Sterling hits eight-year high against the euro: Grain market daily

Tuesday, 17 December 2024

Market commentary

- UK feed wheat futures (May-25) ended yesterday’s session at £192.20/t, up £3.20/t from Friday’s close. The Nov-25 contract was up £3.35/t over the same period, to close at £193.85/t.

- Domestic wheat futures closed higher following Paris milling wheat futures. UK feed wheat and Paris milling wheat futures (May-25) closed yesterday higher by 1.7% and 1.5%, respectively. Support came from the news about Saudi Arabia's agency buying 804 Kt (more than planned) of wheat in a tender yesterday, the main supplies expected to be from Romania, Bulgaria and South America, plus a small volume from Russia (LSEG).

- May-25 Paris rapeseed futures closed at €524.50/t yesterday, down €6.00/t from Friday’s close.

- Winnipeg canola futures (May-25) closed 2.1% lower yesterday, which pressured Paris rapeseed futures. Chicago soyabean futures also fell yesterday, and one of the reasons was lower-than-expected November crushing data from NOPA. Plus, palm oil prices decreased yesterday and eased oilseeds prices.

Sterling hits eight-year high against the euro

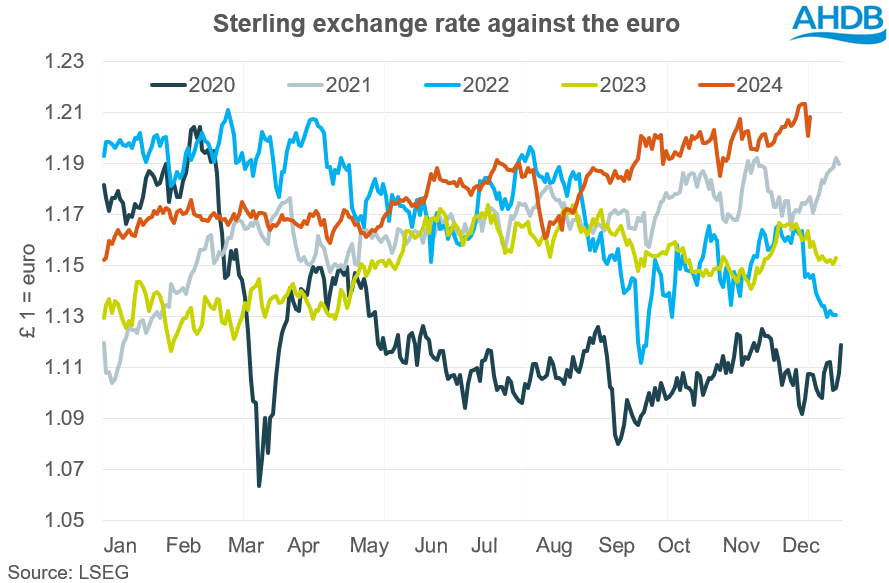

Since August 2024, sterling has tended to strengthen against the euro. During this period, from the low in August to the high last week, sterling has appreciated by 4.5% against the euro to £1 = €1.2134 (LSEG). For UK farmers this means that imports of EU cereals and oilseeds are more competitive and exports from the UK are not stimulated. The current sterling-euro exchange rate is at its highest level for eight and a half years (since the day after the UK’s referendum on EU membership) and its putting additional pressure on commodity prices. On the other hand, for UK farmers, inputs imported from eurozone countries may be cheaper due to stronger sterling.

