Feed report: 15 December 2021

Wednesday, 15 December 2021

By Megan Hesketh

Grains

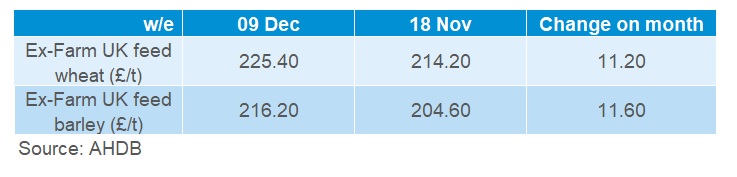

A tight global wheat supply and demand picture continues to strengthen UK grain prices.

Also offering support is a tight UK supply and demand picture, this is helping to keep UK ex-farm grain prices elevated. Due to logistics and local demand Scottish and northern ex-farm wheat prices are rising faster than other areas.

Last month, UK ex-farm barley prices rose faster than UK wheat prices again. This narrowed the discount between both commodities by another £0.40/t, to £9.20/t. Demand for UK barley is expected to remain relatively strong this season.

December’s USDA World Agricultural Supply and Demand Estimates (WASDE) increased global ending wheat stocks by 2.4Mt (released 09 Dec) from the previous report, to 278.2Mt. This was due to increased production estimates for Australia (+2.5Mt), Russia (+1.0Mt), and Canada (+0.65Mt) outweighing any uplift in demand figures. Despite some initial pressure to wheat markets, prices remain strong as news was not ‘new’ to the trade, and the demand and supply picture remains tight.

Australia is expecting a bumper wheat crop this season (at 34.4Mt) on higher-than expected yields. This raises production estimates 3% above last season. Though, milling quality concerns remain considering recent wet weather. This may mean more than usual feed wheat available.

Russian export forecasts by the USDA are still reportedly higher than some trade expectations. This is considering rising Russian export prices and a possible 9.0Mt wheat export quota from 15 Feb to 30 Jun 2022. If Russian exports are tightened, this may mean further reduced global supplies.

Demand has also been supporting wheat markets in December. This includes tenders from the Middle East and North African countries, as well as more recently from China.

Weather monitoring continues in South America as we see dry weather impact on soil moisture. Dry conditions in Brazil especially are important to watch, given this dryness covers key maize and soyabean producing states. Maize markets are expecting and relying on large crops from Argentina and Brazil, as key exporters.

US ethanol demand has been strong in recent weeks, supporting feed grain prices. However, recently the Environmental Protection Agency (EPA) proposed trims to the 2020 and 2021 biofuel mandates, from 2019. Though 2022 is set to rise from 2019.

In the UK, the AHDB’s first crop condition report shows good crop establishment to the end of November. Conditions look improved from this time last season. The mild and settled autumn weather allowed for successful drilling and optimum spraying conditions.

Proteins

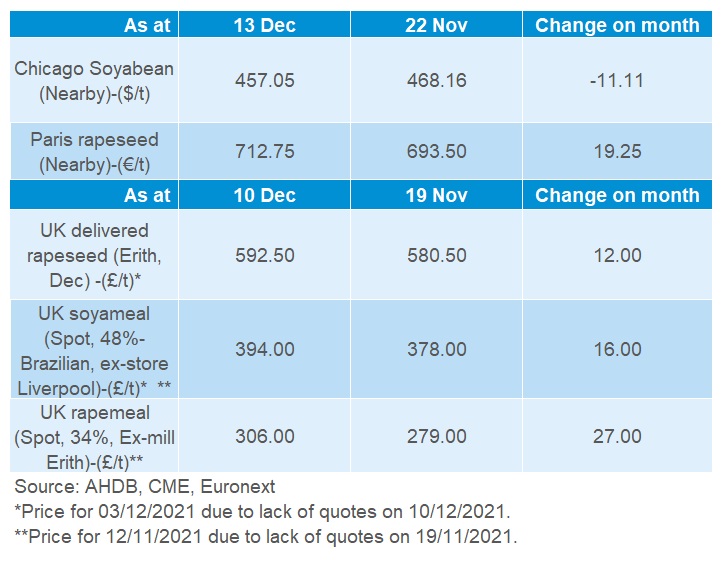

Rapeseed and rapemeal prices continued to see support over the past month. This is due to both global and specifically EU supply and demand for rapeseed remaining tight.

Global oilseeds and oil markets experienced a volatile week at the start of December, as news emerged on Omicron variant. Concerns remain around travel restrictions and reduced demand for fuel, and subsequently oil from global restrictions.

For soyabeans, the latest USDA WASDE report did not result in large changes to the supply and demand picture. Though Brazilian forecasting agency Conab have increased their forecast for the country’s soyabean crop to 142.8Mt (up 0.8Mt).

South American weather is a watchpoint for soyabean markets over the next few months, with markets expecting large South American soyabean crops. This is pressuring the longer-term outlook for soyabean prices. As at 8 December, 75% of the Argentinian soyabean crop was rated good to excellent condition, according to Bolsa De Cereales. Though this is compared to 88% a week earlier. Recent dry weather in parts of Argentina, and forecasts ahead, continue to be watched closely.

In the UK, the AHDB Early Bird Survey for plantings and planting intentions for harvest 2022 shows an increase of 12.9% of rapeseed area from last season. This would be the first yearly rise since 2018. However, at 345Kha, this would still behind 2020 (380Kha) and the 5-year average (2017-2021) at 472Kha. It is important to remember this is drilled area too.

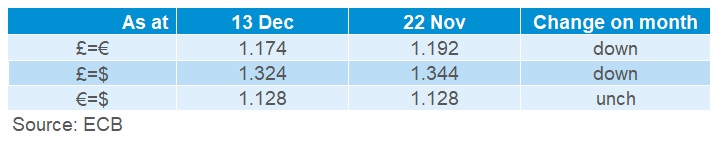

Currency

The pound sterling weakened against both the US dollar and Euro this month. This is mostly down to the introduction of covid restriction measures in England. Measures including working from home, mask wearing, and vaccine passports all posed as downsides to economic recovery.

Though, news from the Bank of England on an interest rate hike in England may help the sterling retrace some losses.

Subscribe to our weekly market newsletters and receive market updates straight into your email inbox

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.