Q2 dairy trade review: exports decline while imports edge up

Tuesday, 27 August 2024

Key trends

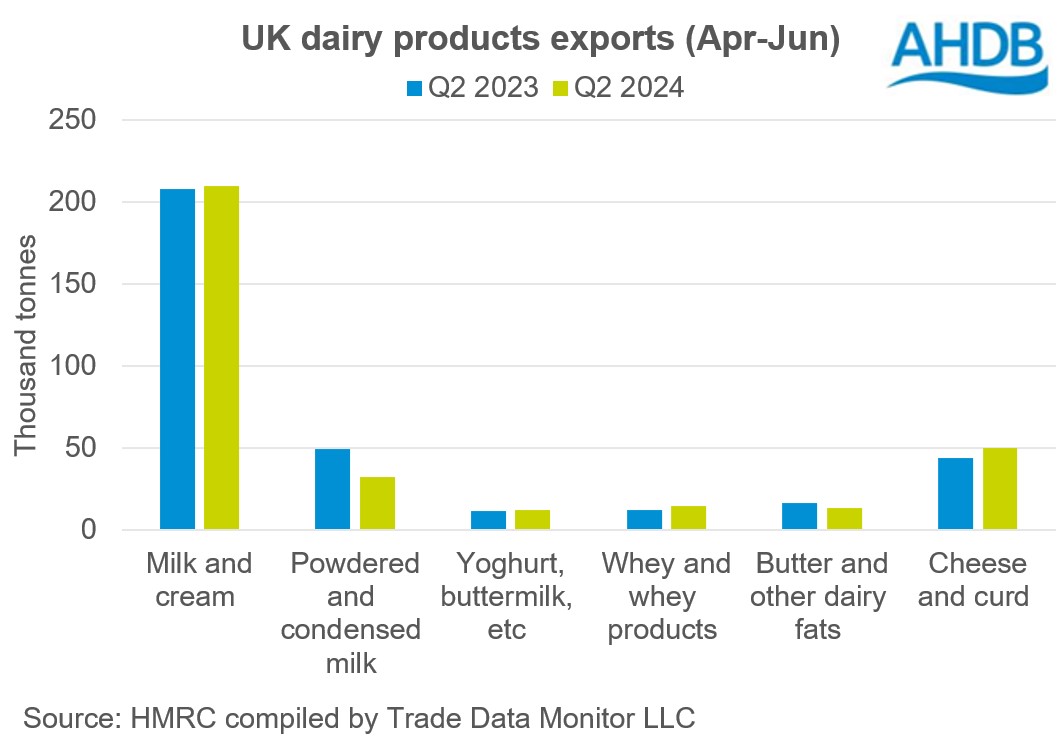

- Total UK dairy export volume for Q2 2024 declined by 2.6% year-on-year at 330,800tonnes.

- Growth in exports of cheese, yoghurt, whey and cream outweighed by massive declines in exports of powders and butter

