Palm oil prices jump on Indonesian export curbs: Grain Market Daily

Friday, 28 January 2022

Market commentary

- UK May-22 wheat futures slid back again yesterday, down £2.55/t to close at £219.00/t. After a weekly high seen at Wednesday’s close (£228.00/t), global wheat markets have steadied as investors monitored the stand off between Russia and the West over Ukraine.

- The UK Nov-22 wheat contract followed the same pattern to a lesser extent, closing yesterday at £198.65/t, down £0.85/t on the day.

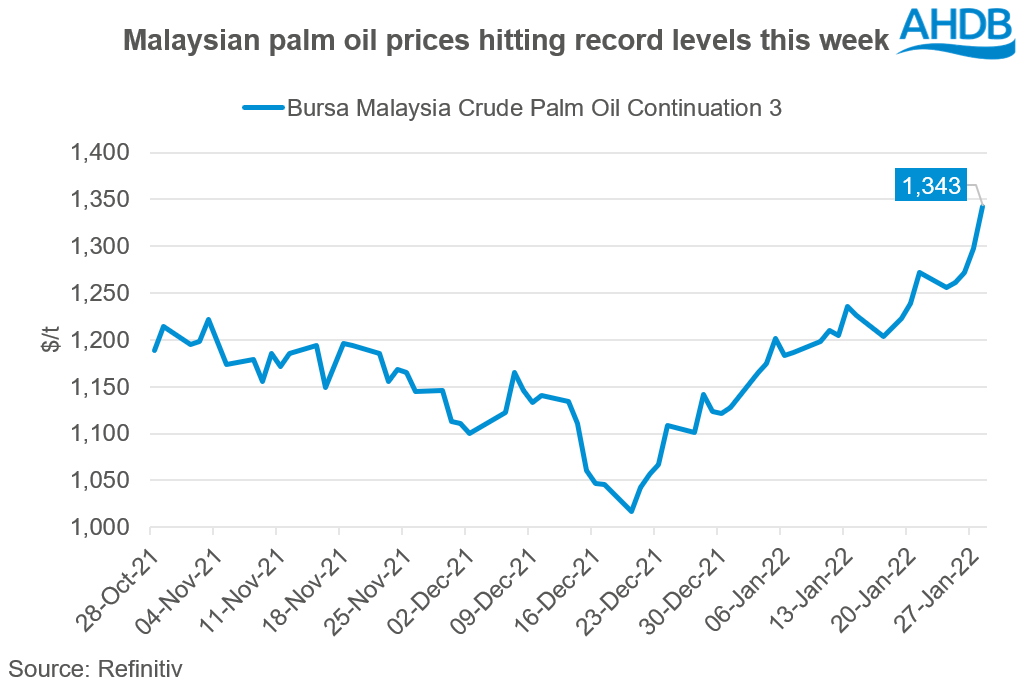

- Indonesia announced yesterday plans to limit palm oil exports, ruling that 20% of the edible oil must be sold domestically. This moved Malaysian palm oil futures (continuation 3) to a record 5,639 ringgit/t. This would make the traditionally cheapest of the three major edible oils (soyoil, sunflower oil and palm oil) the most expensive, and could lead major buyers to turn towards cheaper soy and sunflower oils (read more below).

Palm oil prices jump on Indonesian export curbs

Yesterday, the Indonesian government announced plans to curb the exports of palm oil. This move would see 20% of the vegetable oil mandated to be sold domestically, thereby limiting volumes available to global markets.

Indonesian authorities have announced this ruling in an attempt to dampen rising local cooking oil prices, which have risen c.40% from a year earlier as global prices soar. No timeline has been given as to its end date, the trade minister for the country citing that they would be in effect until domestic prices have stabilised.

Malaysian palm oil prices have hit record levels this week, closing today at $1,343/t (5,628 ringgit/t) and trading as high as $1,346.47/t during the session.

So what could this mean for markets?

Traditionally, Malaysian palm oil has been the cheapest of the three major traded vegetable oils. This recent move makes it to the most expensive.

As such, we may well see major buyers turn to soyoil and sunflower oil, as more cost-effective alternatives. This in turn could offer further support for soyabeans.

Already in 2022, we have seen soyabean prices climbing. Weather concerns in South America and downward revisions to production numbers have supported prices as the month has progressed. Further demand for soyoil and therefore soyabeans provides a bullish tone, which could in turn support rapeseed prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.