- Home

- Lamb market outlook

Lamb market outlook

Key points

- UK sheep meat production in 2026 is forecast to fall by approximately 3% year-on-year to 264,000 tonnes. Higher carryover is forecast to boost slaughter numbers initially, while tightness is expected later in the season with a slightly reduced lamb crop

- Overall, UK lamb consumption volumes are forecast to be steady in 2026. While household budgets remain tight, lamb is expected to hold its importance at holiday celebrations and remain a treaty choice for consumers

- Exports are forecast to grow in 2026, supported by robust EU market conditions. Meanwhile, import share is expected to increase, supported by improved market access. Growth in traded volumes however may be limited by production constraints

- Market fundamentals point to a generally supportive price environment, though early year pressure may present itself against a higher carry over. More widely the market remains exposed to risks from weather, disease and global supply

Overview

The UK lamb market in 2025 was characterised by tighter supply, while buoyant export demand helped to offset weaker domestic demand and contributed to generally supported market prices.

A smaller national ewe flock contributed to a reduced lamb crop, despite improved conditions at lambing. However, the sector faced challenges through the year, including drought conditions and prevalence of midge-borne diseases.

Constrained production in Europe, weaker demand in the UK and a weaker sterling helped export volumes grow to their highest level in six years, with record value. Imports meanwhile increased marginally from the year before, driven predominantly by increased shipments from Australia.

Moving into 2026, the outlook is for a reduction in domestic production, some encouraging export prospects and steady consumption levels.

These factors suggest a supportive pricing environment generally, notwithstanding seasonal supply and demand fluctuations. Domestically, producers continue to adjust to policy change and face continued uncertainty from volatile weather and animal health challenges.

Supply

Breeding flock

Defra pegged the UK breeding ewe flock at 14.8 million head as of 1 June 2025. This was 1% smaller than the same point the year before, and a softer reduction than was recorded in the previous two June surveys.

Two years of improved market returns have seemingly added some confidence in the sector, against a backdrop of fluctuating weather, disease burden and changes in devolved agricultural policy. Indeed, the steepest reductions in ewe numbers were noted in the English and Northern Irish flocks, with Welsh and Scottish flocks posting slight annual growth.

Overall, the gentle contraction in the national flock is expected to have persisted through the latter half of 2025, with a further 1% reduction forecast in ewes put to the ram this season.

2026/27 lamb crop

We anticipate a smaller national lamb crop of 15.19 million head in 2026/27, 2% lower than the estimated crop from the previous season. The expected contraction in ewe numbers - coupled with slightly lower rearing rates - will drive much of this reduction.

Industry reports suggest that scanning percentages recorded so far this season are steady-to-lower compared to last season, with concerns around the impact of drought and forage shortages on ewe condition.

Of course, weather conditions and forage production through the season will be key factors influencing the number and timing of lambs that come to market. Furthermore, the impact of disease (including Bluetongue) on the productivity of the national flock remains a key area of concern.

Clean sheep slaughter

Carry-over/old season lambs (H1 2026)

We estimate a greater proportion of the 2025/26 lamb crop has been carried over into 2026, meaning a forecast carryover of 4.17 million old season lambs. This is around 1% above the carryover from the previous season.

Higher carryover is estimated following slaughter patterns through the latter months of 2026 and reports of producers moving to later lambing generally.

