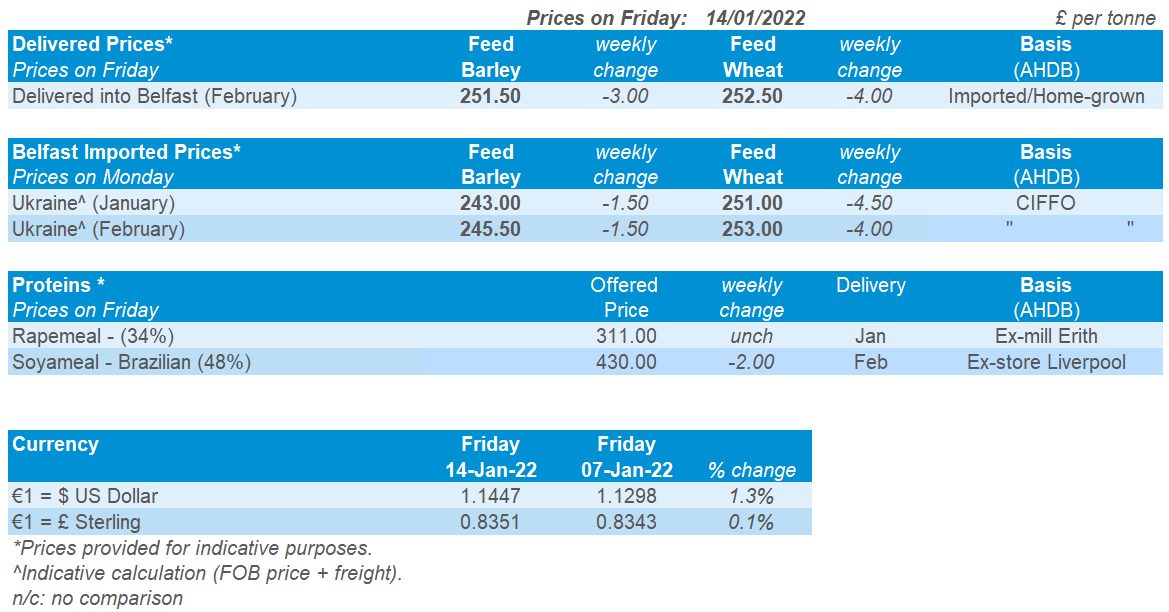

Market Report - 17 January 2022

Monday, 17 January 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

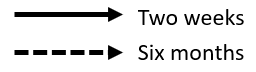

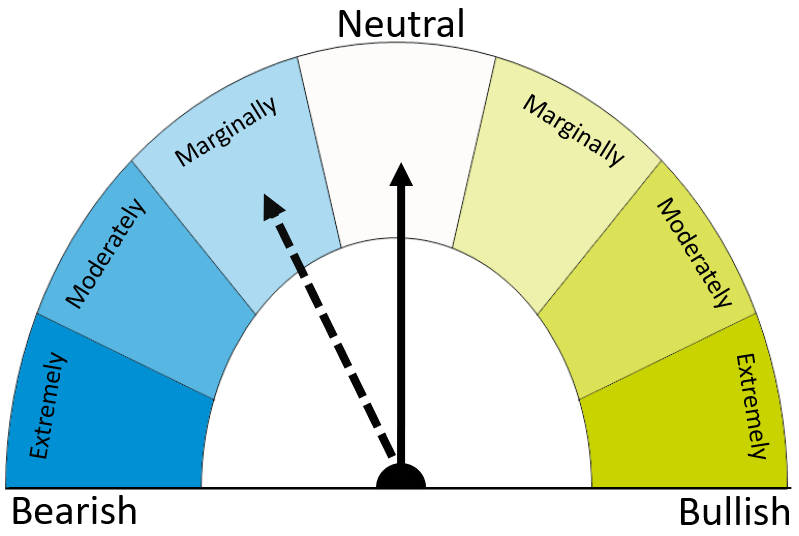

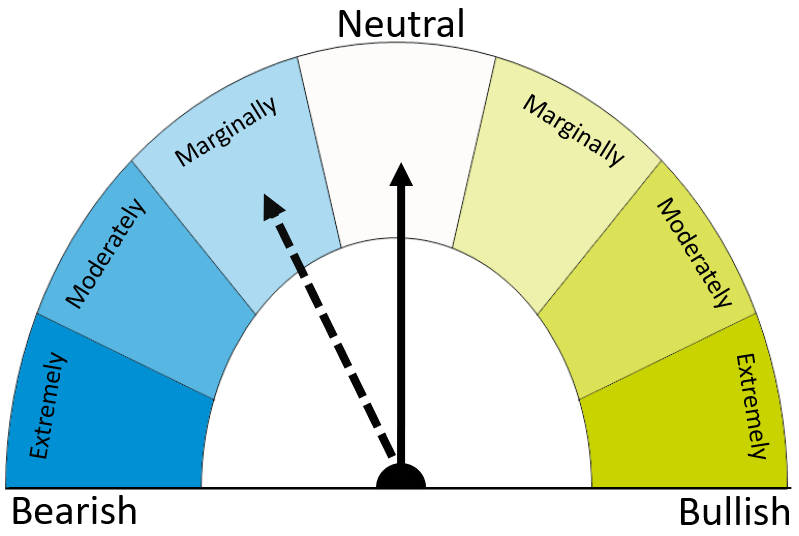

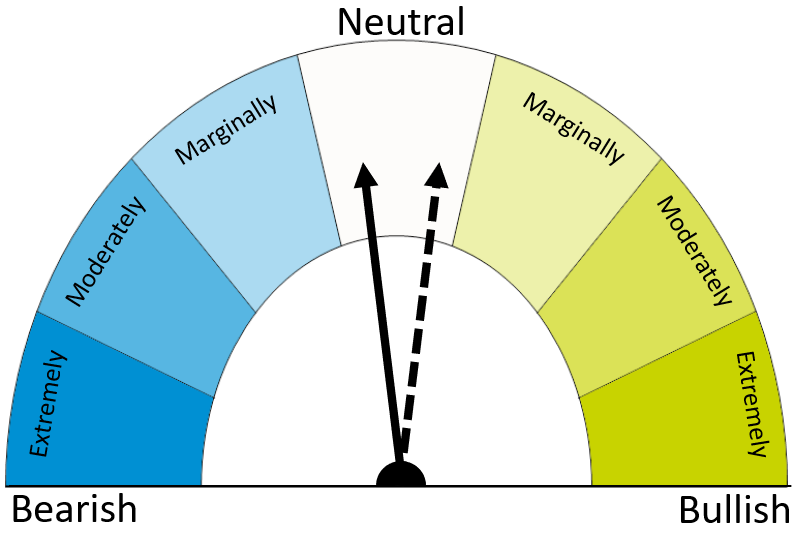

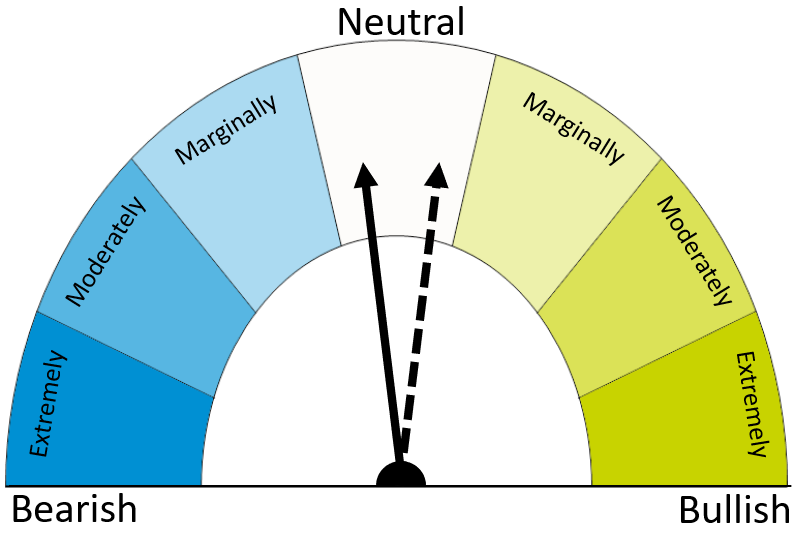

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

Maize

Barley

Large southern hemisphere crops eased global supply and demand slightly, though prices are likely to remain supported due to tight stocks. Longer term prices now look to new-crop; supply rebound is expected, but tight opening stocks could keep prices historically high.

