EU exports strong as Russian prices rise: Grain market daily

Tuesday, 30 November 2021

Market commentary

- UK feed wheat futures (May-22) fell £3.20/t yesterday, to close at £233.40/t.

- Global supply concerns eased slightly yesterday. The Australian 2021 wheat harvest has been raised to a record 34.4Mt by the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES). This is down to higher yields, and boosts production to 3% higher than last season. Yet concerns remain about quality, given recent wet weather.

- US winter wheat conditions were better-than-expected in the last USDA crop progress report of 2021. Last night’s report rated 44% of winter wheat as good to excellent, unchanged from last week. Trade expected a slight decline in ratings.

- India’s rapeseed and mustard production is currently forecast to rise 16% year-on-year for 2021/22. This is down to expected area expansion on high prices and good weather (area is currently up 17% to 7.18Mha).

EU exports strong as Russian prices rise

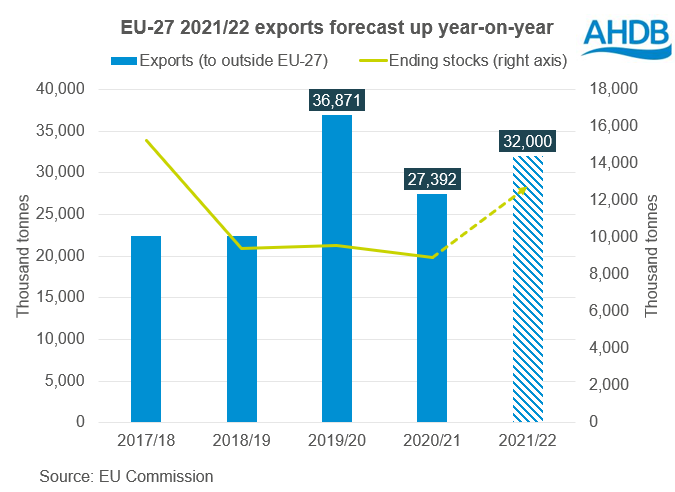

The EU Commission estimates the EU-27 will export 32.0Mt of soft (common) wheat in 2021/22. This is up 2.0Mt from last month’s estimate, and 4.6Mt more than last season. However, it is still below 2019/20 exports totalling 36.8Mt.

The total EU Commission projection for total wheat (32.8Mt) still sits behind USDA forecasts for 2021/22 at 36.5Mt.

Why is this important? Well, higher EU exports may further tighten an already finely balanced EU wheat supply and demand. EU closing stocks still do not look as tight as last season. But an increase in exports is something to watch going forward.

Could we see EU exports even higher with an increasing Russian export price?

Russia and the EU are two of the world’s top wheat exporters. Though after dry conditions cut this season’s crop, Russia has imposed a floating export tax in an attempt to reduce exports.

Last week, we saw Russian wheat prices rise for the sixth consecutive week. This is due to strong export demand. At the end of last week, Russian wheat (12.5% protein, loading from Black Sea ports, Dec delivery) was $340.00/t (approx. £255.00/t) free on board (FOB). This is up $6.00/t (£4.00/t) from the previous week, according to the IKAR consultancy and Refinitiv.

The Russian wheat export duty is set to rise from $78.30/t to $80.80/t from 1 December, according to the Agriculture Ministry. This new duty will be in effect until 7 December.

The Russian Ministry for Agriculture are yet to forecast wheat exports for 2021/22. Though at the Global Grains Geneva 2021 conference, the CEO of the United Grain Company forecast Russian wheat exports at 31-32Mt. The USDA estimate 36.0Mt for 2021/22 exports, compared to 38.5Mt last season.

Currently, SovEcon estimate Russian wheat exports in the season so far (Jul-Nov) as 18.1Mt. Since the start of the marketing season, Russian wheat export pace has on average been 26% slower than last season (SovEcon).

Why is this important to the UK?

If Russian export prices continue to rise, we could see further increases to EU exports. This could result in possible tightening of EU ending stocks.

This is especially important given the recent GASC (Egyptian state) tender, in which Romanian wheat was the most competitive pricing. This means pricing for Romanian wheat was comparatively cheaper to other origins, specifically Russia. This is laying the groundwork for strong EU exports to continue should competitive pricing remain.

Strong demand for European wheat is one of the factors supporting UK prices, which may continue as we progress through the season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.