Wheat dipped after USDA raised stocks: Grain market daily

Friday, 10 December 2021

Market commentary

- Both May-22 and Nov-22 UK feed wheat futures lost £3.00/t yesterday. The May contract closed at £226.00/t, while Nov-22 closed at £201.50/t.

- Over the past few days, expectations for big wheat crops in Australia and Argentina have weighed on wheat prices. Re-positioning ahead of last night’s USDA report (see below) and better weather for winter wheat crops in the US were also likely factors.

- With the Argentine wheat harvest past the halfway point, the Buenos Aries Grain Exchange upped its crop forecast by 0.7Mt to 21.0Mt (17.0Mt last season). Yields have been better than expected.

- Brazilian forecasting agency Conab increased its forecasts for the country’s maize and soyabean crops. Maize output is now pegged at 117.2Mt (up 0.5Mt), with the soyabean crop at 142.8Mt (up 0.8Mt).

Wheat dipped after USDA raised stocks

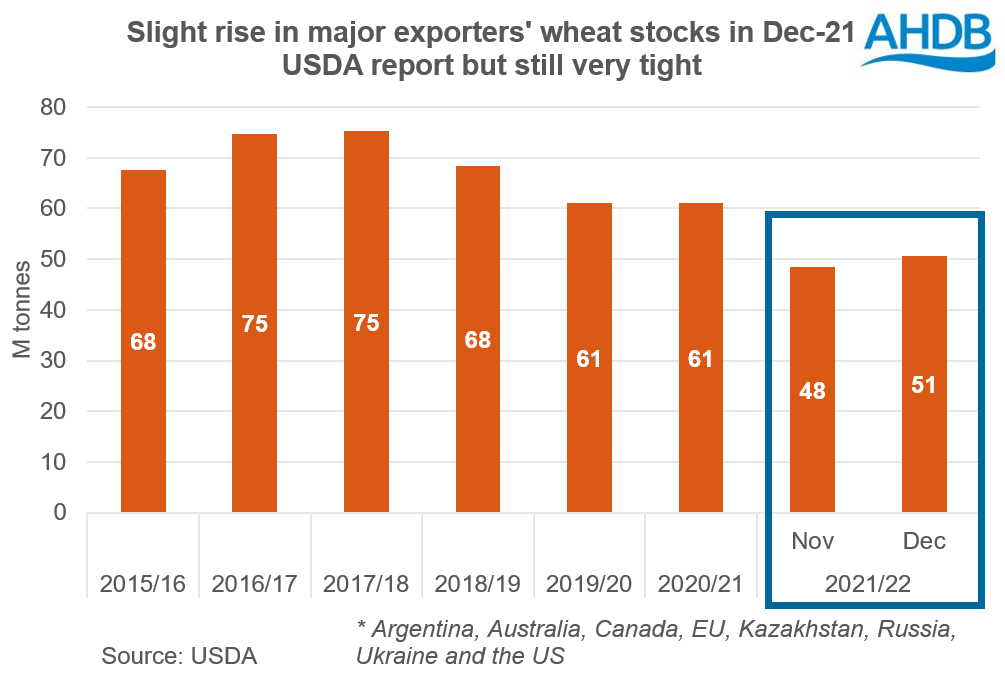

US wheat futures closed lower yesterday after the USDA increased its forecasts for the US and global end of season stocks.

The USDA now forecasts global wheat ending stocks at 278.2Mt, 2.4Mt more than last month. This follows larger crop estimates for Australia (+2.5Mt), Russia (+1.0Mt) and Canada (+0.65Mt). Domestic feed and export demand are both also higher for Australia, the EU and Russia. But, it’s not enough to offset the larger crop numbers. The increase in global stocks was also more than the industry predicted in a pre-report poll by Refintiv.

Maize initially traded lower after the report was released. The USDA lifted its estimate of the Ukrainian and EU crops. This resulted in slightly higher global stock forecasts, up 1.2Mt to 305.5Mt (292.7Mt in 2020/21). But, maize ended the day higher due to good weekly US export sales, including a new shipment to China.

Soyabean prices also rose after the USDA trimmed its forecast of world ending stocks. So far this morning (11.30 am), Paris rapeseed futures are trading slightly higher.

These revisions don’t really change the outlook for either grains or oilseeds. The grain market remains tightly supplied and that means an underlying level of support for prices. Indeed, so far this morning (11 am), UK and Paris wheat futures are trading higher again.

Meanwhile for oilseeds, larger South American soyabean crops are expected to bolster supplies early in 2022. If it occurs, this will likely bring some pressure to prices. But, the margin for error is small and so markets will be nervous until the crops are harvested.

Two of the key things to watch in terms of where markets move over the next month or so are:

- South American weather. The region is expected to account for 10% of global grain production this season and 55% of global soyabean output. The critical yield forming period is underway for soyabeans and early maize crops; it will continue over the next month or so.

- COVID-19 case numbers and the global response. As we saw last year, travel restrictions have the potential to reduce global demand for transport fuel, including biofuels made from grains and vegetable oils. Meanwhile, social restrictions last year reduced demand for malting barley. Whether we see demand losses in the months ahead depends on what happens with the Omicron variant.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.