Drought cuts Brazilian soyabean crop: Grain market daily

Tuesday, 1 February 2022

Market commentary

- Wheat prices around the world fell yesterday. Rain is forecast for the US winter wheat areas, while fears are also easing about the impact of tensions in the Black Sea.

- May-22 UK feed wheat futures fell £4.30/t to £216.70/t, while the Nov-22 contract lost £6.25/t to £195.00/t.

- UK ex-farm feed barley remains at a narrow discount to feed wheat. Last week (up to Thu 27 Jan), spot feed barley averaged £210.10/t. This was just £4.00/t below the average price for spot feed wheat.

- In contrast, cuts to South American crop forecasts pushed up Chicago soyabean prices. This likely helped May-22 Paris rapeseed futures to gain €5.25/t to €715.75/t. New crop (Nov-22) Paris rapeseed futures didn’t follow this due to larger 2022 EU-27 crop expectations.

Drought cuts Brazilian soyabean crop

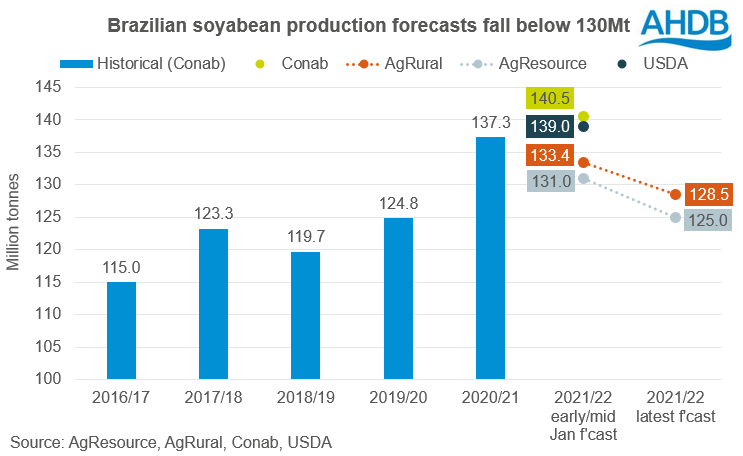

Yesterday, two private forecasters sharply cut their estimates of Brazilian soyabean production. This follows recent dry and hot weather in southern Brazil.

AgResource dropped its forecast for the crop by 6.0Mt to 125.0Mt. Meanwhile, AgRural cut its forecast by 4.9Mt to 128.5Mt. Both forecasters already predicted the crop to be smaller than last year but have now extended the margin.

This contrasts with the USDA and Brazilian state forecaster, Conab. On 10 January, both organisations cut their forecasts but still predicted a record crop.

Harvest is underway, with (Conab). If yields confirm a smaller crop than last year, this will further shrink global soyabean stocks in 2021/22. In turn, this could support soyabean prices.

Last week, South American soyabean worries contributed to a rise in old crop rapeseed prices. So far this week, the focus in rapeseed markets seems to be on potentially larger 2022/23 rapeseed crops. But, a rise in soyabean prices is likely to reduce the extent of any falls in the rapeseed market.

First maize crop also trimmed

Brazil’s first maize crop is anticipated to account for 22% of total Brazilian maize production in this season (Conab). However, 43% of this first maize crop (5-year average) is produced in the south and Mato Gross do Sul, areas affected by drought.

As a result, AgResource also cut its projection for the 2021/22 first maize crop by 3.8Mt to 19.9Mt. If confirmed, this would be 4.8Mt smaller than last year.

This puts more pressure on the second (Safrinha) crop to stop global maize supplies from shrinking further. Global maize prices act as a ‘floor’ to wheat prices, so tighter maize supplies would ultimately mean support for wheat prices too.

Old crop UK wheat prices are currently well above imported maize prices. But, this gap can only close so far before wheat prices also start to rise.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.