- Home

- News

- Dairy September forecast update: Decline in GB milk production for the remainder of 2024/25 to slow

Dairy September forecast update: Decline in GB milk production for the remainder of 2024/25 to slow

Thursday, 26 September 2024

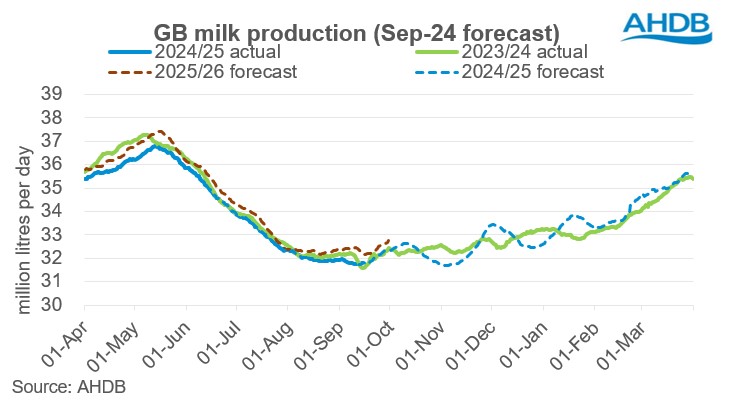

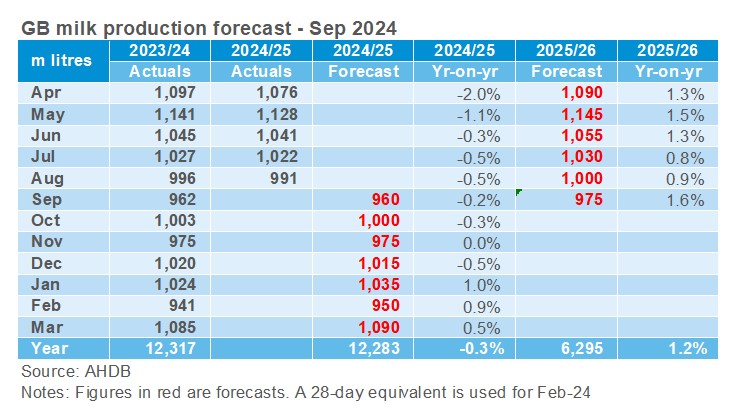

GB milk production for the 2024/25 season is forecast to reach 12.28 bn litres, 0.3% less than the previous milk year, according to our September forecast update

There was lively debate at the latest iteration of the Milk forecasting Forum with some feeling that rising prices and a (hopefully) more positive weather outlook should start to take the foot off the brake on milk production. On the other hand others felt that, despite rising milk prices, some of the more structural challenges faced by farmers including margins and poor quality silage in the shorter term, as well as access to labour, cost of borrowing and increased regulation would discourage farmers from boosting production further. The truth lies somewhere between these two positions and we have tried to balance both bullish and bearish factors in the forecast.

Challenges ease but remain

The milk year so far has run behind last year’s production having been affected by the lasting challenges of the very wet Autumn-Spring which led to lower yields. Coupled with this the size of the milking herd has declined year-on-year according to latest BCMS data available. Our latest forecast is estimated at 12.28bn litres, 0.3% (34mn litres) lower than previous milk year (2023/24).

Deliveries in the first five months of the current milk year (April-August) totalled 5,258mn litres, which is 47mn litres or 0.9% lower year-on-year. We are expecting production to improve from January onwards assuming a more normal winter and recent positive price announcements in September which is also expected to continue in October. However, grass quality is varied across regions. The grass growth is currently lagging behind last year and the five-year average. In certain areas the protein content in grass has been below the average level of 20%. Reports of poor quality sileage as a result will mean that farmers will need to feed more and could need to supplement more with additional feed which will pressure margins.

Considering these challenges, we have assumed lower yield growth in the remaining months of the calendar year. However, as the new season dawns, providing the winter is less exceptionally wet, we have assumed yield growth in the range of 0.5%-1.5% from February till September next year which should push milk production in a more positive direction.

The size of the GB milking herd has contracted as of 1 July 2024, which stood at 1.61 million head according to the latest BCMS data available. This is down 0.3% on the previous year and the herd size is expected to decline marginally going forward. The current record high prices of cull cow may favour herd reduction for some to boost cash flows in the Autumn/Winter. GB producer numbers have also declined as per our latest survey denoting further consolidation in the sector.

Input costs have eased recently, but they still remain at historical higher levels. This will be further exacerbated by higher interest rates meaning the cost of borrowing and overdrafts are much higher. Despite higher farmgate milk prices, higher operating costs and uncertainties pertaining to environmental rules, government support, disease outbreaks such as TB and BTV3, geo-political factors and weather remain a barrier between farmers confidence and growth in milk production.

With commodity costs flying high will milk prices follow suit?

On the other hand, farmgate milk prices have been nudging up for some time and with a GB average milk price of 39.09ppl some farmers will look to capitalise on this. The outlook for price changes in the next three months at least is extremely favourable with the fats market in particular at record breaking levels. The milk price to feed cost ratio has tipped into the expansion zone which would provide some upside to milk flows but the cow numbers and the forage quality needs to be there in order for the current direction of travel to change. It is likely that the more positive movements will be seen as we head towards the flush in Spring.

The downside of those very high prices on fats could put a break on demand once the price increases are passed on to consumers. At these price levels we would also expect to see manufacturers reformulating away from butter where possible. We are also seeing European and UK fat prices at a considerable premium to the southern hemisphere and even the US meaning that there could be some headwinds.

A fine balance

Considering both the bullish and bearish factors, milk production is likely to improve next year onwards assuming less poor weather during the spring and summer. Whether chasing marginal litres of milk around current price levels could be damaging or supportive of on-farm profit margins, will be a key watch point going forward. This will be instrumental in shaping the future milk flows in the market coupled with the sustainability of demand around higher price levels.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.