Analyst Insight: Final UK harvest 2024 estimates

Thursday, 12 December 2024

Market commentary

- UK feed wheat futures (May-25) closed at £188.25/t yesterday, rising £1.55/t from Tuesday’s close. The Nov-25 contract gained £1.00/t over the same period, to close at £190.00/t.

- UK feed wheat futures found support from the USDA’s WASDE report, which cut the EU’s total wheat crop by 1.3 Mt to 121.3 Mt. The report was bullish for maize, revising global ending stocks for maize tighter (-7.7 Mt to 296.4 MT), which also lent support to wheat markets.

- Paris rapeseed futures (May-25) closed at €530.00/t yesterday, falling €1.25/t from Tuesday’s close. The Nov-25 contract lost €2.75/t over the same period, to close at €476.00/t.

- Weakness in palm oil markets due to profit taking spilt pressure over to European rapeseed markets in addition to technical selling of Paris rapeseed futures weighing on prices. IKAR announced that planting of oilseeds in Russia next year may increase by one million hectares (Mha) to at least 19 Mha as oilseeds in 2024 had performed better in comparison to other crops (e.g. wheat).

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Final UK harvest 2024 estimates

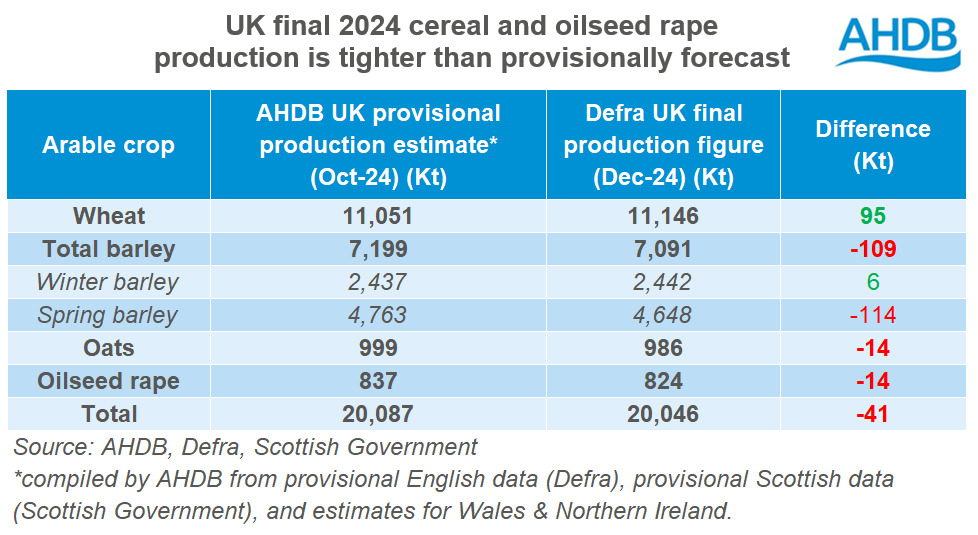

Earlier today, Defra released the final estimates for 2024 UK cereal and oilseed production. In order to provide an initial look at harvest 24, back in October, AHDB published “provisional” UK cereal and rapeseed production estimates following the release of Defra English and Scottish production figures. So, how do the final figures differ from our provisional estimates? And what does that mean for domestic supply and demand?

