EU beef and sheep meat production set for declines in 2023

Wednesday, 5 April 2023

In the European Commission’s short-term Spring outlook, EU beef and sheep meat production are forecast to see year-on-year (YOY) declines in 2023, at 1.6% and 1.2% respectively, driven by lower slaughter. Slaughter weights may increase, assuming improved grazing conditions and some relaxation of feed prices, but not by enough to outweigh lower throughput.

Beef

EU beef production is set to continue the YOY decline, albeit slowing by 1 percentage point (pp) from 2.6% in 2022. This follows continued contraction of both the dairy and suckler herds, amid struggling profitability and environmental pressures. The Commission expects cow slaughter to increase overall in the bloc in 2023, as some dairy producers act on falling milk prices and firm returns at the abattoir.

This comes as per capita beef consumption is set to follow the long-term declining trend by falling 1.7% YOY to just under 10kg in 2023. Food price inflation, tighter beef supply and squeezed consumer budgets, are expected to keep beef demand subdued as trading down to cheaper animal proteins becomes likely.

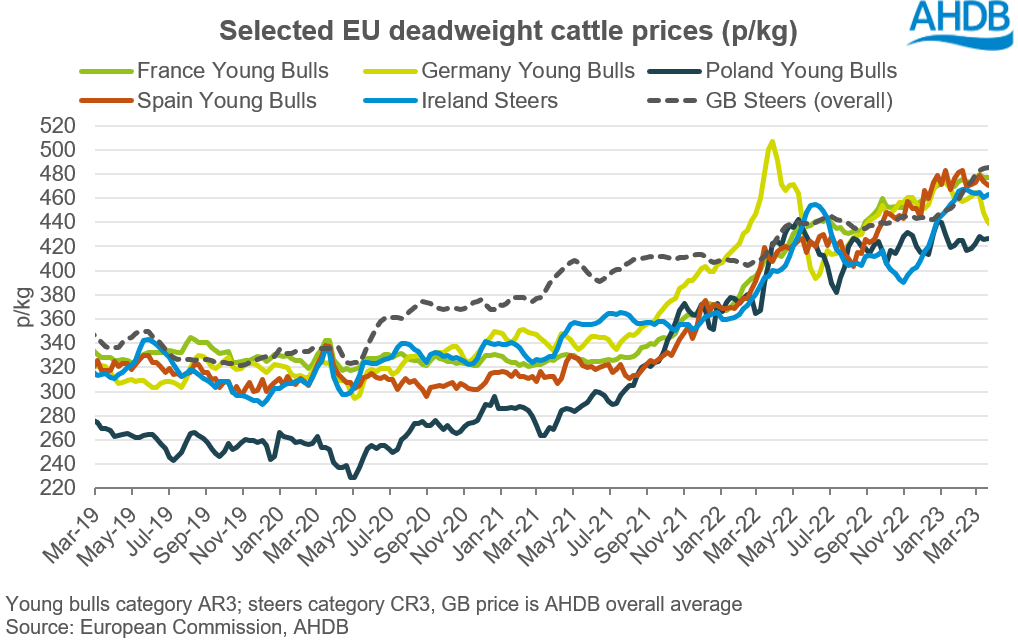

With a tight EU beef supply picture expected to offer support to prices, this could be negative for the export competitiveness of EU beef. As cattle prices have risen throughout Europe (particularly in 2021-2022), the general discount of EU cattle to GB seen previously has faded. Alongside weaker UK demand and lower EU production, this likely contributed to less beef moving into the UK from the EU in 2022. In our latest outlook, we forecast that UK beef imports will fall by around 2% in 2023 based on domestic market dynamics. However, supply tightness and firm demand in the global beef market could help to steady EU export levels, despite high prices.

On the imports side, the current price situation and expectation of lower production could mean increased imports into the EU market, by around 5% versus 2022. This is despite expectations of demand recovery in Asia (particularly China) increasing attractiveness for South America.

Sheep meat*

Despite continued support seen in European sheep meat prices, EU sheep meat production in 2023 could be limited by flock declines. The December 2022 survey showed the EU flock had shrunk by 1.5 million head versus the year before, being the third consecutive YOY decline above 1 million head. This was particularly driven by Spain and France.

Despite the overall flock contracting, total EU production declined by only 0.6% in 2022, as Ireland and Romania increased slaughterings. Production in 2023 is expected to fall by a further 1.2% in 2023.

Looking at imports, the European Commission expect volumes to grow by around 8% in 2023. Similar to beef, this is largely expected to be driven by the current price environment. Greater production and lower demand is forecasted for GB this year, while Australia is expecting record production levels, potentially leading to more competitive imports. Meanwhile, the Commission expect more New Zealand product to enter the market as logistical barriers are overcome. This could pressure domestic EU prices and may lead to stable EU demand in 2023.

Whilst the decline in sheep meat exports is set to slow by 5pp to -1% in 2023 compared to the year before, the total decline in exports is set to be driven by tight domestic supplies and relatively strong prices. It will be key to watch how EU prices impact trade over the coming months.

*Sheep meat figures and insights include both sheep meat and goat meat trends.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: