Analyst’s Insight: How flexible is EU rapeseed demand?

Thursday, 2 September 2021

Market commentary

- UK feed wheat futures (Nov-21) lost £2.50/t yesterday, to close at £191.75/t. UK losses were larger than those seen in the European market.

- Global grain and oilseed prices have generally been weaker this week as markets assess the implication of the damage to export facilities in the US caused by Hurricane Ida.

- The USDA is set to release planted and harvested area acreage updates for corn and soyabeans sooner than normal. Typically these are reviewed in October, however these are now set to be published next Friday, alongside the crop production and supply and demand estimate releases.

How flexible is rapeseed demand?

Over the course of the past six months, we have talked a lot about the price of rapeseed.

Yesterday, the Nov-21 Paris rapeseed futures contract closed at €564.25/t. Prices have moved lower so far this week, but the Nov-21 contract was €187.80/t ahead of the average of the previous 5 November contracts, as at 1 September.

High prices for products that are interchangeable, such as oilseeds and vegetable oils, drive demand destruction. But, while demand destruction is reportedly being seen for rapeseed in Europe, the extent to which this is possible is limited.

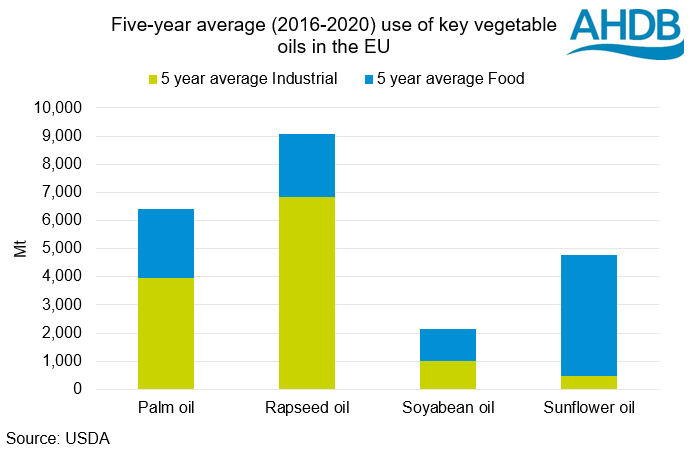

Demand for rapeseed and rapeseed oil can be broken down into two categories, food and industrial. According to the USDA, EU demand for rapeseed oil is 25% food and 75% industrial.

On the food side of demand, it is easier to switch from rapeseed oil to alternatives, such as sunflower seed oil or palm oil. Switching is harder for industrial uses, and this is the majority of EU rapeseed oil demand.

Industrial usage includes biofuel and technical applications. Switching of the feedstock used to make biodiesel is limited by the EU climate. Biodiesel made from rapeseed oil has a lower waxing point than that made from palm oil or soya oil, which makes it better suited to the EU climate. As such, although prices are high the flexibility of EU consumption of rapeseed oil is limited.

Sunflower oil has closer properties to rapeseed oil than palm oil or soya oil. Sunflower oil consumption in energy is expected to increase in the EU this year, albeit from a very low base (www.oilworld.biz).

In the latest EU Commission balance sheet, rapeseed oil consumption is seen at the highest point since 2017/18. That said, Oilworld (www.oilworld.biz) peg rapeseed oil consumption down 3.8% on the year. This is despite rapeseed oil output being forecast to fall 6.3% on the year.

Further, the supply situation of rapeseed is incredibly tight globally. Earlier this week Statistics Canada pegged the 2021/22 canola (rapeseed) crop at a 14-year low of 14.7Mt.

Rapeseed production has improved year on year in Ukraine and is expected to rise in Australia. However, the market will likely remain supported to some degree. The forecast year on year increases in exports from Ukraine and Australia only account for 15% of the 3.7Mt forecast fall in Canadian exports. These factors will support rapeseed prices compared to other oilseeds.

Considerations for the future

While rapeseed values are likely to supported in the short term, and plausibly throughout a fair chunk of this season, longer term demand is more uncertain.

One key feature for forward consumption of rapeseed is the EU agenda to decarbonise the economy. This includes plans to reduce demand for palm and soya oil from unsustainable sources. This was outlined in the most recent Renewable Energy Directive (RED II).

This could drive some increase in consumption of rapeseed oil in the medium term. This will in turn support UK pricing, UK physical rapeseed prices are closely aligned with Paris rapeseed futures.

Long-term demand is likely to be driven towards advanced biofuels, such as Hydrotreated Vegetable Oil (HVO) and biodiesel produced from used cooking oil (UCOME). The technology for HVO is still uncompetitive against traditional biofuels but that may change in future.

A shift to electric vehicles; albeit a long-term consideration, is something else to think about. It could also reduce total demand for diesel and so potentially bio-diesel.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.