The USDA trimmed South American production last week, on drought conditions. Rain is forecast in Argentina, but is it too late? The market now awaits early yield information.

With a relatively small discount to wheat currently, barley generally track wheat markets.

Global grain markets

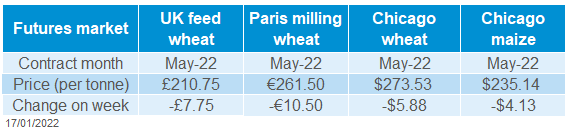

Global grain futures

Chicago maize futures (May-22) lost ground on Thursday post USDA report, released on Wednesday evening. In the January World Agricultural Supply and Demand report (WASDE), the USDA trimmed South American 2021/22 production in line with trade estimates, according to a Refinitiv poll. Increases to US and Ukraine 2021/22 production forecasts led to futures sell off. However, on Friday the May-22 futures managed to regain ground, as concerns started to resurface on the full extent of South American production cuts. This contract closed at $235.14/t on Friday, down $4.13/t on the week.

Last week, Bolsa de Cereales trimmed Argentina’s maize crop conditions scores. In the week ending 12 January, only 23% of crops were rated ‘excellent/good’ and 36% were rated ‘poor/very poor’. This compares to 40% and 21% respectively, the previous week.

Weather forecasts for South America are mixed. Southern Brazil looks to remain relatively dry, whereas Argentina is due rain in most areas in the next week. That said, the heaviest rain is due in the latter part. How much rain arrives, and where, will be crucial.

Global wheat prices took a fall last week, with Chicago and Paris wheat futures leading Russian prices lower. This was down to a boost in the supply outlook for 2021/22. The USDA increased global ending stocks for 2021/22 in the WASDE last week, up 1.8Mt to 279.9Mt. This is down to a marginal global production increase coupled with a greater cut to global consumption. The report also detailed US domestic wheat seedings for harvest-22 above average analyst estimates (Refinitiv) at 13.92Mha. This is up 2% from harvest-21 and 13% from harvest-20.

The International Grains Council (IGC) also raised their global 2021/22 wheat production estimate (+4.0Mt to 781.0Mt) and closing stocks (+2.0Mt to 276.0Mt). However, the IGC cautioned wheat stocks in major exporting countries are unlikely to see much recovery in 2022/23.

The Russian winter has been reportedly favourable for havest-22 wheat plantings, with heavy precipitation in most winter wheat areas as well as warm weather.

UK focus

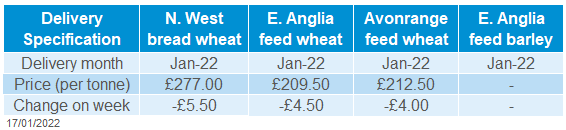

Delivered cereals

UK feed wheat futures (May-22) fell £7.75/t last week, to close at £210.75/t. This is the third consecutive week of falls on this contract, following global wheat contracts down last week. The Nov-22 contract only fell £0.50/t over this same period, to close on Friday at £191.05/t.

Old-crop UK delivered prices, followed UK feed wheat futures down; the May-22 contract dropped £4.45/t Thursday to Thursday.

Feed wheat (Jan-22 delivery) into East Anglia fell £4.50/t, quoted at £209.50/t (average) on Thursday. Whereas East Anglian feed wheat for harvest delivery fell £3.00/t last week to £184.00/t on Thursday.

Bread wheat delivered into the North West (Jan-22) fell £5.50/t week-on-week to £277.00/t.

The latest AHDB cereal usage data is now available up to November for GB animal feed production and UK human and industrial cereal usage.

HMRC UK trade data is also available on the AHDB website, to the end of November.

Oilseeds

Rapeseed

Soyabeans

Relatively inelastic demand and tight global supply keeps rapeseed prices elevated compared to previous years. Longer term, increased plantings might add pressure as new-crop harvest nears, but a tight starting position could counterbalance this.

Despite pressure last week, global soyabean stocks-to-use is very tight and the market could see further support from palm oil too. South American weather remains a key watchpoint for market sentiment.

