Market Report - 31 January 2022

Monday, 31 January 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

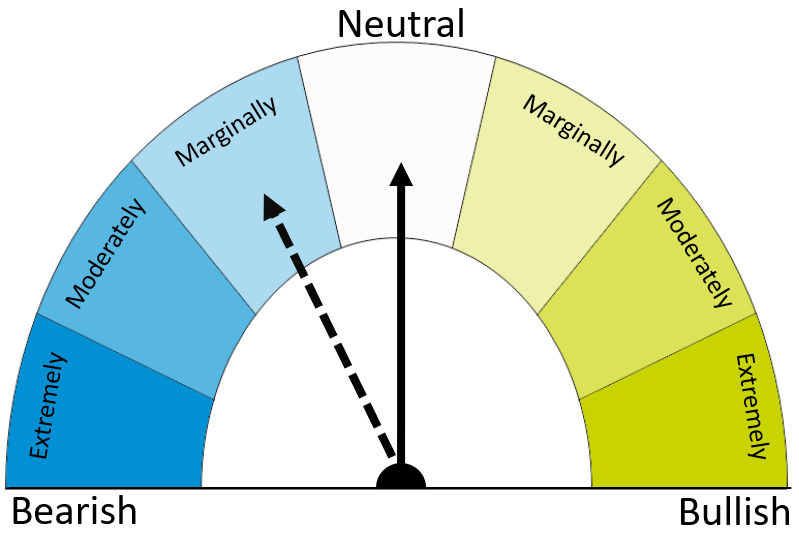

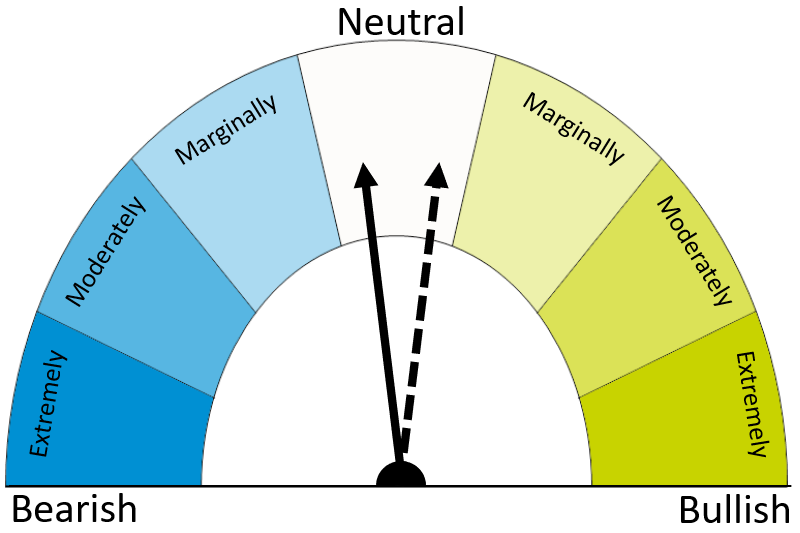

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

Old crop wheat needs to hold a premium over maize to avoid attracting too much animal feed demand. A rebound in wheat crops in 2022/23 could mean softer prices longer-term, albeit from current high levels.

Maize

Recent rain benefited crops in South America, but there’s still a long way to go. Any reductions to yields beyond current market expectations are likely to support prices, while better than expected yields could bring pressure.

Barley

Global barley supplies remain tight until at least the northern hemisphere harvests. This will keep prices at a narrow discount to wheat until more is known about the 2022/23 barley crop.

Global grain markets

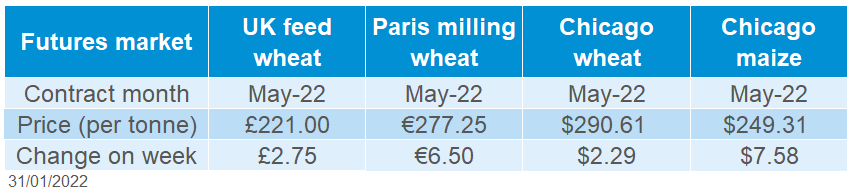

Global grain futures

There were some big fluctuations in wheat prices last week. Prices rose on continuing tensions between Russia and Ukraine. The importance of exports from the region were bought home as Egypt again bought solely Black Sea wheat last week. Freight costs made French wheat uncompetitive.

