Frost risk remains for Black Sea crops: Grain market daily

Tuesday, 25 January 2022

Market commentary

- Concern over Black Sea tensions again pushed up global wheat prices yesterday. May-22 UK feed wheat futures rose £3.75/t to £222.00/t. The Nov-22 contract rose £2.55/t to £199.55/t, its highest price since 23 December 2021.

- Paris rapeseed futures fell yesterday under pressure from lower crude oil prices and a fall in soyabean prices. The May-22 contract lost €30.25/t to €667.25/t (approx. £560/t), the Nov-22 contract fell €9.75/t to €594.75/t (approx. £499/t).

- Improved weather means the Brazilian soyabean harvest reached 5% complete by 20 January (AgRural). This is up from 0.7% a week earlier. Yields are so far described as ‘satisfactory’ in the top producing state of Mato Grosso, but low yields are being seen further south (Refintiv).

- Wheat crops in Texas have deteriorated since late-November. As at 23 January, 71% of the crop was rated ‘poor’ or ‘very poor’, up from 45% on the 28 November. A year ago, just 41% of the crop was ‘poor’ or ‘very poor’ (USDA).

Frost risk remains for Black Sea crops

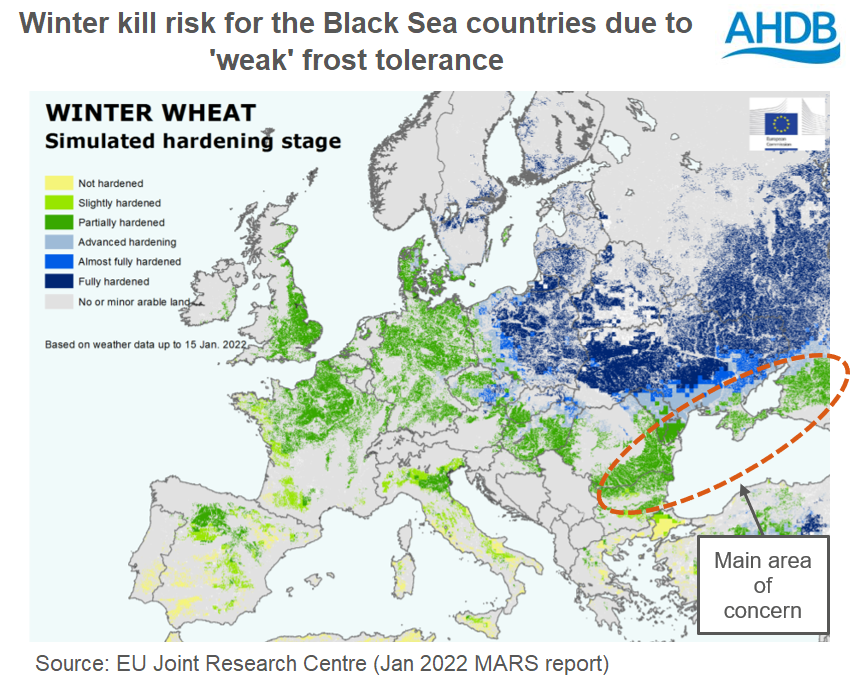

A relatively mild winter continues to be kind to winter crops across Europe and the Black Sea. But, this also continues to leave crops more exposed to frost damage if temperatures drop. These are some of the key points of the latest EU crop monitoring (MARS) report, out yesterday.

Mild weather through December allowed some crops that were behind at the start of winter to catch up. Most winter crops are now described as in a ‘fair to good (or very good) condition’. This reads like an improvement from the December report, which said crops were off to a ‘fair start’.

Encouragingly, the report suggests that little frost damage has occurred so far. Yet, crops in the Black Sea region remain at risk from frost damage, if temperatures suddenly fall. Refinitiv suggests below normal temperatures this week in parts of Russia and Ukraine, before warming up again.

A good start for winter crops supports the potential for production to rebound in 2022/23. Strong European and Black Sea wheat, barley and rapeseed crops could mean global supplies are more comfortable than this season. This is part of the reason we currently feel the market outlook is slightly bearish when looking six months ahead. It’s also part of why new crop (Nov-22) UK feed wheat futures are £22.45/t below old crop (May-22) prices.

But, frost damage could dent the potential for a strong production rebound in 2022/23. If frost damage happens, it could mean more support for new crop prices, especially relative to old crop prices.

Dry weather in North Africa

The MARS report also highlights that drought is persisting in Morocco, negatively impacting winter crops. In addition, rain is ‘imminently needed’ in Algeria to maintain crop growth. There’s still time for crops to recover ahead of harvest beginning in April, but it’s not an ideal start. Lower production in the region can mean higher import requirements. The UK often exports barley to the region, with shipments to Morocco so far this season (Jul-Nov) totalling 68Kt.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.