UK imports eased in December while exports picked up: Grain market daily

Tuesday, 18 February 2025

Market commentary

- UK feed wheat futures (May-25) ended yesterday at £187.45/t, down £1.95/t from Friday’s close. The Nov-25 contract fell £0.10/t over the same period, to close at £197.90/t. The discount of old crop UK feed futures (May-25) under new crop (Nov-25) was £10.45/t in yesterday’s close, the greatest discount since July 2023, when the Nov-25 futures began trading.

- Domestic wheat futures closed lower yesterday following Paris grain markets. Paris milling wheat futures (May-25) were down 0.8% at yesterday’s close. The Chicago futures market was closed yesterday due to the President's Day holiday in the US. Paris milling wheat futures remain under pressure from uncompetitive prices on the global export market, especially compared to Black Sea origin grain. Weather risks for the winter crops in the Northern Hemisphere remain in focus for market participants.

- May-25 Paris rapeseed futures closed at €529.25/t yesterday, up €2.50/t from Friday’s close. Paris rapeseed futures rose despite rumours that India may raise import taxes on vegetable oils.

UK imports eased in December while exports picked up

Updated UK trade data showing figures up to the end of December 2024 confirmed that while wheat and maize imports remained strong, pace dropped back in the month of December. Though overall exports are still steady, UK barley, wheat and oat exports also picked up pace slightly.

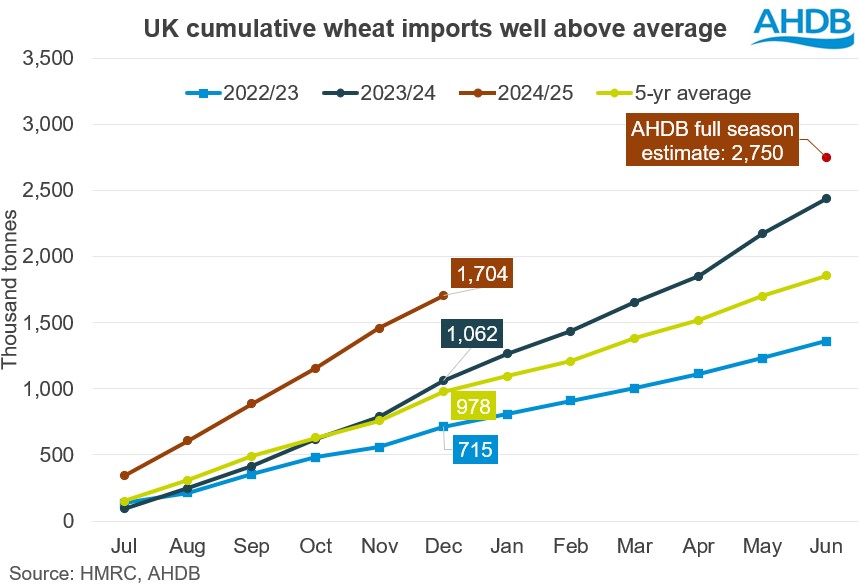

This season-to-date (Jul-Sep) UK wheat imports totalled 1.70 Mt, 60% higher than at the same point last year, and 74% higher than the five-year average. The majority of wheat imported has been supplied by Germany, Canada and Denmark, and as such is expected to be largely of milling quality. In the latest AHDB balance sheet released in January, full season UK wheat imports were estimated to reach 2.75 Mt. At the halfway point of the season, 62% of this has already been imported, and as such a slightly slower pace still is expected moving forward.

As has been discussed previously, due to its competitive price over domestic cereals, maize imports also started off strong this season. From July to September, maize imports have totalled 1.42 Mt, up 14% on the same period last season, and up 16% on the five-year average. However, similarly to wheat, pace dropped back in December when compared to the previous couple of months. In January, AHDB estimated that full season imports of maize would reach 2.68 Mt, up 1% on the year. As such, it is expected that with maize now pricing less competitively on global markets, aside from what has already been purchased earlier in the season, imports of the grain will likely slow in the coming months.

On the exports side, UK barley exports from July to December totalled just 257 Kt, 37% lower than last year and 65% lower than the five-year average. However, exports reached their highest point in December at 68 Kt, compared to a low of 22 Kt in September. AHDB currently forecasts full season exports at 500 Kt for the 2024/25 season.

Looking ahead

The pace of wheat and maize imports has remained firm due to lower UK cereals production, as well as a historically strong sterling against the euro. However, as it stands the pace of these imports is expected to slow during the second half of the season. Equally, cumulative UK barley exports are at a low level this marketing year, but the recent rise in global maize prices, and surplus of domestic barley could support UK barley exports.

In March, AHDB will be releasing the next UK cereal supply and demand estimates, which will include any revisions to imports and closing stocks estimates. Weather over the next few months, and subsequent crop conditions could also influence trade towards the end of the season as harvest 2025 approaches.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.