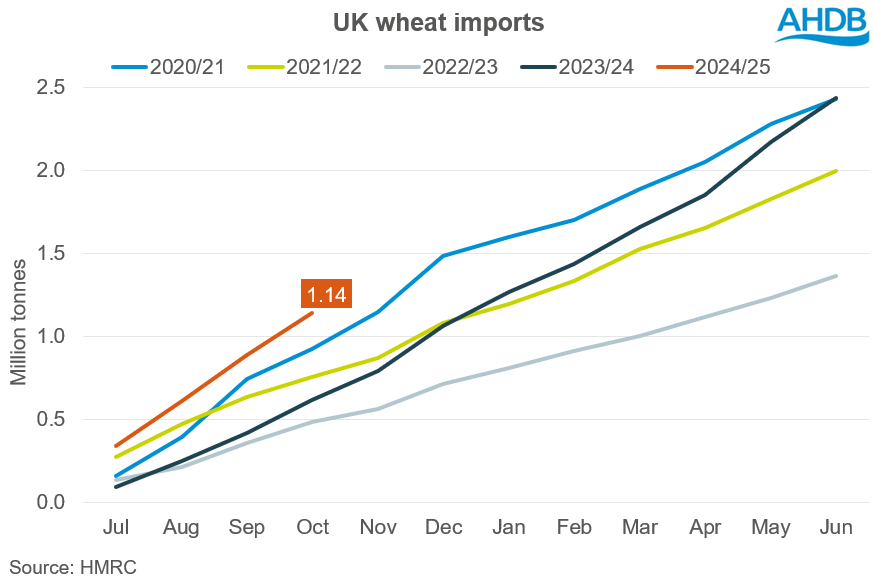

Indeed, the historically low level of the UK wheat production in the current marketing year (-20 % change year-on-year) and quality issues are accelerating additional grain imports. However, the strengthening of sterling against the euro is providing an additional stimulus to the pace of wheat imports. In the current marketing year 77% of all wheat imported into the UK from 1 July to 31 October came from the EU. The pace of UK wheat imports in the current marketing year to October is 80 % higher than the average for the same period over the last five years. The main exporters of the EU wheat to the UK in the current marketing year are Germany, Denmark, Poland and France.

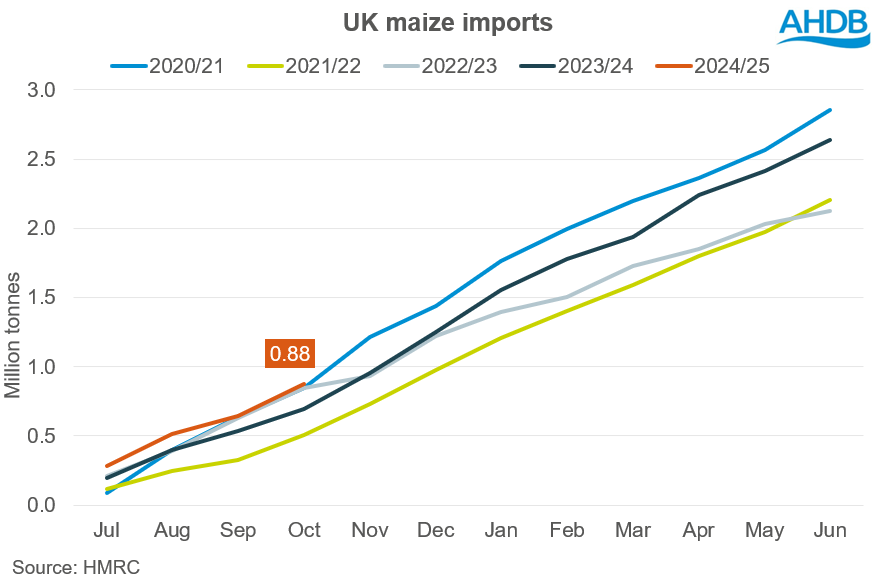

About 48 % of imported maize was from EU countries, so the strengthening of sterling against the euro has less influence compared to wheat, but it is still supporting pace of imports. The main exporters of maize from the EU to the UK in the current marketing year are Romania, Poland, Ireland and France. The pace of UK maize imports in the current marketing year to end-October was 19 % higher than the average for the last five years.

Looking ahead

Data for the last five calendar years show that sterling tends to strengthen from September to November. This is being seen in 2024 and puts some pressure on grain and oilseed prices. The strength of sterling in 2025 could keep or lessen this pressure on UK prices. However, a positive moment for UK farmers from strong sterling is potentially cheaper inputs imported from the EU.

On Wednesday 18 December, markets are waiting for the US Federal Reserve’s interest rate decision. It will be interesting to see for the final decision as it could affect both the US dollar and the commodity market as many global trades take place using US dollars. The consensus forecast is for a potential rate cut from 4.75% to 4.50%. But some surprise is possible as the next US President’s inauguration will be in January 2025.

For the UK domestic market, the Bank of England will make a decision on interest rates on Thursday 19 December and expectations are for the rate to be unchanged at 4.75%.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.