Analyst Insight: Supply and demand estimates show wheat picture tightening

Thursday, 25 November 2021

Market commentary

- UK feed wheat (May-22) contract closed down £1.00/t yesterday, to £240.00/t. Nov-22 also lost a little ground yesterday, down £1.50/t to £210.00/t.

- US wheat, maize and soyabean futures lost some ground yesterday on profit taking ahead of the Thanksgiving holiday today. Though remain at multi-year highs.

- US soyabean exports have been revised back slightly in the latest USDA Agricultural Trade report, to 55.8Mt. There has been talk that China have been opting for Brazilian soyabeans.

- The latest US ethanol production figures remain strong at 1,079K barrels per day to week ending 19 November. Ethanol margins remain reportedly good but there are some concerns around logistics.

Supply and demand estimates show wheat picture tightening

The first official 2021/22 supply and demand estimates have been released today. This includes insights into wheat, barley, oats, and maize.

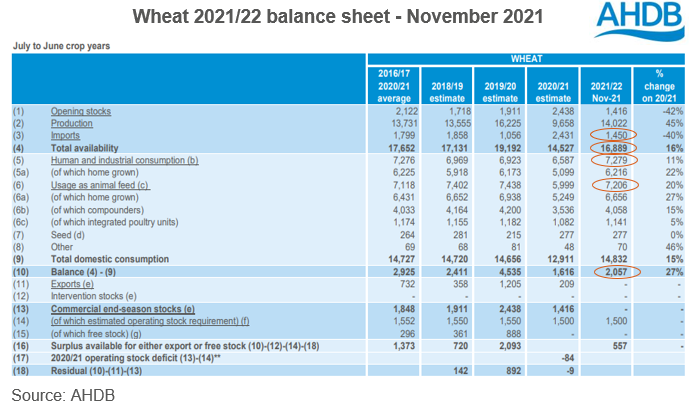

The UK wheat supply and demand picture remains tight. Total 2021/22 wheat availability is estimated at 16.89Mt. This is 2.36Mt higher than in 2020/21, but still the second lowest since 2013/14. Wheat availability estimates have been reduced from earlier projections by 250Kt.

Why is this? Despite higher wheat production year-on-year, availability is tight this season owing somewhat to the tightest opening stocks this century. Adding to this, September saw a slow pace of imports, attributed to current sea freight issues and increased costs. As a result, import estimates have been trimmed this month from earlier estimates to 1.45Mt. This figure would be down 40% from last season but remains above 2019/20 levels.

Despite tight availability this season, wheat consumption forecasts are strong. Human and industrial (H&I) usage for 2021/22 is forecast at 7.28Mt, up 11% from last season. Home-grown H&I usage specifically is also forecast to rise, up 22% on the year to 6.22Mt, on the back of higher production. Increases in consumption can be attributed to the bioethanol and starch sectors, with the introduction of E10. These forecasts assume a fully on-line bioethanol industry by the first half of 2022.

Total millers’ usage remains relatively stand on, year-on-year. Despite initial quality concerns, the functionality of UK wheat is reportedly better-than-expected. With sea freight issues rising freight costs, imports are estimated to be down year-on-year boosting home-grown usage. Though with issues in UK transport logistics too, there may be some regions in which sea freight could be utilised if more readily available.

Animal feed usage too is forecast up 20% year-on-year to 7.21Mt. This is down slightly from the early balance sheet, but close to the 5-year average (2016/17-2020/21) of 7.12Mt. With the discount of barley to wheat narrowing considerably in recent months, a higher wheat inclusion in rations is expected this season. However, labour and logistical issues in some livestock sectors are expected to trim compound feed demand in the second half of the 2021/22 season. Both inclusion and labour issues will be watched as we progress through the season.

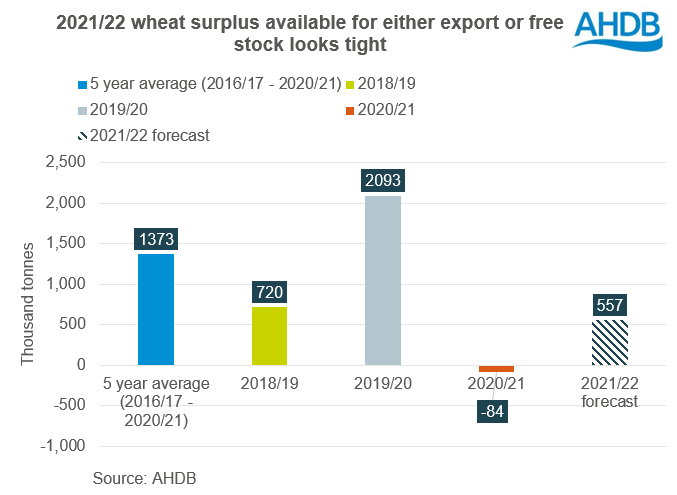

Overall, the wheat balance of total availability and domestic consumption is estimated at 2.06Mt, just 441Kt more than 2020/21 levels and the third lowest this century.

With a tight UK supply and demand picture, we could expect domestic wheat prices to remain relatively elevated this season. It could also result in low stocks heading into next season too.

As Helen pointed out last week, regional differences may become increasingly apparent as we head through the season. With northern and Scottish ex-farm wheat prices currently rising faster than other areas.

** Due to the highly unusual nature of the 2020/21 seasons hugely reduced wheat production figure, an extra line is included in the balance sheet to show the operating stock deficit

For commentary on the other grains, see below.

Total barley availability for 2021/22 is estimated down 1.32Mt on last season, to 8.25Mt. Availability is forecast down mainly due to a reduction in forecasted production (-12%) and opening stocks (-22%).

For consumption, forecasted H&I usage is expected up 9% to 1.87Mt. Despite some logistical issues, the outlook looks more positive for brewers, maltsters, and distillers as sales of beer and alcohol are understood to be back to pre-covid levels.

Whereas animal feed demand is forecasted down 23% to 4.07Mt. With the discount of barley narrowing to wheat substantially, it is expected that demand will switch to wheat.

Availability of oats for 2021/22 is up 13% to 1.31Mt, with a high proportion on account of larger production. At 1.15Mt, this is the largest crop since 1972 and attributed to higher yields. Comments from trade suggest that this figure may be too high though.

Consumption remains relatively stand on from last season, with total domestic consumption up 1% to 974Kt. Increased usage is forecast in animal feed demand (up 2%, to 407Kt), down to feed oat prices at a sizable discount to other cereals. Though, logistics is reportedly difficult.

With consumption relatively unchanged and availability up, end-season stocks for 2021/22 are forecasted up 93% year-on-year to 284Kt. This figure may be over-inflated by the potentially over-estimated Defra production figure.

Maize availability is forecasted down year-on-year for 2021/22. This is mostly on account of imports expected down 26% year-on-year, to 2.12Mt. Currently, import pricing of Black Sea maize is not competitive against domestic cereals, as global prices remain relatively supported. As a result, consumption too is forecasted down for both H&I usage and animal feed demand alike.

However, in a case that freight issues ease and maize prices become more competitive to UK wheat, we could see higher use of maize as a feedstock in ethanol production and in animal feed rations. You can monitor price competitiveness using the import parities dataset.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.