Market Report - 13 December 2021

Monday, 13 December 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

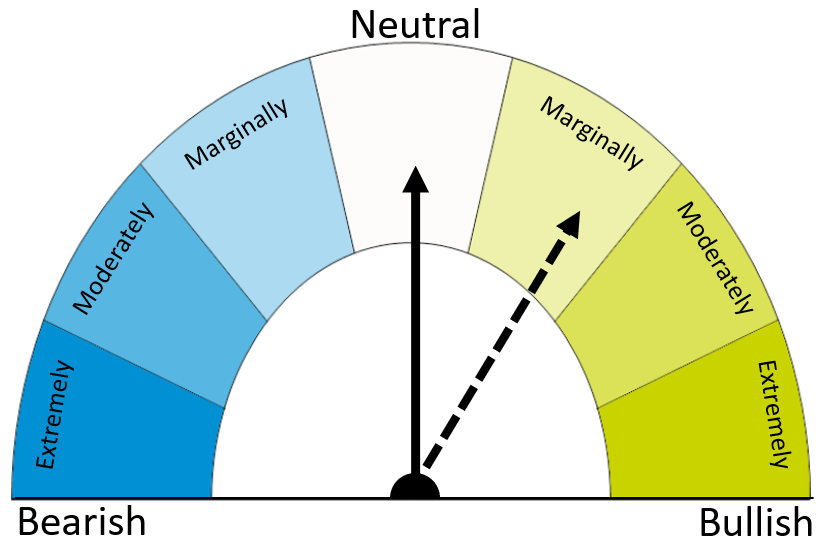

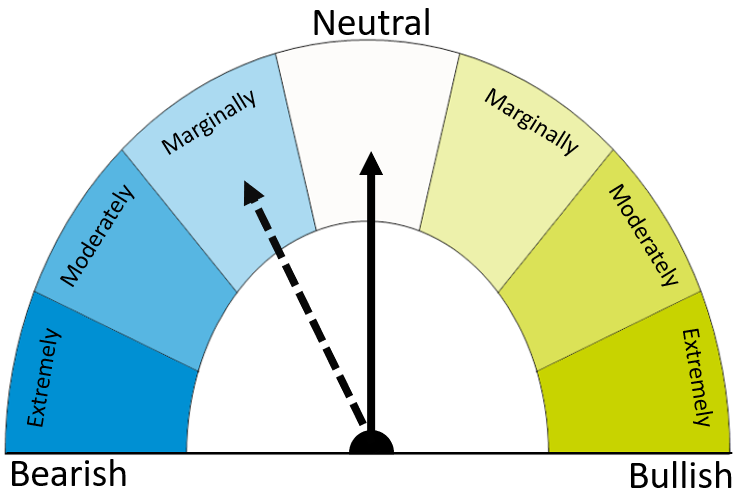

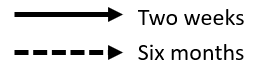

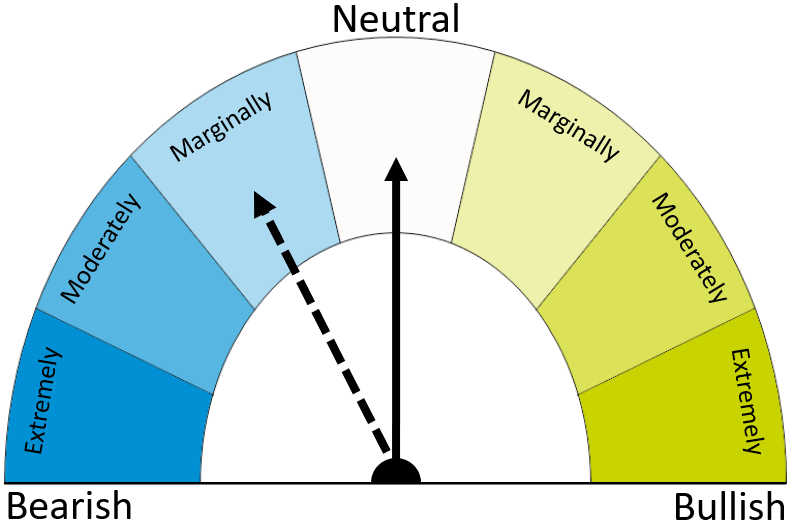

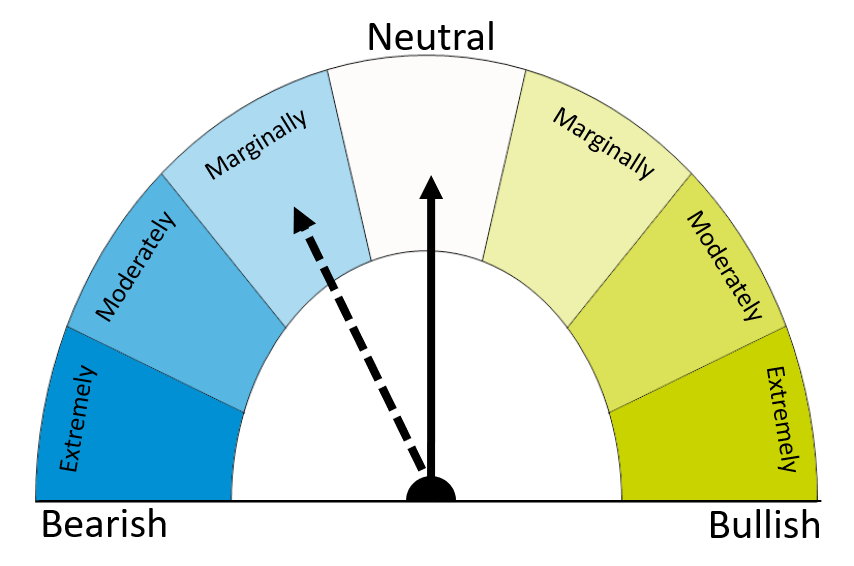

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

Maize

Barley

Globally, feed wheat supplies appear to be in a more plentiful position compared to last month. However, there is a growing difference between bread wheat and feed wheat, as high-quality wheat is still in tight supply.

South American maize crops are still far from confirmed but have potential to be substantial. Weather will remain a key watch point. Crop progress will be a continued driver of maize markets direction and conditions are currently dry.

Tight global barley supplies allow prices to track wheat markets closely. This will likely continue until the northern hemisphere harvest is nearby.

Global grain markets

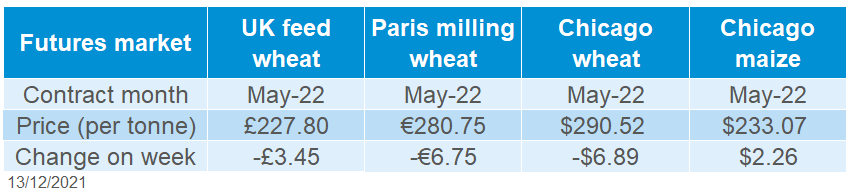

Global grain futures

Friday-to-Friday saw key global wheat futures contracts lose ground in anticipation of the USDA world agricultural supply and demand estimates (WASDE) released on Thursday. Then, Chicago, Paris, and London wheat futures contracts (May-22) all rebounded a bit on Friday (10 Dec) on the back of Chinese purchasing.

