Sharp contrasts in UK crop production figures: Grain market daily

Friday, 15 October 2021

Market commentary

- Prices for both UK wheat and European rapeseed rose yesterday due to a rise in US maize and soyabean futures. US prices rose because the market ‘looked oversold’ after falling sharply in the wake of Tuesday’s USDA report. Buying by speculative traders was also reported as a factor yesterday.

- Nov-21 UK feed wheat futures rose £2.25/t yesterday to £206.50/t, while the Nov-22 contract gained £2.15/t to £190.15/t.

- Paris rapeseed futures for Nov-21 gained €13.00/t to €660.00/t, roughly equating to £558.50/t. The Nov-22 contract rose €8.25/t to €535.25/t, roughly £453/t.

- Missed our Grain Market Outlook conference? You can watch a recording of the livestreamed outlook session here.

Sharp contrasts in UK crop production figures

Defra released provisional data on the UK crop areas, yields and production yesterday. It shows a year of contrasts, with wheat and oats production up, but lower barley and rapeseed crops. There were also sharp differences in the amount of area and yield recovery seen.

There’s more detail below on the estimates and what sits behind them. But, the key market impacts for 2021 are likely to be:

- The UK will again need relatively high grain imports after wheat production recovered less than many expected. Scottish production is high, with yields near the all-time record. However, Defra reports below-average yields in the south and east of England, reducing the English crop.

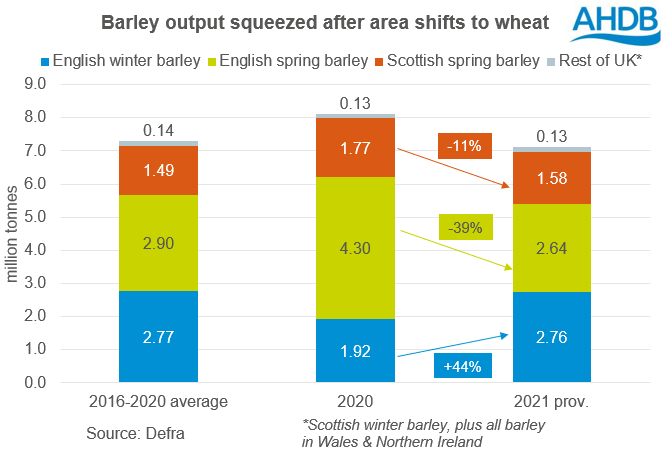

- The 2021 barley crop is provisionally 1.0Mt smaller than last year due to the smaller spring barley area in England. Although Scottish spring barley output is down, it’s still above average. For the UK as a whole, the smaller crop, coupled with higher ex-farm barley prices means less barley is likely to be used as animal feed than last season.

- Oat production is the highest since 1972. The impact is seen in ex-farm feed oat prices, which last week were more than £40/t below those for feed barley. This is likely to keep more oats being used as animal feed.

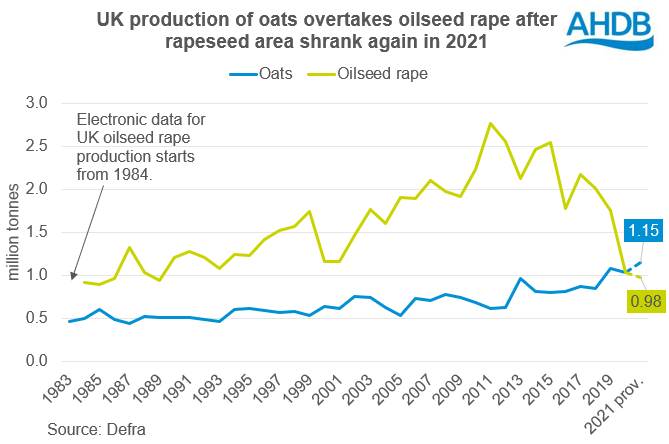

- The 2021 rapeseed crop is provisionally the smallest since 1989. As a result, UK prices will need to stay near the top of the global price complex to enable imports and support UK crushing.

Defra is still collecting replies for the UK production survey. If you’ve received this form, you can complete it online or post it back until 25 October. More responses mean better information for everyone in the industry, from growers to end-users and policy makers.

Defra will release the final results on 16 December 2021.

Wheat output rebounds, but mixed picture on yields

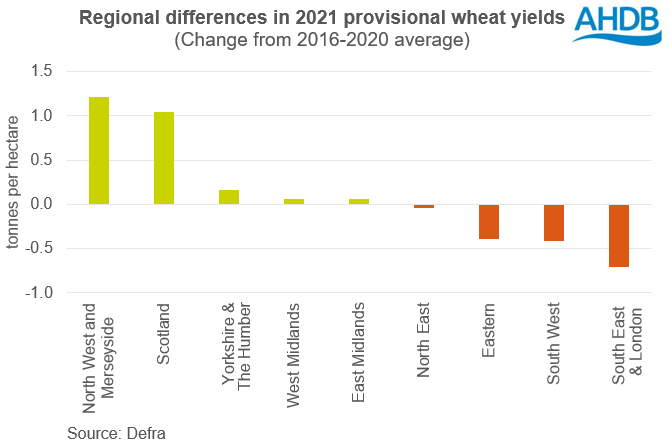

UK wheat production is estimated at 14.0Mt, up from the 9.7Mt harvested in 2020 due to a rebound in area to 1.79Mha. The average yield is provisionally calculated at 7.8t/ha. This up from 2020 (7.0t/ha), but still below the 2016-2020 average of 8.0t/ha. As a result, the provisional crop size is smaller than many expected.

But, there’s a sharp divergence in yields across the UK, which has made it difficult to fully assess the UK average. Results from Yorkshire and Scotland are good and well above average. The Scottish yield is reported at 9.2t/ha, the second highest on record.

In contrast, yields in the East and South of England are still below average, limiting the recovery in production in these areas. This may be linked to reports of higher moisture levels and lower specific weights in these areas. Defra uses a standardised moisture content of 14.5% for all crops.

Barley crop down as area shifts back to wheat

At 7.1Mt, the UK barley crop is provisionally 1.0Mt smaller than last year. A marked recovery in the English winter barley area (+36%) and yields (+12%), is offset by the smaller spring barley areas. The English spring area is down 41% to 471Kha as area shifted back to wheat, while the Scottish spring barley area fell 4%.

Biggest oat crop since 1972

The UK provisionally harvested 1.15Mt of oats in 2021, up 11% from 2020 and the biggest crop since 1972.

Although the area fell 5% to an estimated 199Kha, this was offset by a recovery in English yields. The Scottish yield is virtually unchanged from last year’s record. The UK average yield (including both winter and spring oats) is pegged at 5.8t/ha, 17% higher than 2020 and above the five-year average of 5.4t/ha.

Smallest OSR crop since 1989

UK rapeseed production fell below the 1 million tonne mark for the first time in 32 years, according to the provisional figures. At 977Kt, the 2021 crop is 6% smaller than 2020. The sharp (20%) drop in the area is only partly offset by better yields. The average yield, at 3.2t/ha, is provisionally above last year’s low of 2.7t/ha, but slightly below the 5 year (2016-2020 average) of 3.3t/ha.

Note: Defra carried the 2020 figures forward for Wales & Northern Ireland as 2021 data was not available. So, these figures will change in December. However, the two countries only account for 2% of total UK wheat production, 3% of barley, 4% of oats and 1% of rapeseed. As a result, the impact is likely to be fairly limited at the total UK production level.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.