Analyst Insight: What’s Russian-Ukrainian tensions doing to oils?

Thursday, 17 February 2022

Market commentary

- UK feed wheat (May-22) closed yesterday at £217.65/t, down £1.75/t from the day before. The Nov-22 contract also lost ground yesterday (-£0.85/t) to close at £199.65/t.

- Paris rapeseed (May-22) gained €14.00/t from Tuesdays close ending the day at €702.25/t. New-crop (Nov-22) also gained yesterday (+€8.50/t) to close at €615.75/t.

- Sterling strengthened yesterday against both the US dollar and the euro.

What's the Russian-Ukrainian tensions doing to oils?

Not only has the current Russian-Ukrainian tensions boosted grain markets, but it has affected oil markets too.

Russia is one of the largest oil producers in the world. Brent crude oil has been particularly sensitive to news of a potential Russian invasion of Ukraine. From Friday to Monday’s close, the nearby contract rose 2.2% ($2.04) to close at $96.48/barrel. This is the highest price since September 2014. The jump happened following news from global media that an attack was imminent, and several nations urged their citizens to leave Ukraine. Similarly on news that Russian troops had been withdrawn from the border on Tuesday (15 Feb), brent crude futures (nearby) slumped, closing Tuesday at $93.28/barrel.

Price movements like this shows that geopolitics is a key driver in the current market. Yesterday, the contract remained relatively high, closing at $94.81/barrel, $15.83/t (20.0%) higher than the start of the calendar year.

However, there is also underlying support to crude markets from tight US inventories. Market sources citing American Petroleum Institute (API) figures say, last week (week ending 11 Feb) crude stocks fell by 1.1 million barrels.

With both these factors in mind, it is likely any disruption to oil coming out of Russia would bolster prices above the $100/barrel mark.

What does this mean for the wider market?

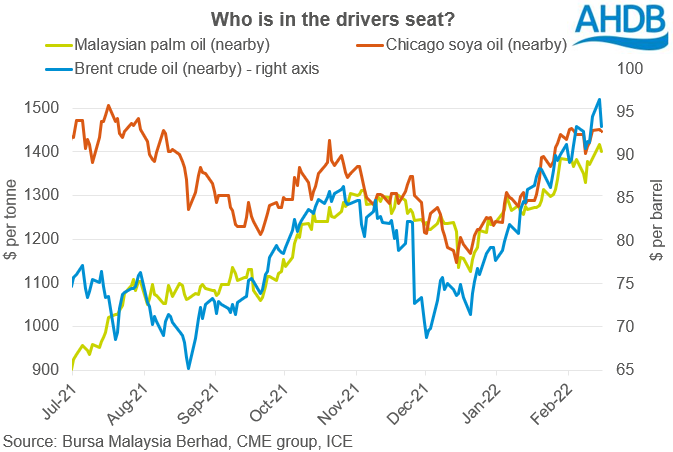

Essentially, high oil prices all round. Brent crude oil isn’t the only driver of oil markets though. Currently soyabean supply concerns are helping to elevate soyabeans and in turn the soy oil market. Along side that, there are supply worries for palm oil too.

So, whilst there may not be one clear leader right now, it is obvious they influence one another. Crude is currently setting the ceiling and therefore, there is scope for other oils to rise in value too. Lets not forget though, as previously mentioned, if Russian-Ukrainian tensions escalate, brent crude oil values would likely jump up further. If this happens, it could well drag up vegetable oil markets too.

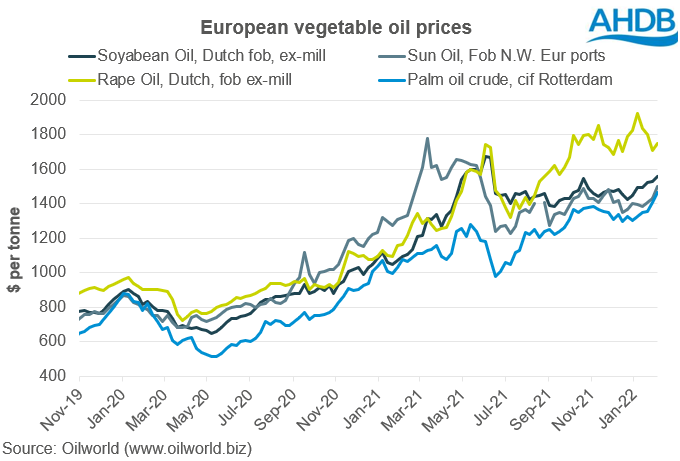

Within Europe, there are four main vegetable oils consumed. These tend to trade within a range. Over the past ten years they have traded within an average range of $234/t and it varies season-to-season as to which oil sits at the top. But, in that timeframe rape oil has been at the top over 50% of the time and palm oil at the bottom c.85% of the time.

As you can see from the graph above, rape oil has sat well above the others pretty much since the start of the current marketing year (2021/22). Rape oil will likely continue to lead in European markets due to the tight availability and relatively inelastic demand. So with this in mind, any further boost in the global oil complex (think crude oil) could push all oil prices even higher.

On the back of any rise in the liquid (oil) market, we often see a lift in the seed/bean markets too. Whilst fundamentals surrounding overall rapeseed supply and demand have largely been driving rapeseed markets, oils will continue to play an important role.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.