Provisional UK crop production estimates for 2024: Grain market daily

Tuesday, 15 October 2024

Market commentary

- UK feed wheat futures (Nov-24) closed yesterday at £187.25/t, down £1.70/t from Friday’s close. The May-25 contract ended the session at £201.50/t, down £2.25/t over the same period.

- UK feed wheat futures followed Chicago wheat futures (Dec-24 down 2.3% from Friday’s close) and Paris wheat futures (Dec-24 down 0.25% from Friday’s close) lower yesterday. The USDA raised its outlook for global wheat stocks to 257.7 Mt on Friday, which pressured prices. But support from concerns over production and shipments from Ukraine and Russia limited the decline. Argentina and Australia had dry weather in recent months that could reduce yields, though Argentina received some rain at the weekend.

- Nov-24 Paris rapeseed futures closed at €495.25/t yesterday, down €4.00/t from Friday’s close. The May-25 contract was down €2.00/t over the same period, ending at €503.00/t.

- Crude oil prices and soyabean prices decreased yesterday as a result Paris rapeseed futures followed in the same direction. Chicago soybean futures fell on Monday from harvest pressure in US and forecasts of favourable rain in Brazil. From a technical trading perspective, Paris Nov-25 rapeseed futures needs to cross the strong price level of €500.00/t for further potential support.

Provisional UK Crop Production Estimates for 2024

Following the release of provisional data by Defra for England last week and by the Scottish government for Scotland this morning, we can now provide a first insight into the UK’s 2024 production.

Please note that for Wales and Northern Ireland, estimates are included, as figures for these countries are not yet available. To estimate the figures for Wales and Northern Ireland, we calculated the year-on-year percentage change in output for England and Scotland combined. This percentage was then applied to 2023 production levels for Wales and Northern Ireland to generate 2024 estimates.

The provisional figures show widely expected falls in UK wheat and oilseed rape (OSR) production. While the wheat crop is still larger than 2020’s historically low figure, OSR output is provisionally the lowest since 1983. Despite increases in barley and oat production from 2023, both remain below their respective five-year averages. As a result, the UK will be much more reliant on imports than usual this season.

AHDB will release its first estimates of wheat and barley UK supply and demand for the 2024/25 season later this month. See estimates for the past season here. Hear more about UK supply and demand at AHDB’s Grain Market Outlook events on 5 November (briefing), 7 November (webinar) and 13 November (seminar at Agri-Scot).

Defra will release final UK production estimates on 12 December.

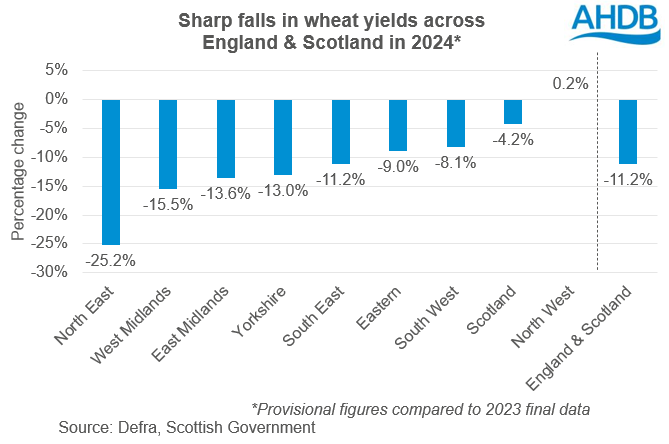

UK wheat production for 2024 is provisionally estimated at 11.1 Mt, which is a decrease of 2.9 Mt compared to 2023 harvest. This figure is also 21% below the five-year average (2019 – 2023) but above 2020’s 9.7 Mt crop, despite fears earlier in the year. The extremely wet weather through last autumn and winter, and into spring, disrupted wheat planting, led to crop losses and badly impacted early crop development.

The North East region of England experienced the most significant proportional decline in wheat production, with a 32% drop year-on-year. In contrast, Scotland saw the smallest decrease, with production falling by 12%.