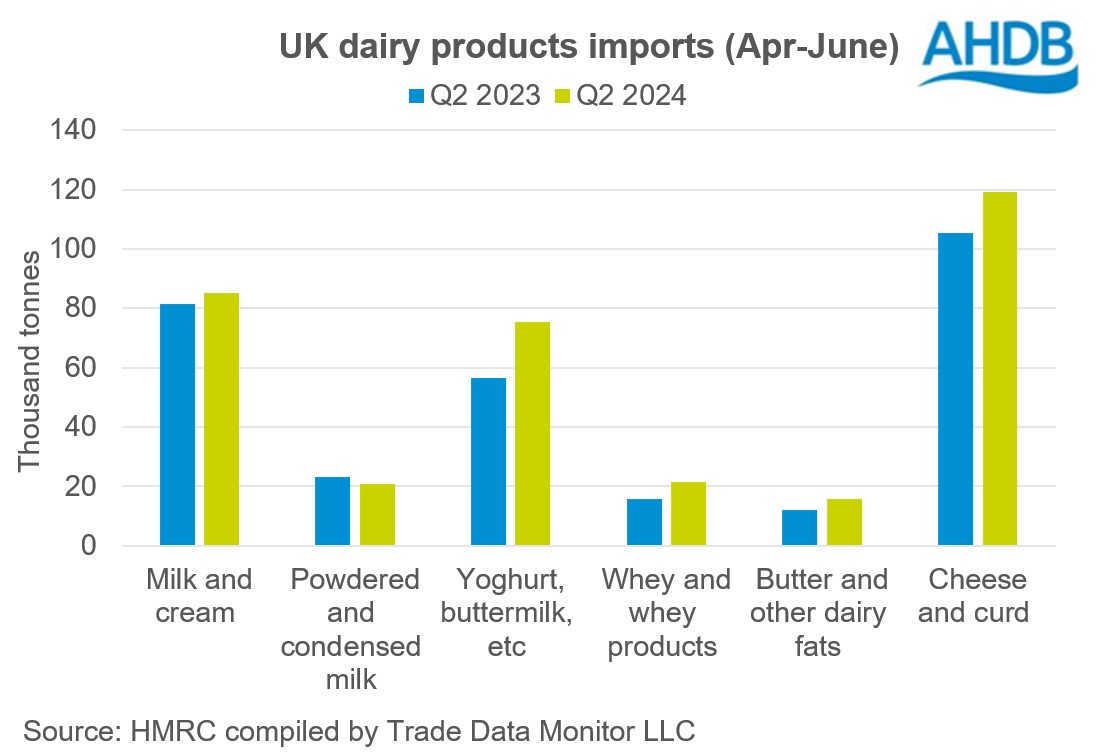

- Total UK dairy import volume for Q2 2024 surged 14.8% year-on-year at 337,600tonnes

- Yoghurt and cheese dominated year-on-year increase in the import basket and others follow the trend up with the exception of powders

Cheese exports continue to boom while butter and powders edge down

Total export volumes of dairy products from the UK have declined by 2.6% in Q2 2024 year-on-year. Total export volumes for Q2 2024 were 330,800t, a decline of 8,800t year-on-year. Exports of dairy products to the EU declined by 1,700t and that to non-EU nations declined by 7,000t during the period.

Despite the overall decline in exports, cheese, whey, milk and cream and yoghurt saw growth year-on-year. Cheese exports grew the most, increasing by 5,900t, followed by whey products at 2,600t. Exports of yoghurt increased marginally by 800t, however it is the highest recorded in a quarter since 2021. Exports of milk and cream increased by 1,900t. Increasing consumer demand for cheese supported the growth. Exports of powders declined very significantly by 16,600t (-34%) whilst butter declined by 3,300t (20%).

Growth in exports to the EU were mainly going to Ireland (+3,800t), Belgium (+2,700t), Spain (+900t), Greece (+200t). However overall exports declined due to lower exports to the Netherlands (-6,400t), France (-3,200t), and Italy (-600t). The decline in exports to non-EU nations also outweighed EU nations in Q2. Exports declined in emerging nations after a period of growth seen in the first quarter 2024. Exports to MENA nations; Algeria (-1,700t), UAE (-700t), Saudi Arabia (-300t), Libya (-300t); Asia (Bangladesh (-2,500t), China (-1,300t) and Africa (South Africa (-1,700t), Nigeria (-900t) declined on a year-on-year basis. Across product category, powders noticed significant decline followed by butter.

Imports edge up

Total import volumes in Q2 are up over 43,000t (14.8%) from year ago levels to 337,600t. This was predominantly driven by an increase of 38,400t from EU nations, which make up the vast majority of our imports. Major EU nations contributing to the increase are Ireland (+15,200t), Belgium (+9100t), Greece (+4,800t), Germany (+3200t), France (+1,800t) and Spain (+1,400t).

The most significant increase was seen in yoghurt by 18,700t (33.1%), followed by cheese and curd 13,800t (13.1%). Whey and whey products and butter also followed the trend increasing by 5,700t (36.1%) and 4,000t (33.5%) respectively. Milk and cream saw a minimal increase of 3,700t (4.6%) during the quarter compared to year ago levels. The imports of yogurt, cheese and cream have been influenced by the increase in consumer demand as reflected in the latest retail data, teamed with tightening domestic supplies. Conversely, imports of powders saw a decline of 2,300t (-9.9%), the only one to decline in the basket.

Imports from New Zealand continue to build seeing an increase of 5,100t in the second quarter year-on-year, most of which constitutes cheese and curd.

Opportunities for the UK

Increasing cheese exports denotes we are on the right track for delivering our commitment of increasing the exports of value-added products. With a muted spring flush this season, availability of dairy products is likely to be tight. This denotes imminent increasing imports. To balance that, increasing our foot hold in the emerging and established markets could be fruitful. With Irish milk production tanking in the recent times, there lies opportunities for British exporters. However, we need to be watchful of factors like weather, global economic and geo -political scenarios, which will shape the trajectory of future trade flows.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.