New-crop US wheat conditions down: Grain market daily

Wednesday, 26 January 2022

Market commentary

- UK feed wheat (May-22) futures climbed £6.00/t yesterday to close at £228.00/t. Though this morning has re-traced some gains. New crop futures (Nov-22) closed at £204.00/t, gaining £4.45/t on Monday’s close.

- Gains were made following US and Paris wheat contracts up, strengthened by rising political tensions in the Black Sea region as well as poor US crop conditions. There is more information on US crop conditions below.

- Recent rains in Argentina in the Northwest have reportedly improved the outlook for maize and soyabeans according to Bolsa de Cereales (Refinitiv). Though the South has received less rain. More rain forecasted in the Northwest and central Argentina in the coming days, but the South looks to remain dry (Refinitiv).

New-crop US wheat conditions down

Yesterday, we saw Chicago wheat (May-22) futures climb $6.70/t to close at $302.09/t. UK feed wheat (May-22) futures followed prices up, as discussed in the market commentary.

One of the factors supporting prices yesterday, was poor US crop condition scores. Although there is still a lot of crop development between now and harvest. These crop condition scores build sentiment into the market as speculations are made on potential yields.

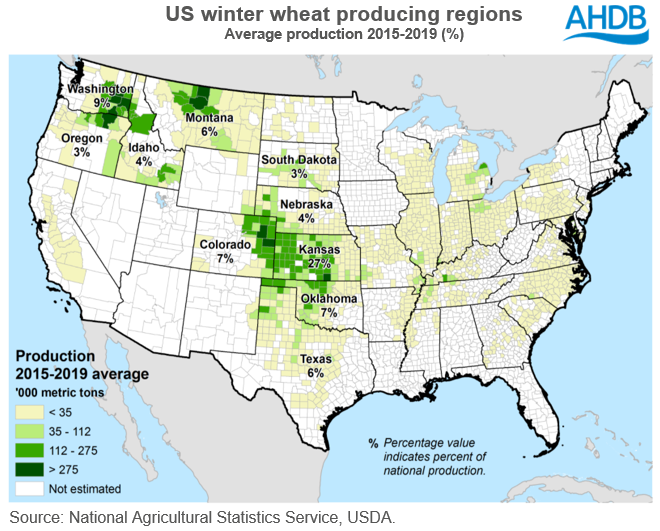

As a large global wheat producer, the US are important to the global wheat supply and demand balance. The 5-year average (2016/2017-2020/21) show the US wheat crop make up 7% of the world’s wheat production. For comparison, Russia produced 10% on average.

Conditions in the US remain dry

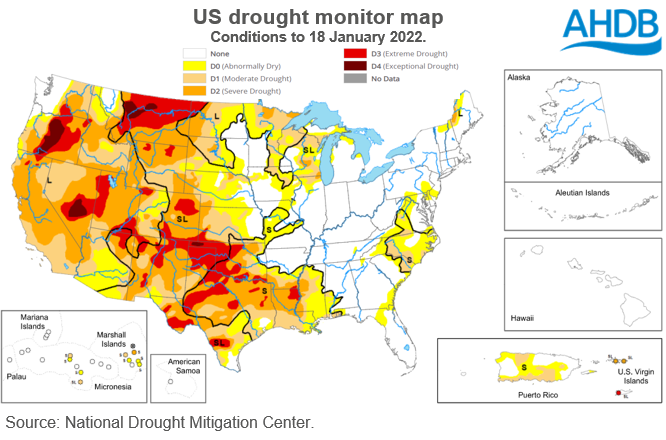

Though extreme and exceptional drought is arguably not as widespread as we saw this time last year (January 2021), the latest drought monitor data to 18 January 2022 shows clear coverage of moderate to severe drought.

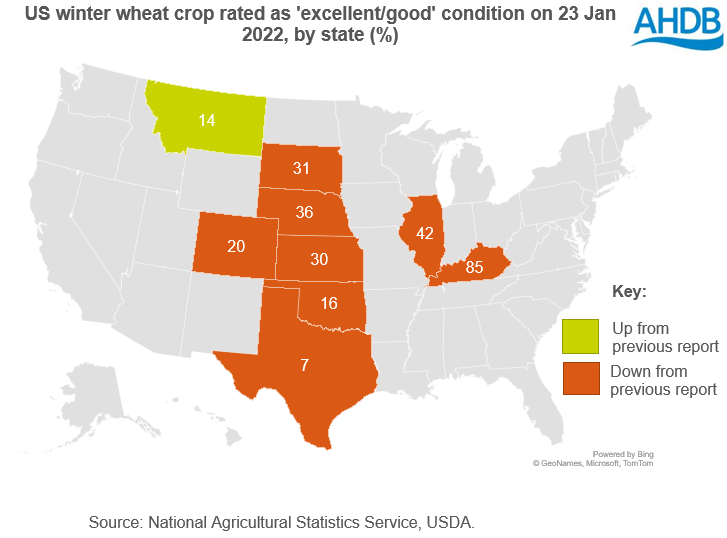

With such dry conditions, Monday’s latest USDA National Agricultural Statistics Service crop condition reports show ‘good/excellent’ winter wheat ratings have declined in many key producing states (data to 23 January 2022).

Key winter wheat states Texas, Oklahoma, and Colorado especially look to have regions of extreme drought and all saw reductions to ‘excellent/good’ condition scores to 23 January from previous reports.

However, as mentioned, there is still a long way between now and harvest. With global wheat stocks low and the market sensitive to news, US crop conditions will be a market sentiment driver.

For many states, the next monthly reports are due on 22 February (however this varies by state).

Before then, some cold weather is advancing and likely rain/snow due in some key US wheat producing regions. Though expected levels of rain for many key states are still below normal, according to COLA (The Center for Ocean-Land-Atmosphere Studies).

As we head closer to the 2022/23 marketing year (starting in July 2022), global new crop conditions will become an increasingly important global price driver. This will impact UK feed wheat futures prices also, as the market assesses the possible size of global production next season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.