Frost tolerance a concern in Black Sea areas: Grain market daily

Wednesday, 15 December 2021

Market commentary

- UK feed wheat futures (May-22) gained £0.25/t yesterday, to close at £227.50/t. This is despite small falls on the Paris milling wheat (May-22) and Chicago wheat (May-22) contracts. Yesterday saw only small volumes traded and sterling strengthen.

- Demand for wheat continues, with global tenders from Jordan, Turkey, Iran, and Algeria this week.

- Algeria’s state grain agency (OAIC) reportedly purchased 690Kt-700Kt of milling wheat yesterday at around $372.00-$373.00/t (C&F) for panamax vessels, to $376.00/t for handymax vessels. Likely origins are thought to be Germany, the Baltic Sea region, and Black Sea region.

- Chicago soyabeans (May-22) gained $4.96/t yesterday, to close at $467.61/t. Gains were reportedly tracking Chicago soyabean meal prices, which were up $12.90/t to $411.38/t.

Frost tolerance a concern in Black Sea areas

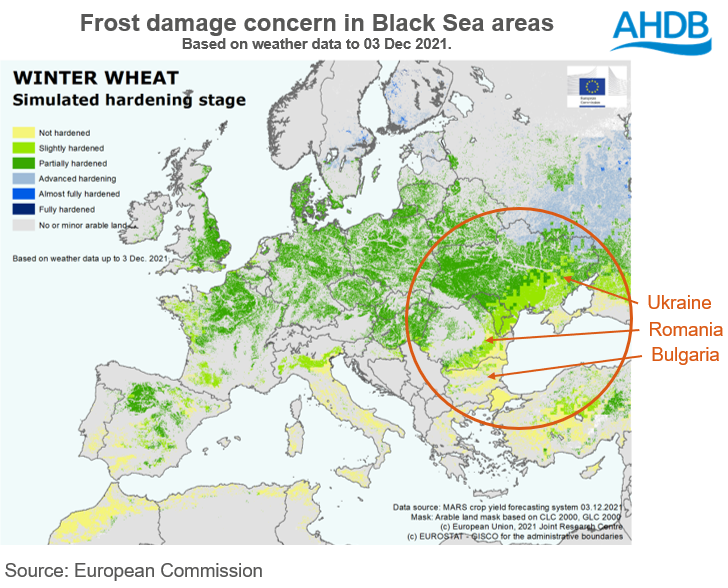

Across most parts of Europe, favourable weather allowed a ‘fair start’ for winter cereal crops. However, there are concerns for frost tolerance, in particular, Black Sea winter cereals.

The latest MARS Crop Monitoring report released yesterday, stated sowing was either complete or mostly complete by early November in most European countries. However, the European Commission said some Black Sea countries (Romania, Bulgaria, and Ukraine) experienced a delay of a few weeks.

November saw above average temperatures and near average rainfall for central and northern Europe. This allowed favourable early crop development. However, western Europe (France is referred to specifically), saw below average temperature. This hampered early winter wheat development and meant only a few fields have reportedly started tillering.

In south-eastern Europe, particularly the Black Sea region, the end of November turned cold. This slowed development of cereals that were already planted late. Frost tolerance is a concern in this area particularly, as well as most parts of central and eastern Europe overall. Frost tolerance is reportedly ‘weaker than usual’ in these regions. This poses risk during winter dormancy.

In the majority of European Russia, hardening is reportedly more advanced. This means crops are potentially better prepared for winter dormancy. Whereas for areas in southern Russia hardening is weak.

Though frost tolerance may strengthen, before this, any sharp frosts may damage delayed winter cereals.

Why is this important?

With a tight global wheat supply and demand balance, we are likely looking to next seasons supply to ease concerns. Prices are expected to stay relatively elevated until this balance appears to be easing.

Ukraine is a major wheat exporter. This month, the USDA increased Ukraine’s 2021/22 export forecast by 200Kt to 24.2Mt in their world agricultural supply and demand estimates (WASDE). This places them as the fourth largest global exporter of wheat in 2021/22. This means domestic production is important to global availability.

Romania too is a large wheat producer, accounting for 10.42Mt of EU-27 production this season (fourth largest) according to Stratégie Grains. Therefore essential to EU supply.

The MARS report states ‘colder-than-usual conditions’ are forecast for these south-eastern European countries, although the forecast is only to the end of the week. It is too early to predict impact on yields, though weather will be followed closely in these key regions. This is especially important given dry conditions have already made Ukraine and Russia watchpoints.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.