China dairy imports H1 2024: What’s in store for the rest of the year?

Tuesday, 20 August 2024

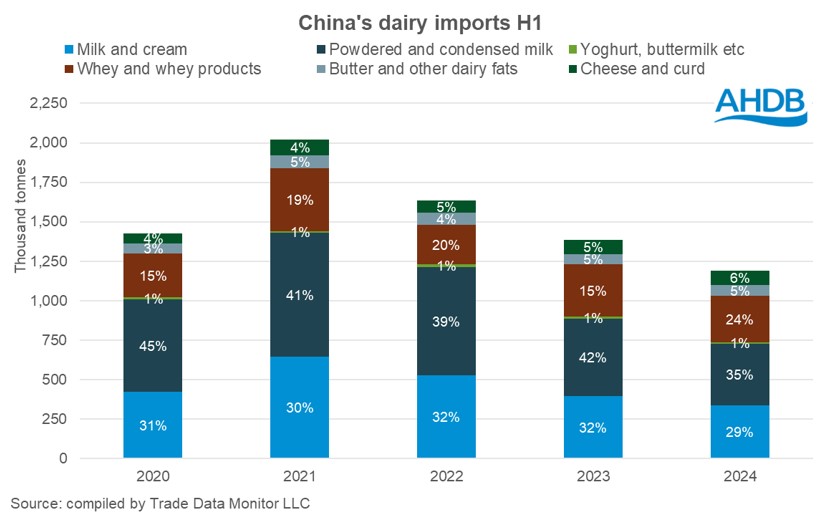

In the first half of 2024, imports of total dairy products in China were at their lowest since 2018. This has been primarily driven by increased self-sufficiency and a sluggish economy. China’s total import volume of dairy products stood at 1.19M tonnes, a decline of 14.1% year-on-year. This decline is the continuation of a trend noticed since 2022.

Self-sufficiency

Rabobank forecasts that China’s milk production will increase by 3.2% in 2024, to 43.3M tonnes. According to the National Bureau of Statistics, milk production volumes in Q1 grew by 5.1% year-on-year. Herd expansions and yield growth on larger farms have been the key drivers attributing to the increase.

With milk supplies increasing, the government is subsidizing WMP production. The longer shelf life of WMP makes it a good destination for excess raw milk to be absorbed. USDA forecasts WMP production in China to increase by 3.3% to 1.24M tonnes in 2024.

Key products topple year on year

Ample milk supply and increased production have weighed on powder markets. WMP imports have declined by 9.5% in the first half of 2024, and at 250,300t stand at the lowest recorded volume since 2016. A larger decline was noticed in imports of SMP, with volumes back by almost 36% year-on-year to 132,400t. As powders are the largest contributor to the overall import basket, these declines will impact global trade dynamics, likely pressuring prices.

Imports of milk and cream also saw a large decline, down 58,800t followed by whey losing 38,700t. Although the volume of whey has fallen year-on-year, the market share of the overall basket has increased compared to last year. Smaller volume decline was seen for yoghurt at 5,400t.

Butter and cheese buck the trend

On the contrary, imports of butter have seen good growth year on year, up by nearly 6,000t to 70,300t. Meanwhile, cheese imports have been more steady, increasing by just 560t to 88,400t. The increasing popularity of home baking and western food products has improved consumption of butter, cheese and curd. Improved demand from the recovering hospitality sector has also encouraged import volumes.

Where are the imports coming from?

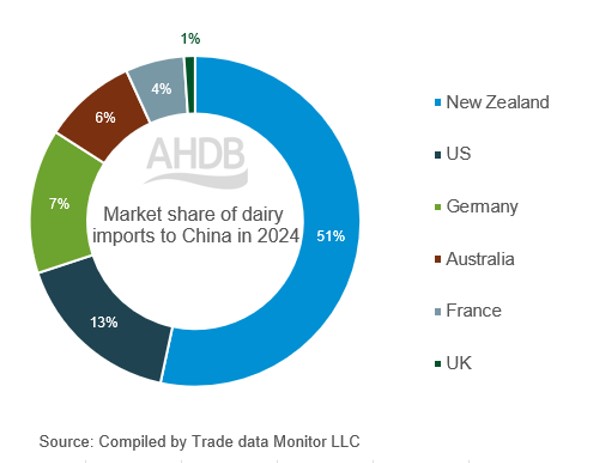

New Zealand remains the largest exporter of dairy products to China, capturing a 51% market share in the first half of 2024. Nearly half of the import volume from New Zealand is made up of powders, followed by milk and cream. The US is the second largest supplier of China’s dairy imports with around 95% of this product made up of whey and whey products. Other key importers include Germany, Australia and France.

The UK holds just less than 1% of total Chinese dairy import volume. Around 80% of UK shipments are made up of milk and cream, totalling 6,700t. Although volume from UK is not as significant as others, changes to demand from China have a ripple effect across global dairy markets.

The road ahead

China’s economy continues to face headwinds and with a shrinking population it is anticipated that dairy consumption will remain subdued. The declining trend in import demand during the last few years, particularly for powders, paints a gloomy picture of the overall global dairy market, potentially softening prices. According to Rabobank, overall Chinese dairy imports are likely to fall 8% in 2024.

However not everything in the air is gloom and doom. With consumers becoming health conscious, there is likely to be more spending on products deemed healthy and nutritious, which is a marketplace dairy products could excel in. Coupled with this, the appetite for butter and cheese has seen been increasing within the wealthier urban population. China’s domestic production of cheese and butter is limited by processing capacity and so this is a market opportunity the UK could tap in to further, especially with speciality cheeses.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.