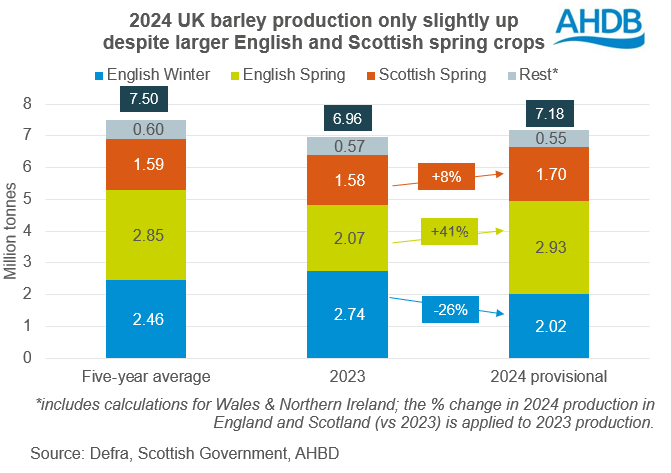

The UK’s total barley production for 2024 is estimated at 7.2 Mt, an increase from the 6.9 Mt harvested in 2023. However, this figure is below the five-year average of 7.5 Mt (2019 – 2023). Despite a 5% year-on-year increase in the total barley area for harvest, provisionally estimated at 1.19 Mha, overall production has declined. This drop is primarily due to lower yields of winter barley.

Spring barley

The UK’s spring barley crop for 2024 is projected at 4.76 Mt, up 1.00 Mt compared to the 2023 harvest. This figure also surpasses the five-year average (2019 – 2023) of 4.57 Mt.

Spring barley yields have seen notable improvements this year, with increases reported in every part of England, and in Scotland.

Winter barley

UK winter barley production for 2024 is estimated at 2.44 Mt, representing a 24% fall from the 2023 harvest and a 17% drop (480 Kt) from the five-year average (2019 – 2023) of 2.92 Mt. Yields were lower across England, while Scotland provisionally saw a 2% increase.

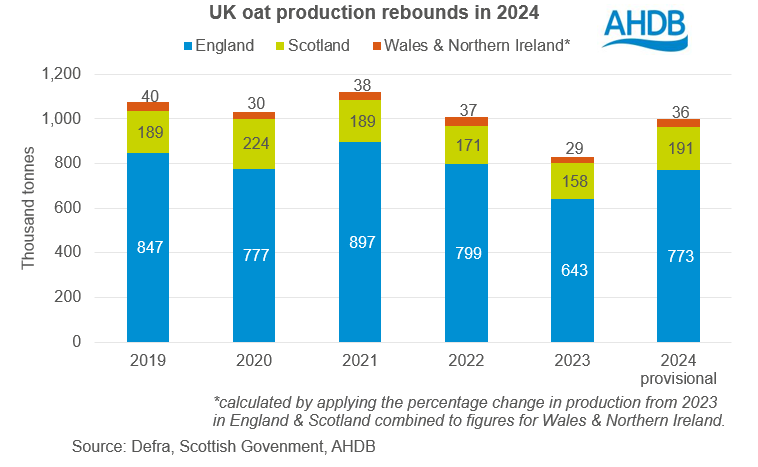

The UK’s oat production for 2024 is estimated at 999 Kt, up 169 Kt from the 2023 harvest. However, this is still below the five-year average (2019 – 2023) of 1.01 Mt. Production has increased in all regions except the North East, which saw a 4% decline.

In terms of yields, most regions of England have seen improvements, except for the North East, East Midlands, and West Midlands. Scottish yields, estimated at 6.9 t/ha are also above the five-year average.

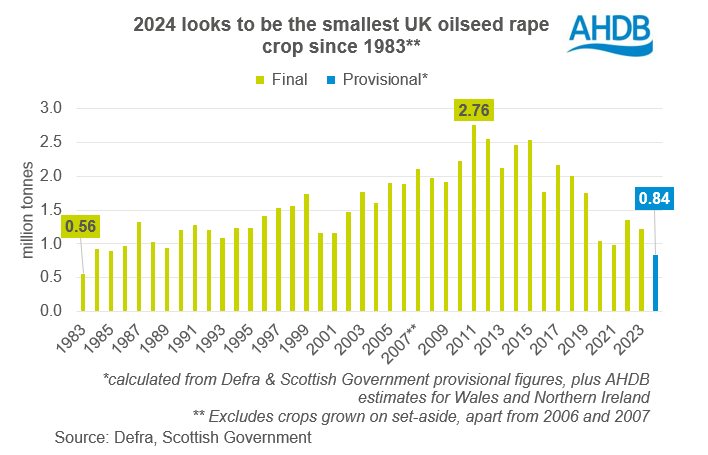

The significant reduction in the areas planted with OSR in 2024 compared to 2023, and lower yields in many parts of the UK, sharply reduce production. Yields were only higher than 2023 in Eastern England (+2%), South East (+2%), and South West (+1%). Scottish yields are provisionally down 11% at 3.6 t/ha.

Therefore, UK OSR production for 2024 is estimated at 837 Kt, a 31% decrease from the 1.22 Mt harvested in 2023. This figure is also 432 Kt below the five-year average (2019–2023) of 1.27 Mt, and the smallest crop since 1983.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.