Meanwhile, maize prices continue to find support from less-than-ideal weather in South America.

In Argentina, rain in mid-January provided relief, but there is little rain in the forecast for this week. February rainfall is critical to the final yields according to the Rosario Grain Exchange. On Friday, the local USDA office forecast the Argentine crop at 51.0Mt, but cautioned the forecast may fall if conditions remain dry. This is already 3.0Mt below the official USDA figure.

Over half of early maize crops in Brazil are flowering and at grain fill, so weather conditions in the next few weeks will have a big influence on yields. The earliest crops are already being harvested (Conab). Meanwhile, the crucial Safrinha crop, which is expected to account for 76% of Brazilian output, is starting to be planted.

From a 2022/23 perspective, winter crops in Europe and the Black Sea are looking good. However, the crops have limited tolerance to low temperatures. This leaves them exposed to damage if temperatures drop, but this week at least, temperatures are likely to be above normal. Meanwhile, winter wheat in the US is showing negative effects from dry weather. It’s still early but this is something to watch as we move forward.

UK focus

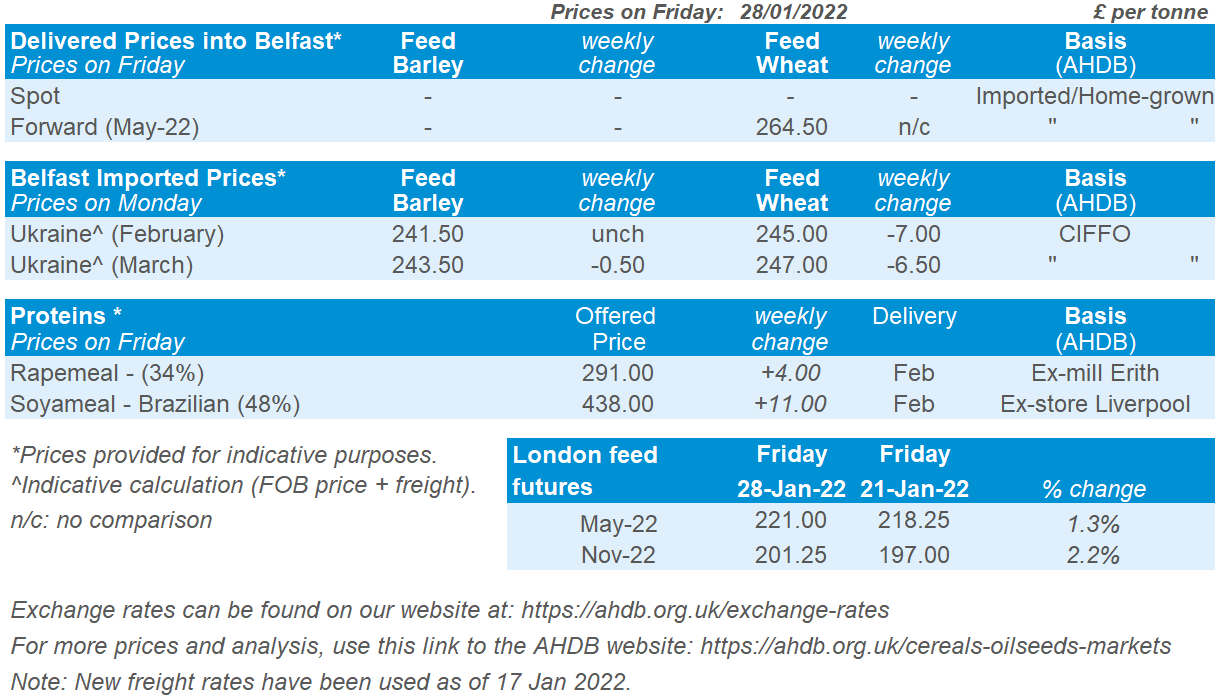

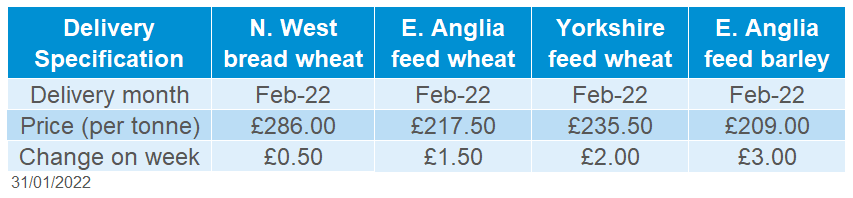

Delivered cereals

Old crop (May-22) UK feed wheat futures followed global prices last week. Overall, the May-22 contract gained £2.75/t Friday-Friday. However, prices were volatile. The May-22 contract closed as high as £228.00/t on Tuesday, before dropping back to £219.00/t on Thursday and ending Friday at £221.00/t.

