How important is the UK’s ‘rollover’ of existing EU free trade deals?

Friday, 4 October 2019

The EU has around 70 free trade agreements (FTAs) with countries around the world. If the UK leaves the EU in a ‘no-deal’ scenario, it will no longer be able to enjoy the benefits of these FTAs. As a result, the UK Department for International Trade (DIT) is working on ‘rolling over’ these trade agreements by negotiating the continuation of the FTAs the EU has in place with various countries and trade blocs.

In this article, we look at the progress that has been made and what it means for agri-food trade.

How much food does the UK export to countries under EU-FTAs?

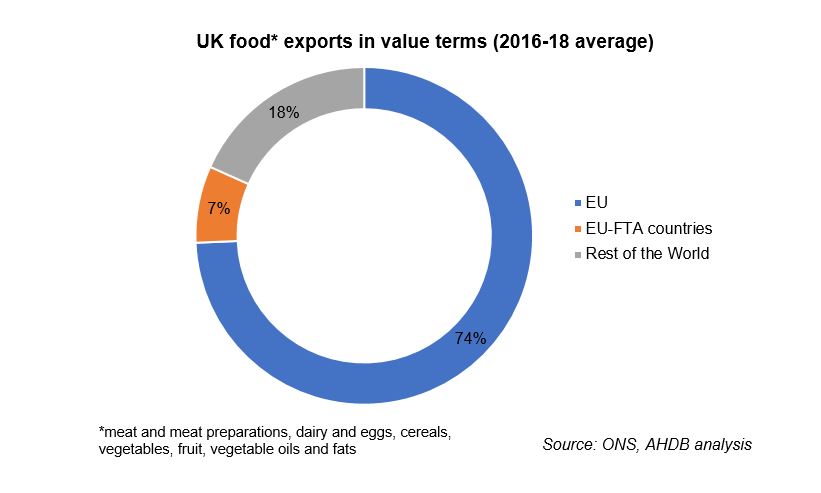

UK food exports to countries with which the EU has an FTA accounted for 7% of total food exports in value terms (2016-18 average). The main market for UK food exports is the EU, which accounted for 74% of the share of total exports in value terms over the same time period. UK food exports averaged £7,239 million between 2016 and 2018.

How many of these rollover trade deals have been agreed?

As at 1 October 2019, the UK had 15 agreements (covering 45 countries) signed or in place to continue after 31 October 2019.

The devil is in the detailThe countries with which an agreement has been reached account for 3% of total UK food1 exports. Countries for which it is unlikely that there will be a continuity deal in place by 31 October represented 1.6% of the share of total UK food exports (2016-18 average).

It’s worth noting, however, that even for agreed rollover trade deals, there may be elements which differ from the original FTA agreed with the EU.

For example, the continuity deal which the UK has agreed with Switzerland will not allow the UK to export organic products to the country and the UK will need to show equivalence for sanitary and phytosanitary (SPS) measures relating to plant health, animal feed, seed, animal health and trade in animals and animal products. The Food and Drink Federation (FDF) has estimated that 54% of existing UK food and drink exports (and 67% of imports) will be excluded from the continuity agreement.

What’s the incentive for Canada?

One of the EU-FTAs that the DIT is still in the process of negotiating a rollover for is the Comprehensive Economic and Trade Agreement (CETA) with Canada. However, the UK tariff schedule in the event of a ‘no-deal Brexit’ which was published in March 2019, provides little incentive for Canada to put pen to paper.

UK food exports to Canada (in value terms) accounted for 14.5% of total exports to EU-FTA countries (2016-18 average). If a continuity deal is not agreed and the UK leaves the EU under a ‘no-deal’ scenario on 31 October, these exports will face WTO tariffs rather than being tariff free under CETA. Cheddar exports, for example could face tariffs of 245% of the overall price. Though to put things in context, UK cheddar exports to Canada account for 2% of total UK cheddar exports (2016-18 average).

On the other hand, around 87% of Canadian goods coming into the UK would have tariff free access under the UK tariff schedule. As a result, there is little incentive for Canada to sign a continuity agreement with the UK.

Why is Japan a ‘no-go’ for the Brexit deadline?

One of the continuity trade deals that is unlikely to be agreed by 31 October 2019 is an agreement with Japan. In value terms, UK food exports to Japan (2016-18 average) accounted for over 10% of total exports to EU-FTA countries.

The reason for the stumbling block is that Japan expects more concessions from the UK than it did from the EU when it negotiated the EU-Japan Economic Partnership Agreement. This could be a likely theme as the UK seeks to negotiate trade deals post-Brexit.

Rules of Origin

Even for continuity agreements which have been agreed, there may be issues ahead, particularly for satisfying Rules of Origin (RoO) criteria. As part of the EU, when the UK trades with countries that have an FTA with the EU, the RoO criteria means that any product that is produced in the EU can be used in a product exported by the UK. If the UK leaves the EU without a deal on 31 October, products used in UK exports which originate from other EU countries may mean that the RoO threshold is exceeded and so wouldn’t be eligible for any preferential tariffs or conditions.

For example, if a cake was to be exported from the UK to one of the EU-FTA countries but the flour that was used to produce it was from Germany and the butter used to produce it was from Ireland, it may not qualify for a preferential tariff as a sufficient proportion wasn’t made from ingredients produced in the UK.

What will be the overall impact?

While there has been a fair amount of attention on the number of EU trade deals the UK has been successful in ‘rolling over’ in preparation for the Brexit headline, the fundamental point is that these countries represent a much smaller share of UK exports compared with the EU. This is true not only for food, but for all goods. Nevertheless, for seed potatoes, agreeing a continuity deal with Egypt and Morocco is important as they are the destination of the majority of UK seed potato exports.

If the UK leaves the EU under ‘no-deal’ circumstances on 31 October (or even a later date), WTO tariffs will apply to exports to the EU, the destination of 74% of total UK food exports in value terms.

Other issues such as RoO criteria might nullify any preferential access to countries where a continuity deal has been agreed. Furthermore, examples of negotiating continuity agreements with Canada and Japan have shown that trade negotiations post-Brexit with countries outside of the EU may not be as straightforward as some may think.

Topics:

Sectors:

Tags: