Chicago soyabeans are jumping: Grain market daily

Friday, 21 January 2022

Market commentary

- UK feed wheat (May-22) softened yesterday, down £0.15/t to close at £218.85/t. The Nov-22 contract fell by the same amount, ending the day at £197.85/t. Markets looked to be taking a breather, following three days of price rises.

- Chicago soyabeans (May-22) had its biggest jump of the season, up $12.40/t to $527.04/t (read more below).

- Paris rapeseed (May-22) followed soyabeans trajectory, though to a lesser extent. The contract finished the day at €705.00/t, €4.50/t more than the day earlier.

- Malaysian palm oil futures ended at a record high this week, with lower January output and export limit plans driving the rises. The contract for April delivery has ended the week at 5,323 ringgit ($1,271.92)/t, up 3.9% on the week.

Chicago soyabeans are jumping

The Chicago May-22 soyabean contract had its biggest jump of the season yesterday, up $12.40/t to $527.04/t (£387.05/t). This was driven by several factors, including rising export hopes, South American crop concerns, and technical buying. Let’s look into these in more detail.

Is China back in the buying mood?

The trade is reasonably bullish for US export sales this week. Estimates range from 600Kt – 1,200Kt of soyabeans (736Kt the week before). Rumours that China is back in a buying mood are circulating, offering support. China almost doubled its US soyabean imports in December, receiving 6.09Mt against November’s 3.63Mt. The hike is largely attributed to Delayed shipments as a result of Hurricane Ida. Good crush demand is also driving sales.

This week’s export report is due at 13:30 GMT. Any export figures above or below trade expectations could lend a bullish or bearish tone respectively.

South American worries rumble on

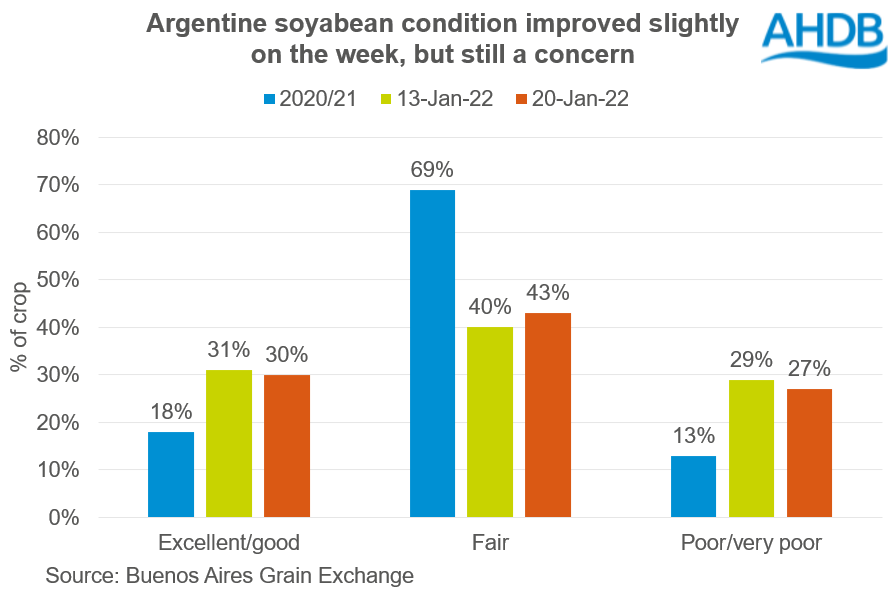

South American weather woes continue to affect market sentiment. In the latest report from Argentinian agency Buenos Aires Grain Exchange, soyabean crop condition was pegged at similar levels to week earlier, with 30% of the crop rated “good-excellent”. This is down 1 percentage point on the week. Yet, abundant rains are forecast, which may mute any further price rises.

However, Brazil remains the headache. The south of the country continues to be impacted by extremely hot and dry conditions. Some producers fear significant crop loss. Rio Grande de Sul, in the south, accounts for c.16% of Brazilian soyabean production.

Conversely, it has been the wet weather affecting the crop in the north of the country. Harvest is now underway, standing at 1.7% complete as at 17 January. This is ahead of last year's progress (0.2% at the same point) when the crop was planted later. The rains have delayed progress, although it is hoped with an improving forecast next week that progress will move forward.

With an already tight global soyabean outlook, the world needs strong production from South America this season. The record Brazilian soyabean area is already being walked down in the latest estimates from all parties. Any further weather woes will only support the price further, which could in turn support rapeseed prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.