The USDA WASDE report increased global ending wheat stocks by 2.4Mt from the previous report, pegging it at 278.2Mt. Revised production estimates for Australia (+2.5Mt), Russia (+1.0Mt), and Canada (+0.65Mt) outweighed any uplift in the demand figures. This added pressure to wheat markets early on Friday. But, as mentioned before, Friday closed higher than the previous day for three of the key global contracts (May-22).

Refinitiv sources state that China has bought “large volumes” of French, Ukrainian and Australian feed grains (wheat, barley and maize). Buyers were likely seizing the comparatively low prices wheat slipped to on Thursday. This purchasing comes despite the recent Chinese maize harvest, and troubles within the pig industry.

The Australian harvest will likely cap gains from Chinese demand prospects. Despite recent interruption from wet weather, Australia is set for a bumper crop for the second year running. The bumper crop will likely ease supply concerns, at least in the feed wheat market. The Australian bureau of meteorology (BOM) anticipate drier than average weather in Western Australia, the largest wheat growing state or territory in Australia, from 20 December to 02 January.

Other weather news to watch comes from South America. This will particularly affect maize markets, which are relying on big crops from key exporters, Argentina, and Brazil. Dry weather is causing concerns for the current maize crop, but also may lead to the second crop being planted into dry conditions in early 2022.

