Market Report - 24 January 2022

Monday, 24 January 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

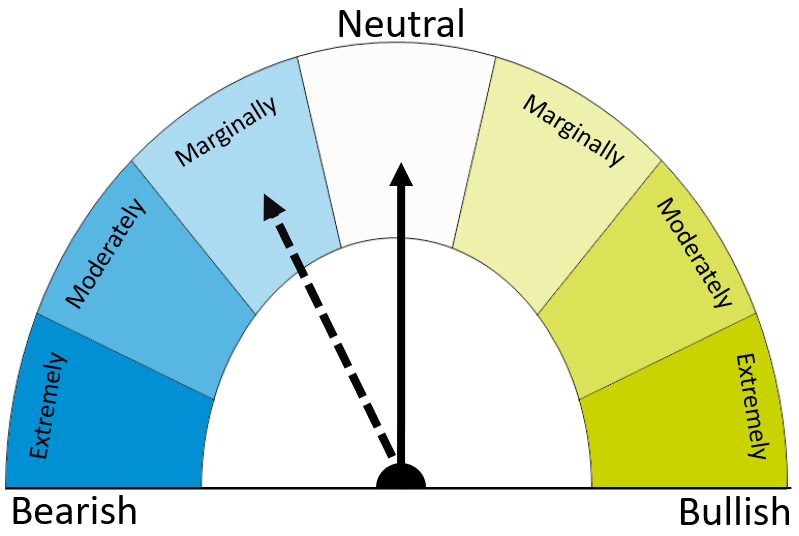

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

The potential for a recovery in global wheat production next season keeps a slightly bearish tone for markets longer-term. But, disruption to exports from top suppliers in the Black Sea could change the outlook.

Maize

Wetter weather has bought some relief to later crops in Argentina, but some damage has already been done to early crops. The scale of the damage and weather conditions in the region will be important for some weeks yet.

Barley

Old crop barley supplies globally remain tight, keeping prices close to those for wheat. The outlook for barley in 2022/23 is not yet clear and will need to be watched closely due to low global stocks.

Global grain markets

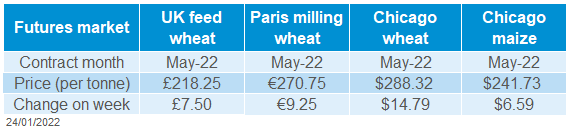

Global grain futures

Global grain markets rose last week. This was due to a combination of weather issues in South America and the political situation with major Black Sea exporters.

On Friday, wheat prices eased back slightly due to profit taking by speculative traders. In contrast, maize prices continued to rise due to robust US maize export sales. US export sales of maize this season (2021/22) totalled 1.1Mt in the week ending 13 January. This was more than the 0.5 to 1.0Mt the trade had expected (Refinitiv).

Political tensions in the Black Sea are causing concern in grain markets, due to the threat of disruption to exports. The main threat is arguably to the wheat market, from a volume perspective. However, Ukraine also exports a sizeable amount of maize, including to the UK, and barley. In addition, any further rise in natural gas prices could push up fertiliser prices.

Rain in Argentina last week was welcome but patchy and too late for early maize yields, according to both the Buenos Aries and Rosario Grain Exchanges. More rain is forecast, which will likely help later planted maize, as well as crops still to be planted.

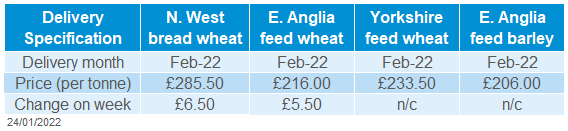

UK focus

Delivered cereals

UK feed wheat futures recovered nearly all of the previous week’s losses last week. The May-22 contract rose £7.50/t between 14 and 21 January to £218.25/t. This is just £0.25/t below the price on Friday 7 January.

Domestic trade levels reportedly slowed towards the end of the week because of uncertainty in the global market.

Ahead of the release of the next estimates of UK supply and demand this Thursday (27 January), the AHDB Cross Sector Working Group met last Thursday. The slides discussed can be found here. To find out more or if you are interested in joining the group, please email balance.sheet.team@ahdb.org.uk.

Oilseeds

Rapeseed

Tight global supply and relatively inelastic demand keep prices historically high. New crop supply is set to be larger, though tight opening stocks and wider oilseed strength may support prices.

Soyabeans

Supply and demands remains tight, and the market is sensitive to news. South American weather remains a key watch point. Rains arrived in Argentina, but there are concerns it may be too late.

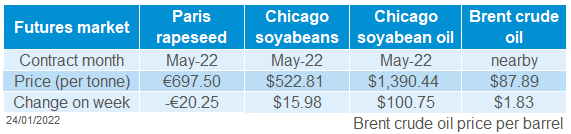

Global oilseed markets

Global oilseed futures

Chicago soyabean futures contract (May-22) gained last week, reaching $527.04/t on Thursday. This is a contract high. Though we saw some profit taking on Friday pressuring price, the contract closed on Friday at $522.81/t. This is up $15.98/t Friday to Friday.

South American weather continues to be a key market driver. Argentina received rain last week. However, the question remains, is it too late? On Thursday, updated crop conditions from the Bolsa de Cereales to the 19 January, show 27% of Argentinian soyabean crops were rated ‘poor/very poor’, down 2 percentage points (pp) from the previous week. Meanwhile, 30% were rated ‘excellent/good’, down 1pp from the previous week.

