Is palm oil the base of supported vegetable oils? Grain market daily

Wednesday, 17 November 2021

Market commentary

- UK wheat futures (May-22) closed yesterday at £226.25/t, down £1.90/t on Monday’s close. The Nov-22 contract closed yesterday at £199.25/t, down £1.50/t on Monday’s close.

- After 6 successive sessions of gains, Chicago wheat (May-22) closed yesterday, down 1.90% on Monday’s close at $303.14/t.

- Pressure came from a strengthening dollar, against the Euro and Yen, combined with profit taking.

- According to the German oilseed industry association UFOP, the countries winter rapeseed area for 2022 harvest is likely to rise to 1.03 – 1.08Mha.

- The UK’s planted area intentions will be published this Friday, in our Early Bird Planting Survey.

Is palm oil the base of supported vegetable oils?

Recent support within oilseeds markets is due to a variety of reasons spanning from soyameal demand to US export demand, as well as the liquid (oil) market.

Global trends have transpired into our domestic rapeseed values. Last Friday (12 Nov), delivered OSR (into Erith, Feb-22) was quoted at £612.50/t, up £11.00/t, on the week before.

Oilseed rape will likely sit at the top of the oil/oilseed complex for the rest of this marketing year due to tight global supplies. However, other commodities within the vegetable oil/seed complex can drive the sentiment, filtering down into domestic rapeseed values.

Remembering palm oil

Palm oil is a big player in the vegetable oil market. Europe’s use of palm oil relies solely on imports to fulfil demand. The EU commission forecasts palm oil imports at 6.2Mt for the 2021/22 marketing year. The USDA peg 2021/22 EU imports of palm oil at 6.9Mt.

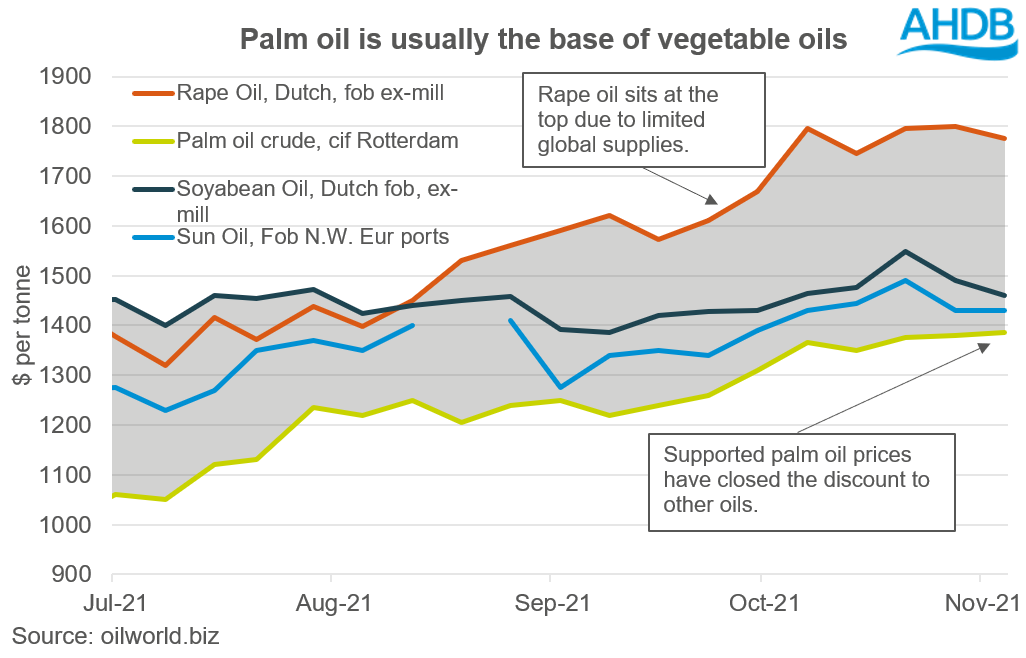

As the graph shows above, palm oil sits at the bottom of the vegetable oil complex. Meanwhile, as mentioned in the introduction, rape oil (due to scarcity this year) sits at the top. But all oils drive one another.

Recent support for palm oil

Since July, palm oils discount to other oils has narrowed. Malaysian palm oil futures (delivery 3 months from now) have increased 28.8% (in USD terms) since the start of July.

Recent news, such as differences in Malaysian palm oil export data, can influence prices. Malaysian exports for 1-15 November 2021 have risen compared to the same period in October, but depending on which data source you look at they have jumped anywhere from 10.3% to 29.4% .

It is expected that these strong exports and lower production (Malaysian outputs is less between November and March) will reduce Malaysian palm oil inventories. Monthly ending stocks for October are currently pegged at 1.83Mt, which is the second highest so far for the 2021 calendar year and is up 17% year-on-year.

What could happen?

Although Malaysian palm production will slow, stocks remain high.

If palm oil prices do not retract, we could see other oils such as soy, rape and sun stay inflated. This is because conventionally palm oil is the cheaper source of vegetable oils. This will inherently have impacts on the price of the oilseed that produce these oils, like rapeseed.

Although this news around palm can drive sentiment in the second half of this marketing year, the main watch points will likely be:

- South American soyabean crop production – weather is favourable in Brazil currently

- Whether Chinese demand is strong in the second half of the 2021/22 marketing year.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.