UK focus

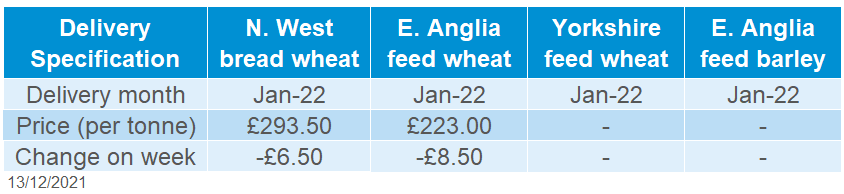

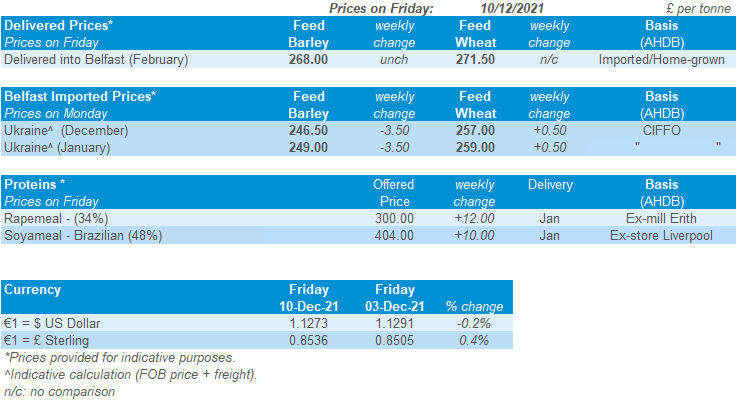

Delivered cereals

The UK followed global trends. The May-22 London feed wheat futures contract lost £3.45/t week-on-week, closing at £227.80/t. This is despite a £1.80/t rebound on Friday.

Thursday-to-Thursday, London futures (May-22) dropped £9.20/t and physical delivered prices followed a similar trend. For May-22 delivery, feed wheat into East Anglia experienced a £9.00/t drop, quoted at £228.00/t. Feed wheat delivered into Avonmouth (May-22 delivery) didn’t drop quite so much on the week (-£7.50/t) and was quoted at £229.50/t.

Bread wheat delivered into Northamptonshire (May-22 delivery) was quoted at £285.50/t, down £7.50/t from the week before. However, despite the weekly drop, the premium over feed wheat futures (May-22 contract) has extended. Last Thursday it calculated at £59.50/t versus £58.00/t the week before.

Oilseeds

Rapeseed

Soyabeans

Continued strong prices for rapeseed seem likely in the short-term as global supplies remain tight. Longer-term, pressure may come from increased 2022 crop prospects. Stratégie Grains peg the 2022/23 EU-27 crop at 18.0Mt, up 6% year-on-year.

On-going Chinese demand is crucial to keep the market balanced in the short-term. Going forwards, the weather in South America is a critical watchpoint. If dry weather persists in select regions over the coming weeks, we could see sentiment change.

Global oilseed markets

Global oilseed futures

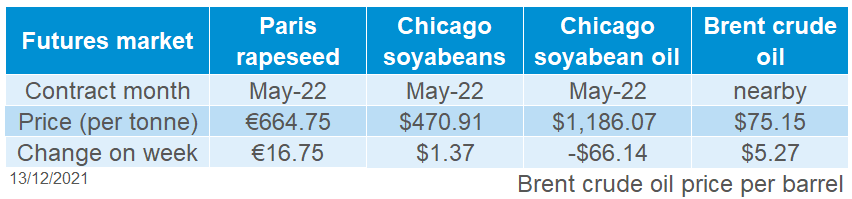

Across the week (03 Dec – 10 Dec) commodity funds were net buyers of Chicago soyabean futures. But, Chicago soyabeans futures (May-22) only marginally gained (in dollar terms) by 0.29% across the week.

Support comes from soyameal. Chicago soyameal futures (May-22) gained 3.1% across the week. However, the opposite occurred for Chicago soyoil (May-22) as prices fell 5.3% across the week. The sentiment driver for soyoil is the US’ proposal to scale back biofuel blending mandates.

The latest USDA world agricultural supply and demand estimates (WASDE) report, released Thursday (09 Dec), didn’t pose any seismic change to supply and demand. Therefore, it had minimal impact on markets (read more on this report here). This said, last week, Brazilian forecasting agency Conab increased its forecast for the country’s soyabean crop to 142.8Mt (up 0.8Mt).

In other oils, exports of Malaysian oil products rose 0.2% for Dec 1-10 compared to Nov 1-10, at 572.7Kt (Cargo Surveyor Interek Testing Services).

Malaysian palm oil futures gained across the week. This said, towards the end of the week pressure occurred due to a smaller than expected decline in November stockpiles. Malaysian stocks fell 0.96% from a month earlier, now estimated at 1.82Mt. A Reuters survey showed expectation was a 3.5% decline.

Rapeseed focus

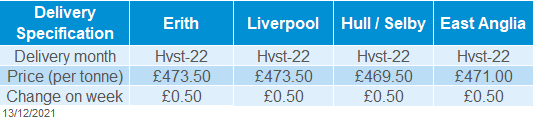

UK delivered oilseed prices

Old crop rapeseed prices found support across last week as Brent crude oil (nearby) rebounded 7.5% to close Friday at $75.15/barrel.

Paris rapeseed futures (May-22) gained €16.75/t across the week, to close Friday at €664.75/t. New crop prices (Aug-22) closed at €553.50/t, down €1.50/t across the week.

Delivered rapeseed (into Erith, Harvest-22) was quoted on Friday at £473.50/t, up £0.50/t across the week. A divergence in price is due to the Paris market easing on Friday afternoon after our survey was completed.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.