For Brazil, the USDA attaché (GAIN) report reduced its soyabean production forecast for 2021/22 by 8.0Mt to 136.0Mt. This was based on a reduced yield forecast. Harvest has started in Brazil but is delayed by rain, standing at 1.7% completed to 17 January. The market still awaits early yield data.

The weather forecast ahead looks mixed. For Argentina, many growing regions are due rain, though February could bring drier weather again (Refinitiv). For Brazil, warmer weather is expected, with some regional rainfall this week. Cool and wet weather is due longer term for Brazil (Refinitiv).

Export sales also added support to soyabean markets last week, with expectations China is back buying. In the week ending 13 January, the US net export sales totalled 671.0Kt for 2021/22. This is down 9pp from the previous week, but up 12pp from the 4-week average. The main destinations were China and Mexico. For the same week, net sales for soyabean meal (for 2021/22) were at 314.9Kt. This is up from the previous week and 4-week average.

Finally, high palm oil prices continue to support the wider oilseed complex. Thoughts are that palm oil price volatility is set to continue in 2022, with slow progress on Malaysian labour issues and green policies boosting demand (Refinitiv). The Malaysian palm (May-22) futures contract climbed 8% Friday to Friday, to a contract high.

Rapeseed focus

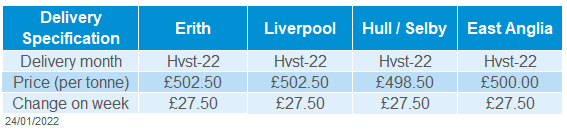

UK delivered oilseed prices

Paris rapeseed futures (May-22) closed down last week by €20.25/t to €697.50/t on technical trading. However, the Nov-22 contract gained last week. This contract increased €19.00/t, closing on Friday at €604.50/t.

New crop UK delivered prices followed futures movement (Nov-22) up. On Friday, delivery into Erith (Harvest/August 22) was up £27.50/t to £502.50/t.

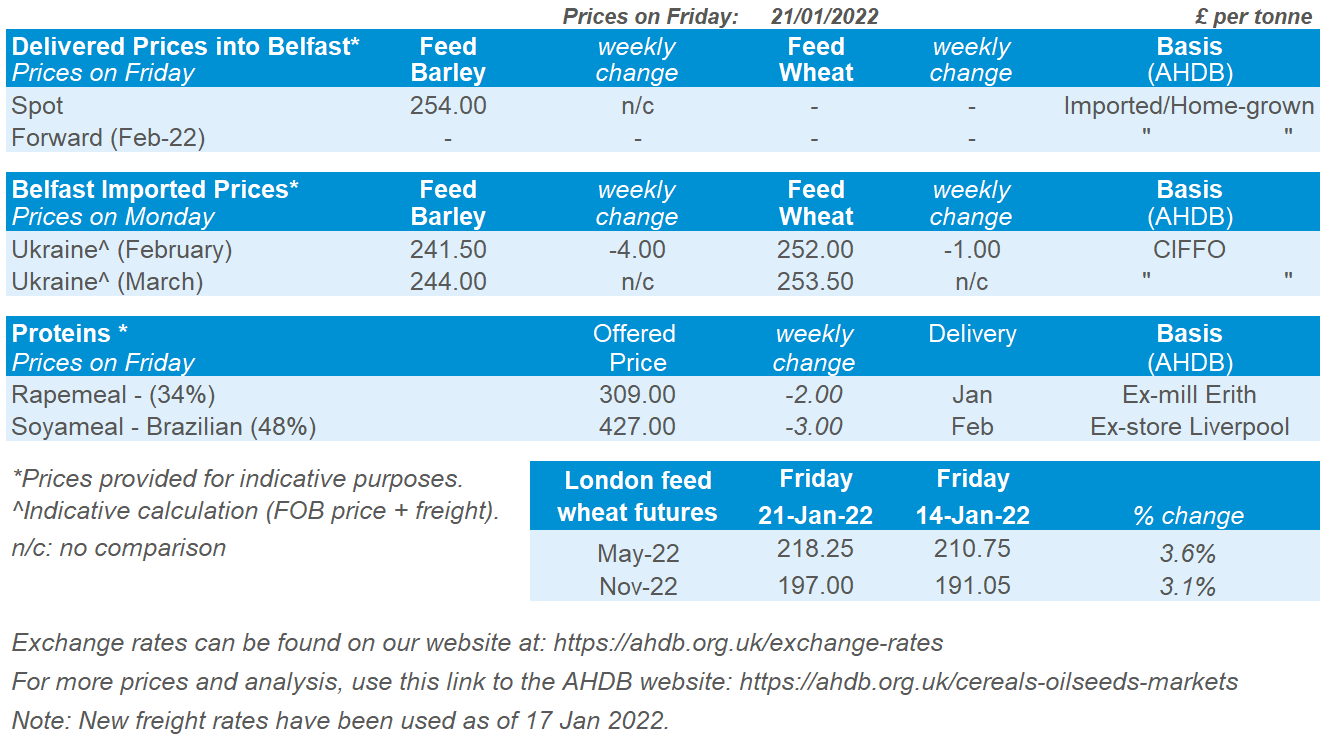

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

.PNG)