WASDE tightens wheat: Grain market daily

Wednesday, 13 October 2021

Market commentary

- UK feed wheat futures continued their recent climb yesterday. The Nov-21 feed wheat futures contract gained a further £4.00/t yesterday, closing at £208.50/t. The Nov-22 contract gained £3.30/t to close at £191.30/t.

- UK markets tracked European markets higher. Yesterday’s USDA supply and demand estimates pushed wheat ending stocks to the tightest position in more the last five-years (more in the today’s article). Further, The EU market was tightened by FranceAgriMer, who have trimmed French soft wheat ending stocks by the end of the 2021/22 season by 0.5Mt to 2.4Mt.

- Signs of demand destruction for wheat were seen yesterday, with Egypt’s national wheat buyer, GASC, cancelling a tender after offers were received. The tender drew offers from France, Romania, Ukraine and Russia, the tender was cancelled owing to high prices.

Grain market outlook conference 2021

WASDE tightens wheat

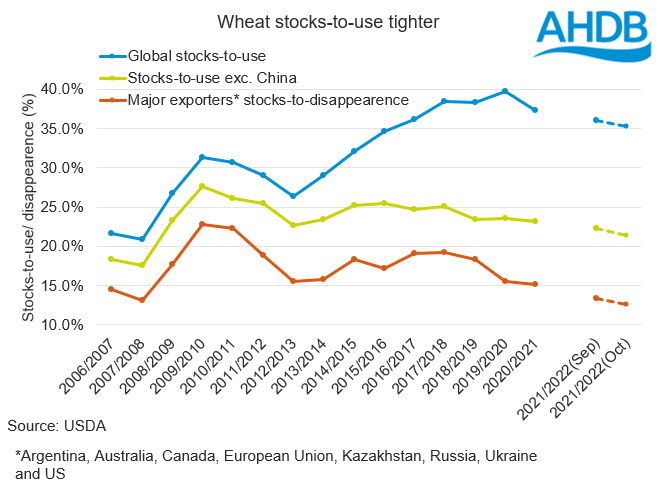

Yesterday, the USDA released, amongst other reports, its latest global supply and demand estimates. The report tightened the outlook further for wheat, taking the stocks-to-use of the crop to 35.2%, [1]still the tightest point since 2015/16. Excluding China, stocks-to-use is at the tightest point since 2007/08.

The stocks-to-disappearance (ending stocks divided by exports and consumption) of major exporters is also tightened in the latest WASDE. Moving to the lowest point since the USDA first published EU data collectively (1999/2000) at 12.6%. Stocks were revised lower for all nations except Ukraine and Canada. This tightness offers support to wheat markets.

The increased tightness stems from reduced global wheat stocks, 6Mt lower than in the September report at 277Mt. Global opening stocks are also revised lower, as is wheat production. Production cuts are seen for the US (-1.4Mt) and Canada (-2Mt). Production was revised lower; and subsequently imports revised higher, for a group of Middle East nations.

Maize stocks increased

While wheat is tighter, some of the support from the bullish changes is tempered by a more positive maize outlook.

While not dramatically improved, improvements in opening stocks and production were seen in the US. Increased opening stocks were also seen in China. The combined impact of production and opening stock increases while demand is kept stable, is to increase ending stocks. This pressured maize markets yesterday.

Soyabeans down

Soyabeans followed a similar trend to maize. Ending stocks are seen growing considerably (+5.68Mt) on improved production in the US (better yields) and bigger opening stocks in the US and China. This has added further pressure to the soyabean market and aided the two-day decline in Paris rapeseed futures.

What happens from here?

A key, if unsurprising, point of note is that the outlook for South America is largely unchanged. Dry weather concerns following the lingering effects of last year’s La Niña and this year’s La Niña watch could impact output of wheat in Argentina and maize and soyabeans in both Argentina and Brazil.

[1] Please note, the stocks-to-use calculation references the global wheat consumption data in the PDF version of the USDA World Agricultural Supply and Demand Estimates. AHDB note that the 2021/22 wheat consumption figure differs from the data available in USDA Production, Supply and Distribution database, which includes the latest WASDE numbers.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.