Feed Report: 23 February 2022

Wednesday, 23 February 2022

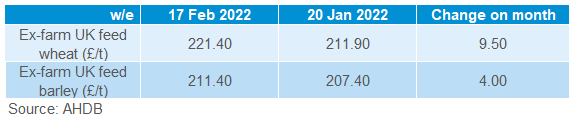

Grains

Grain prices (as at 18 February) are up from late January when we wrote our last report. There are two main reasons for this:

- Firstly, the political situation between Russia and Ukraine. Both countries are major exporters of wheat, and Ukraine also ships sizeable volumes of maize and barley. Exports are continuing for now. But any conflict could mean disruption and push extra demand to other major exporters, such as the EU or US. Until the political situation is resolved, the threat of disrupted exports will continue to support wheat prices.

- Secondly, dry weather in South America has cut production for the earliest planted maize crops. Some crops are still in their critical growth stages and rain in the last week of February is critical. But, Brazil’s second, or Safrinha, crop is expected to account for 48% of production in the region this year (Conab/USDA). These crops are being planted and rainfall levels in March and April matter for these crops.

These issues are likely to support prices in the short term. But, the outlook is uncertain in the longer term (six months or more ahead). There is potential for grain production to recover, which could bring prices down a bit. So far, things look good in Russia and the EU, but dry in the US.

However, stocks are very low. So, even if all goes well with the 2022/23 crops, the recovery in stocks and subsequent respite from high prices might not be as big as wanted. The condition of crops for harvest in 2022/23 will increasingly drive prices in the coming weeks and months.

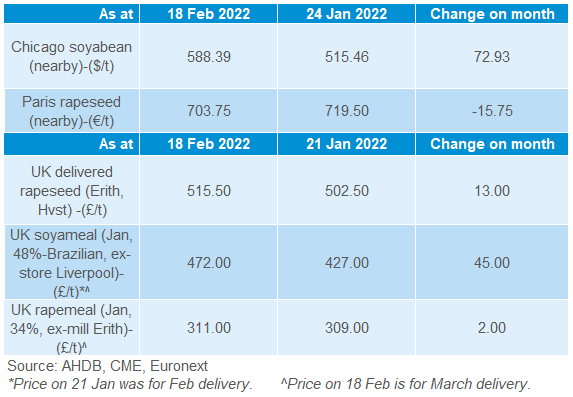

Proteins

Like grains, dry weather in South America has pushed up oilseed prices, especially soyabeans. For soyabean crops, the impact has been more severe than maize.

Global soyabean stocks are expected to fall year on year, when previously they were predicted to rise. Harvests are ongoing in South America and if the crops are smaller than expected, there is also potential for stocks to fall more. Smaller crops could mean prices rise further.

The political situation in Russia and Ukraine is also a factor in protein price rises. Brent crude oil is now close to $100/barrel, which has pushed up prices for vegetable oils, including rapeseed. While the situation continues prices of oilseeds and related products are likely to be supported.

Looking to the longer-term:

- Rapeseed supplies will stay tight so prices will stay relatively high until the 2022/23 harvests start in the summer. If we get bigger crops in 2022/23, prices could ease a bit.

- The main potential for prices to fall comes from a larger 2022 US soyabean crop. US farmers are currently expected to plant more of the crop due to high prices and if this happens, prices for autumn delivery could fall.

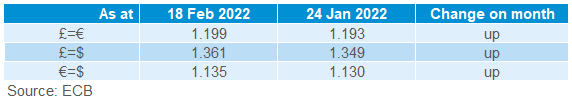

Currency

Sterling is stronger against both the euro and US dollar than in late January, though it has fluctuated quite a bit. This strength is due to the UK economy re-opening as COVID-19 restrictions eased and the rise in the Bank of England interest rate. Stronger sterling makes imports relatively cheaper and may have helped to mitigate a little of the global price rises.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.