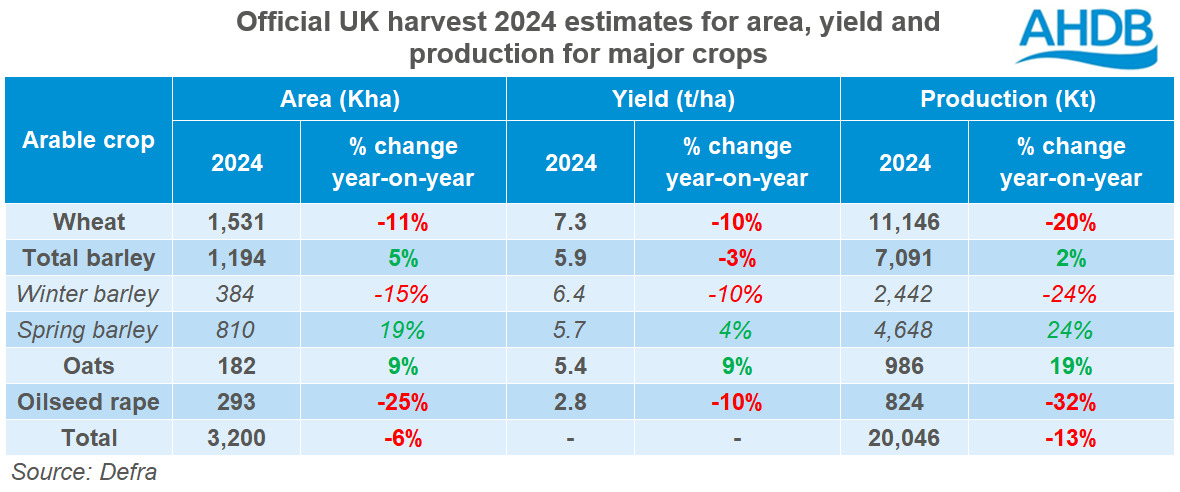

As is well known, following the wettest September – May on record (1,168 mm) last season, cereal and oilseed rape production in the UK was considerably challenged, particularly winter sown crops. While most spring crops fared better, according to today’s figures, total production of wheat, barley, oats and oilseed rape contracted by 13% on the year in 2024 to 20.0 Mt. This was in line with AHDB’s provisional estimate made in October, and remains the smallest harvest since 2020.

While most of the final crop estimates were relatively in line with AHDB’s provisional figures, the table below shows a larger decline in spring barley production than expected. This is due to smaller-than-expected yield estimates for the English and Scottish spring barley crops.

What does this mean for the UK cereals balance sheets

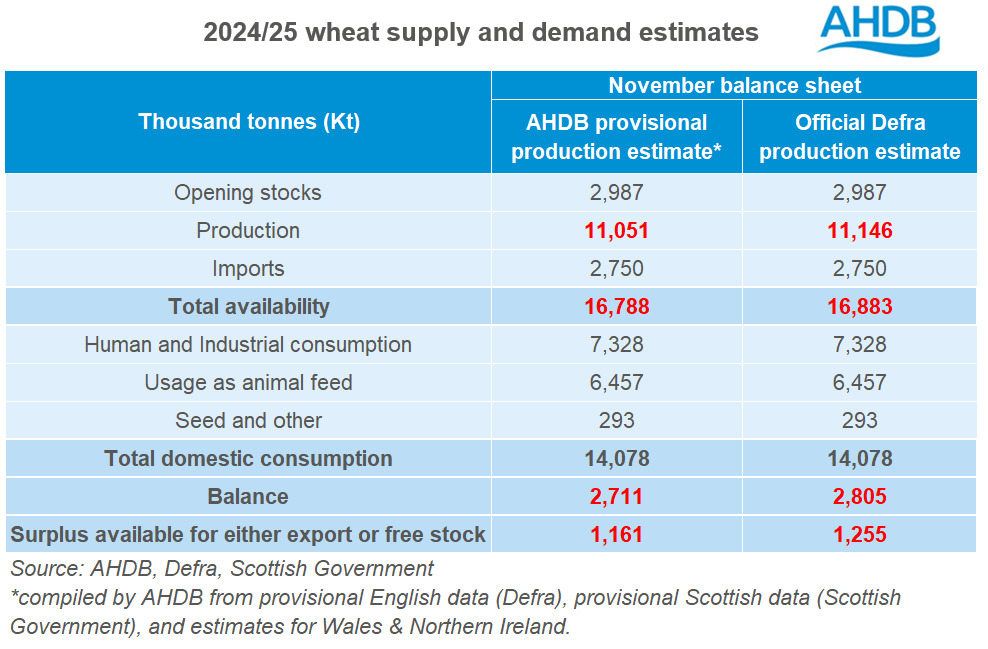

Defra’s slightly larger wheat crop estimate leads to a slight increase in wheat availability this season. With this new estimate, total availability of wheat would reach 16.88 Mt, up from 16.79 Mt using AHDB’s provisional figure. Using the latest consumption estimates, this therefore leads to a heavier balance of 2.81 Mt, and a greater surplus for either export or free stock of 1.255 Mt (just below the five-year average).