On a delivered basis, bread wheat continues to hold very high premiums over the May-22 futures. North West bread wheat was reported at £70.00/t over the May-22 futures last week. A year ago, May-21 delivery was £37.50/t over the May-21 futures and two years ago, the May-20 delivered premium to May-20 futures was £33.05/t.

Volatility in the global market reportedly held back traded volumes for all wheat again.

Oilseeds

Rapeseed

Old-crop rapeseed remains tight until the Northern hemisphere harvest. Due to price incentive, global production for 2022/23 should increase. However, longer-term sentiment in soyabeans will influence new crop price direction.

Soyabeans

Soyabean prices, short-term, are finding support from the South American drought, but conditions are looking to improve slightly. Insight into yields when harvest fully commences will drive longer-term price direction.

Global oilseed markets

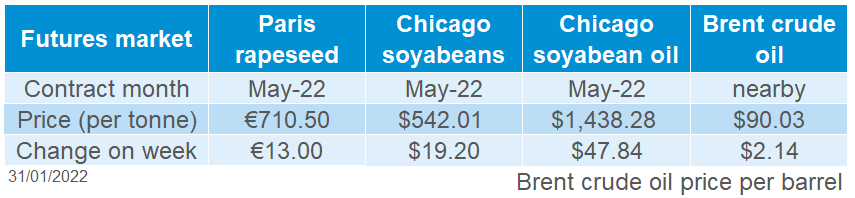

Global oilseed futures

It was a strong week for Chicago soyabeans as commodity funds were net-buyers. The May-22 futures contract gained 3.7% across the week, to close at a contract high of $542.01/t.

Several factors caused this weekly gain. Firstly, there are still worries about the scale of damage to the drought hit crops in Argentina and Southern Brazil. Despite the worst of Argentina’s drought being now past, the risk from dry weather remains (Rosario Grain Exchange). Over the next 14 days Argentina is expecting rains. However, it’s still abnormally dry.

Another supporting factor across the week was Indonesia announcing export curbs on palm oil, and mandating domestic sales. This provided a bullish spur to Malaysian palm oil futures (Apr-22), which gained 5.7% across the week (Fri-Fri). Chicago soyoil futures (May-22) followed suit by gaining 3.4% across the week.

Potential implications of the Russian-Ukrainian situation are further providing support to commodity markets. Nearby Brent crude oil gained 2.4% across the week, closing on Friday at $90.03/barrel. This is the first time oil has hit $90 per barrel since 2014.

Rapeseed focus

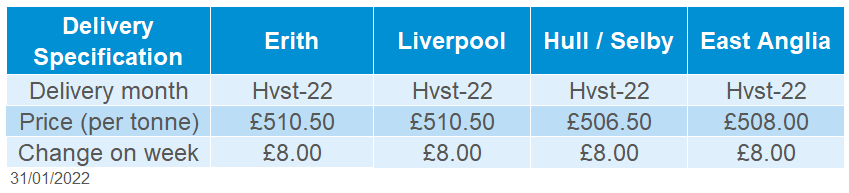

UK delivered oilseed prices

All the support for soyabeans and palm oil filtered into rapeseed prices. Paris rapeseed futures (Aug-22) closed Friday at €615.75/t, gaining €7.25/t across the week. The domestic delivered market followed. Rapeseed delivered (into Erith, hvst-22) was quoted at £510.50/t last Friday, gaining £8.00/t from 21 January.

The latest Stratégie Grains oilseed report revised up EU-27 rapeseed output by 200Kt on last month’s report. EU production for 2022 is now estimated at 18.2Mt, a 7.4% increase on 2021.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.