU supply.

However, the downside risk is that there is likely to be excess product available within the EU, looking for alternative markets, including the UK. This will place downward pressure on EU prices and, as a result, downward pressure on UK domestic prices.

The extent to whether the opportunity will outweigh the risk varies by individual product. At AHDB we have been examining the potential sector by sector impact for our levy payers.

What are the prospects for dairy?

China has been boosting their domestic dairy supplies in recent years with a clear policy goal of increasing self-sufficiency. However, according to industry commentators China may have “overcooked” the drive for production. Post-covid domestic demand for dairy products fell, and a weaker economy has led to less demand. A declining birth rate has also cut demand for a myriad of dairy products from the highly lucrative infant formula market to children’s yogurts and snacking cheese. China’s statistics bureau reported that milk consumption fell from 14.4kg per capita in 2021 to 12.4 kg in 2022.

At the same time Chinese milk production has grown to 41 million tonnes in 2023, which was a 28% increase from 2019 and a 4.6% increase year-on-year (Source: GIRA). Chinese milk prices have fallen sharply and are not covering the cost of production in many cases. According to GIRA, from 2022 to 2023 20% of independent farms ceased production. One solution to this supply/demand imbalance is to adopt more protectionist policies with the goal of limiting imports.

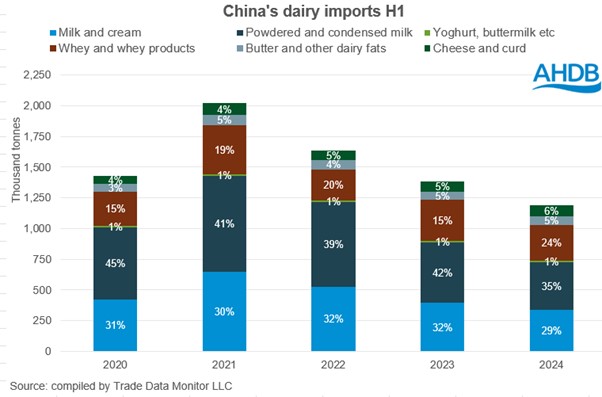

Even without additional tariffs Chinese import demand has been falling consistently year-on-year. Whey and whey products, milk and cream have been the biggest contributors to the decline. Rabobank are forecasting this demand to fall further this year by an additional 8%.

The probe will not cover the highest volume dairy categories including whey, whole milk powder, skimmed milk powder and butter. However, this scope could be increased in the future. It WILL cover cream and cheese.

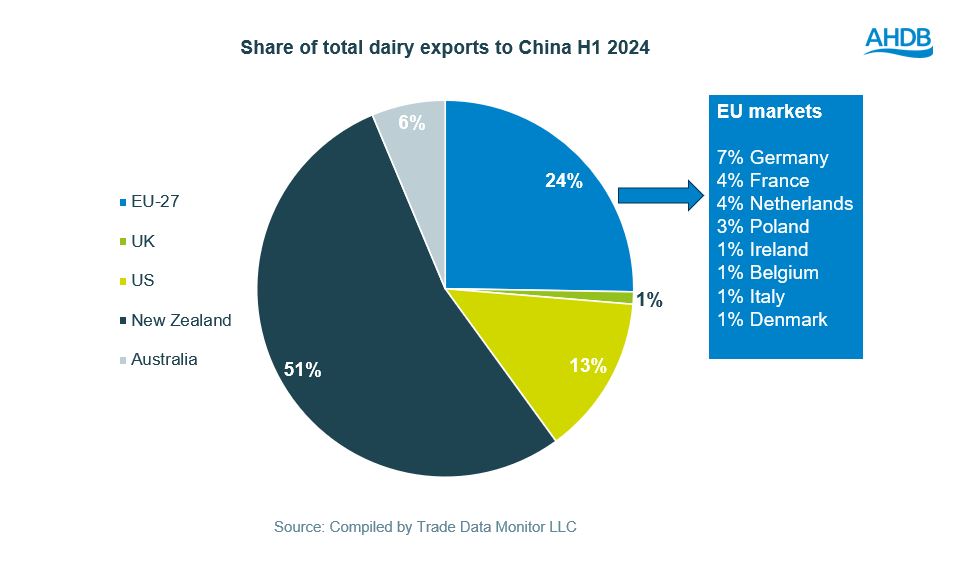

According to Rabobank, China imports more than 50% of its needs for these products despite having grown domestic production. Opportunity will vary by product. If tariffs were to be introduced then products sourced from Australia, New Zealand and the UK could displace more expensive European products. China’s imports of Australian and New Zealand cheese amounted to 20,920t and 107,000t, respectively, compared to 32,550mt from the EU. This could leave a gap that the UK could fill but considering the UK is a net importer of cheese it could be small volumes. The US have notably increased their cheese production capacity in recent months with the opening of several new plants so could be well placed to fill the gap. However, in May, President Biden announced that he would also be raising the import tariff on Chinese EVs from 25 to 100% over a three-year period which could indicate further retributive action.

For cream, China already sources more product from New Zealand than the UK with imports of cream at 147,500t in 2023, compared to 97,000t from the EU. Much would depend on where prices are at the time and availability of product. Current there is a high price differential between cream from Oceania and the UK meaning New Zealand would be better placed to service China. However, displaced European product could look to find a buyer on our shores which has the potential to decrease prices in the UK. Milk from the EU, no longer destined for China, would need to be turned into butter and skim which could also pressure prices.

Regionally, there could be more of an impact. The Northern Irish market has more exposure to world market forces as more products are produced which are exported, as well as cross-border trade into the Republic of Ireland.. As Ireland are the second biggest European cream exporters to China and the eighth biggest cheese exporter this also exposes Northern Ireland, disproportionately to the tariff restrictions. It has the potential to have a suppressing effect on local milk prices.

China is an enormous market but is no longer the growth engine that it once was. Whilst there may be opportunities for some British exporters there is also significant risk overall.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.