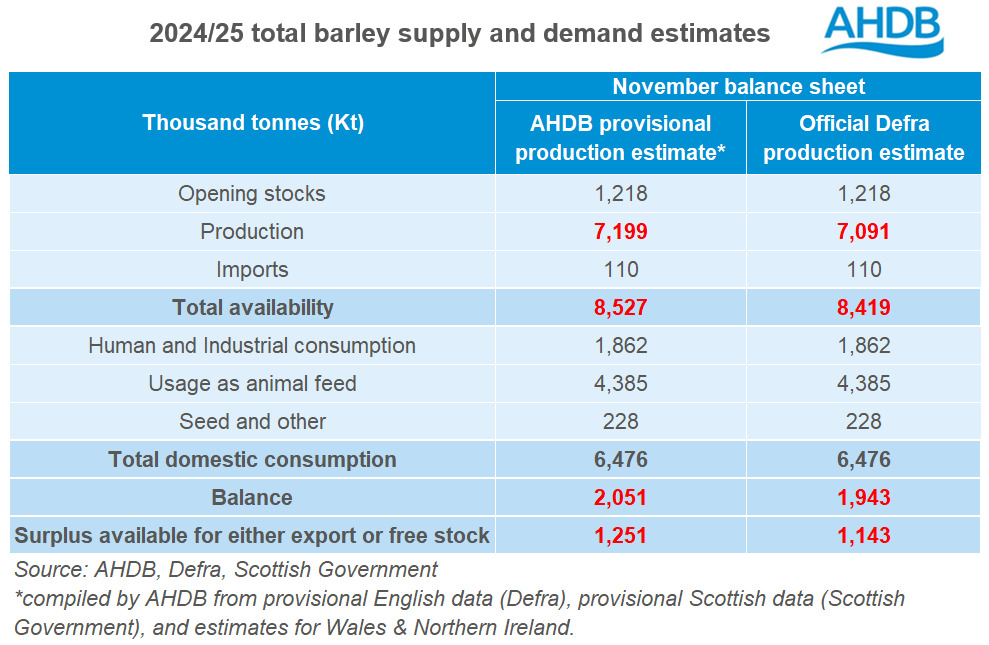

The downwards revision to the spring barley crop leads to a tighter barley balance of 1.94 Mt, and the surplus available for either export or free stock at 1.14 Mt (below the five-year average but in line with 2023/24).

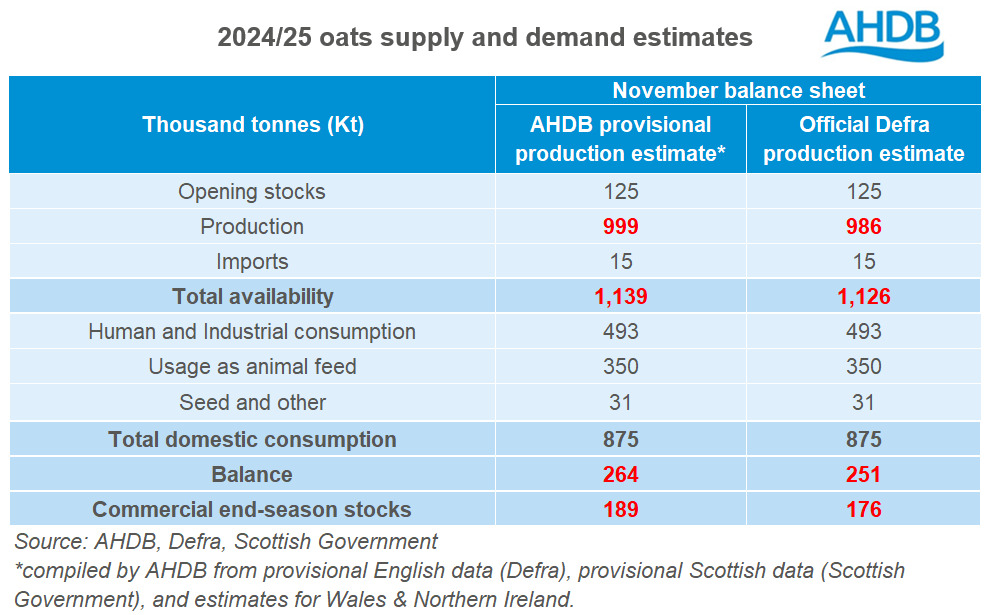

A small cut to the oat estimate leaves the balance of UK oat supply and demand at 251 Kt. With exports currently estimated at 75 Kt, this would leave ending stocks at 176 Kt, above the five-year average and the heaviest since at least the turn of the century.

Conclusion

Overall, the final Defra production figures for harvest 2024 saw relatively minimal change from AHDB’s provisional estimates made in October.

The crop which saw the largest revision was barley, leaving a slightly tighter balance than initially expected. However as current export pace remains steady, we are unlikely to see much price reaction.

Focus has turned to what we can expect from harvest 2025. AHDB’s provisional Early Bird Survey forecasts an uptick in the planted wheat area, and a fall in barley area; the revised estimates using the final Defra figures are due to be published in the coming days. Our latest crop development report shows that the condition of crops is variable across GB, due to drilling time and regional weather changes.

The next AHDB UK cereal supply and demand estimates are scheduled for release in January 2025. These will include the 2024 Defra production estimates which were released today.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.