Global oilseed markets

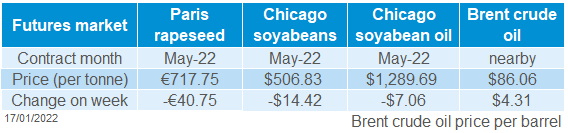

Global oilseed futures

May-22 soyabean futures lost 2.8% ($14.42/t) last week, closing the week at $506.83/t despite a relatively bullish USDA report. Pressure came from anticipated rain in South America impacting market sentiment. This said, some analysts are sceptical that rainfall will be enough for recovery. According to average estimates, commodity funds were net sellers of soyabeans last week (Refinitiv).

The USDA world agricultural supply and demand estimates (WASDE) cut Brazilian and Argentinian production by 5.0Mt and 3.0Mt respectively. The production estimates came in below average trade estimates from a Refinitiv pre-report poll, but still above some private estimates. The USDA also made cuts to their global consumption estimates by just 2.1Mt compared to the 9.2Mt cut to global production.

Global stocks-to-use (2021/22), using the latest USDA estimates, is now 25.4%, down from 27.1% in Dec-21 and the lowest since 2015/16.

Other supportive news comes from Malaysian palm oil. The May-22 Bursa Malaysia crude palm oil futures contract gained 149MYR (3.2%) last week. News emerged today that top palm oil producer, Indonesia, is implementing road tests for biofuels with increased palm oil content in February. The biofuel will contain 40% palm oil, boosting the potential outlook for palm oil.

China remains a watchpoint for soyabeans (and maize) as 2021 soyabean imports slipped year-on-year on the back of poor hog margins and increased wheat feeding. However, 2021 pork output was pegged 29% higher than 2020 and almost in line with pre-African Swine Fever (ASF) outputs of 2017. Chinese pork prices sit relatively low currently, though recovery to the herd could aid positive sentiment surrounding feed demand.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (May-22) jumped €18.25/t on Friday, but this was not enough to negate the losses in the previous sessions. From Friday to Friday the contract lost €40.75/t, to close the week at €717.75/t.

This said, the supply and demand picture remains very tight. The USDA increased global production slightly (+0.92Mt), but also raised global consumption estimates (+1.14Mt). Using the latest figures, global rapeseed stocks-to-use is at 5.7%, and 5.1% for major exporters. The 5-year average (2016/17 to 2020/21) for major exporters stocks-to-use is 14.0%.

Therefore, despite a potential rebound in production for 2022/23, the balance sheet will open with tight stocks.

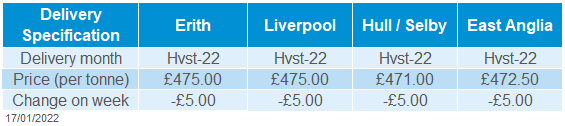

New-crop domestic rapeseed prices lost ground last week. Harvest-22 delivery into Erith was quoted at £475.00/t, down from £480.00/t the previous week. This is still £10.50/t higher than quoted in the pre-Christmas survey (17 Dec) though.

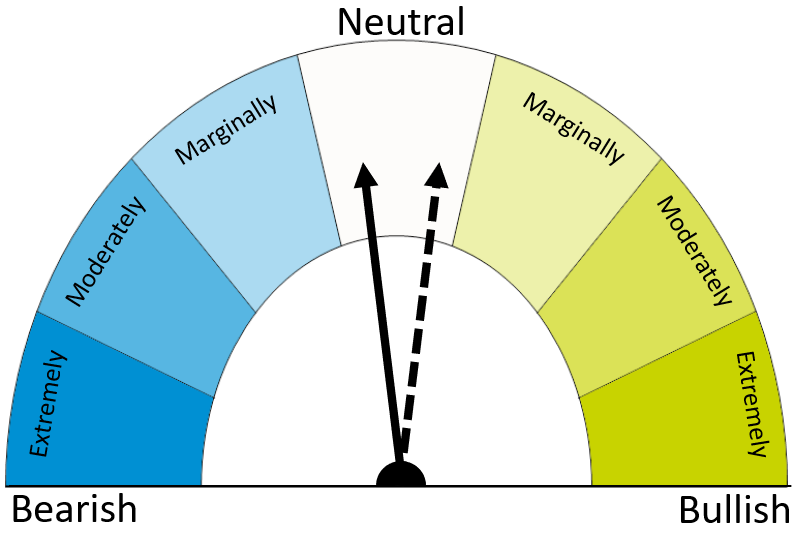

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.