Why Black Sea tensions matter for wheat: Analyst’s Insight

Thursday, 20 January 2022

Market commentary

- Global wheat prices rose again yesterday, as political tensions between Russia and Ukraine continue. Short-covering by speculative traders and technical trading signals also contributed to the rise.

- Old crop (May-22) UK feed wheat futures gained £5.50/t to £219.00/t, while new crop (Nov-22) prices rose £4.10/t to £198.00/t.

- Uncertainty over the extent of the benefit of recent rain in parts of Brazil and Argentina also supported Chicago maize and soyabean prices.

- Paris rapeseed futures benefited from the lift in Chicago soyabean futures and stronger crude oil prices. Old crop (May-22) rapeseed futures gained €13.50/t to €700.50/t, while new crop (Nov-22) prices rose €8.50/t to €588.50/t.

Why Black Sea tensions matter for wheat

Political tensions in the Black Sea are a big part of why wheat prices have bounced in the past few days. The latest news relates to comments by the US Secretary of State about the number of Russian troops near Ukraine’s border.

Political and/or economic events often have more impact on grain prices in our winter. This is because there’s less news about grain supply. But, the tensions matter as both Russia and Ukraine are major exporters of wheat.

Further escalation of the tensions could disrupt grain exports from the region. It could also push up natural gas and/or crude oil prices. In turn, higher natural gas prices could push up nitrogen fertiliser prices, which are already very high. Meanwhile, higher crude oil prices can make it more attractive to use more biofuels, such as those made from wheat or maize. More demand for biofuels increases demand for the grains and vegetable oils they’re made from.

In early 2014, wheat and crude oil prices rose sharply as Russia annexed the Crimea. Between 19 of February and late March, nearby UK feed wheat futures rose over £13/t (+9%).

When we compare the USDA’s export forecasts made in January 2014 and the latest estimates, it suggests that the total exports from Russia and Ukraine were not impacted in 2013/14. For example, in Ukraine, the latest export figures for 2013/14 are close to the forecast made in January 2014 (-0.2Mt). For Russia, over the same period the latest estimates are higher (+2.1Mt).

Despite this, uncertainty is a powerful driver of markets. The situation dominated headlines for weeks in the spring of 2014. Meanwhile, the uncertainly added to the complexity of global trade.

This season, global wheat supplies are so tight that any disruption to exports from the region could have serious impacts. The USDA forecasts wheat stocks held by all major exporting countries at the end of 2021/22 is estimated to be the lowest since 2007/08. This is despite increases in last week’s USDA report. What’s more, Russia and Ukraine account for far more of wheat trade (29%) than they did in 2013/14 (17%).

The current export situation

The two countries have exported significant volumes of grain already this season. But, there is still much more to ship:

- So far in 2021/22, Ukraine’s Agriculture Ministry reports the country has exported 16.1Mt of wheat (July to 10 Jan, Refintiv). This equates to two-thirds of the USDA’s latest forecast (24.2Mt).

- Meanwhile, Russia have exported an estimated 21.1Mt from July to December (Refintiv). SovEcon estimate that a further 2.6Mt could be shipped in January. Combined, this could take Jul-Jan exports to 23.7Mt or 68% of the current USDA forecast (35Mt).

Based on the latest USDA forecasts, this leaves around 20Mt to ship before the end of June. This is a significant volume. It means the market is still vulnerable to any potential disruption to exports from political tensions. As a result, if the political tensions continue, they could well continue to offer some support to old crop prices for some weeks yet.

New crop risk as well?

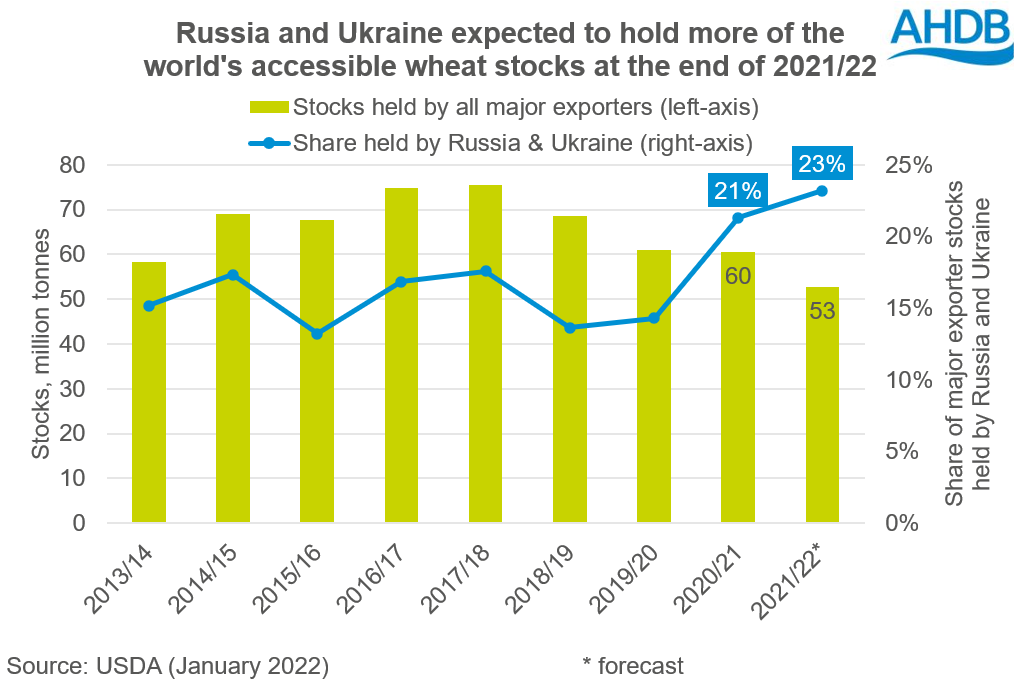

It’s also worth bearing in mind that Russia and Ukraine are expected to hold more of the exportable wheat stocks than normal at the end of this season. The stocks held by major exporters are important as they are most accessible to the market.

The amount of stock held by major exporters is already low and expected to fall further by the end of this season. This gives a low buffer against any production issues in 2022/23.

The political tensions in the Black Sea region could threaten the market’s ability to access 23% (Ukraine and Russia combined) of those accessible stocks. If this happens, it could give some further support to new crop prices. However, this will only be a factor if there are potential issues with the global 2022/23 crop.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.