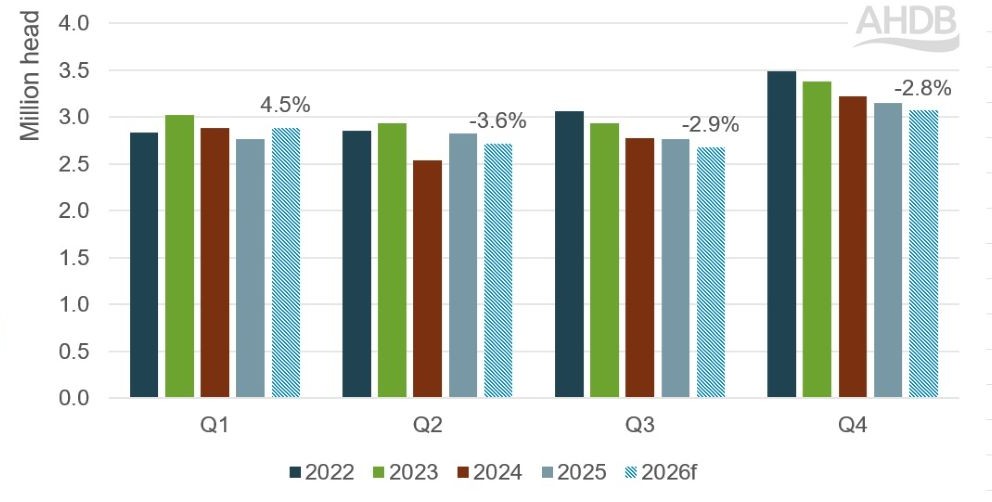

Based on estimated carryover and seasonal slaughter patterns, UK clean sheep slaughter is forecast to grow by approximately 4.5% year-on-year in the first quarter of 2026 to 2.89 million head.

Slaughter in the second quarter is expected to be down year-on-year by approximately 3.6% to 2.7 million head. However, the Muslim festival of Eid al-Adha is expected to fall on 27 May: this may affect kill patterns as lambs may be marketed later to target this demand.

2026/27 new season lambs (H2 2026)

Taking the forecast size of the lamb crop and applying seasonal slaughter patterns, slaughter through the third quarter is forecast to total 2.7 million head, down 2.9% year-on-year.

Slaughter through the final quarter of the year is forecast to total 3.1 million head, down approximately 2.8 year-on-year.

Figure 1. Actual and forecast UK clean sheep slaughter, 2022 to 2026

Source: Defra, Livestock Auctioneers Association Limited, AHDB

The bar chart in Figure 1 shows actual and forecasted quarterly slaughter of clean sheep in the UK between 2022 and 2026. Defra actuals are shown for 2022 to 2025 in the solid-coloured bars and AHDB’s 2026 forecasts are shown in the light blue hashed bars. The year-on-year change is shown for each quarter in 2026.

Adult sheep slaughter

Ewe and ram slaughter is forecast to fall by 1% to 1.35 million head. This factors in a modest forecast reduction in breeding ewe numbers and assumes similar rates of culling.

Sheep meat production

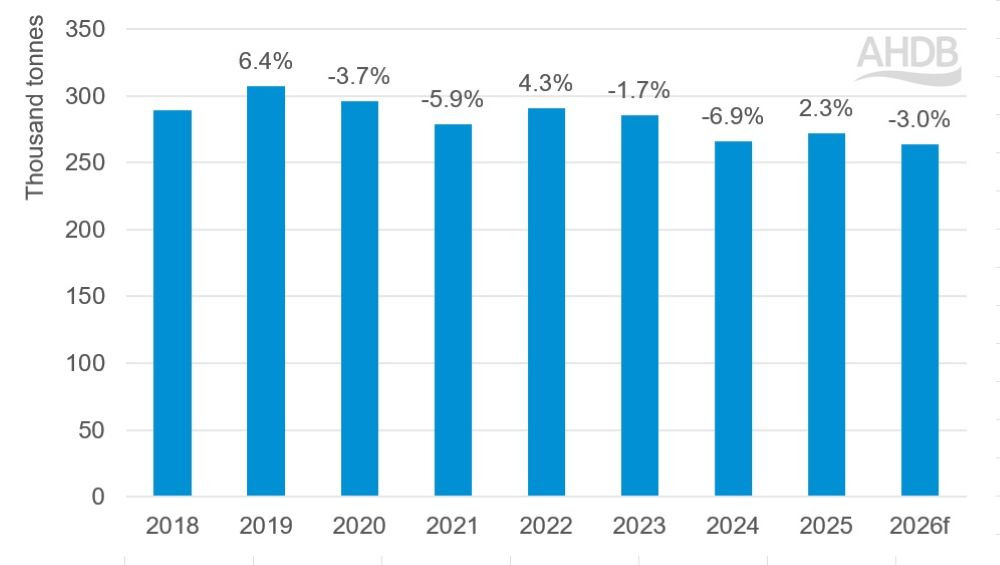

Carcase weights are expected to remain at average levels, barring any shocks from atypical weather or climate. Combined with forecast slaughter numbers, UK sheep meat production for the full year of 2026 is forecast to total 264,000 tonnes, down 3% versus 2025.

Figure 2. Actual and forecast UK sheep meat production 2018 to 2026

Source: Defra, AHDB

The bar chart in Figure 2 shows annual volumes of sheep meat production in the UK. Actual volumes as reported by Defra are shown in the solid blue bars for 2018 to 2025, with AHDB’s 2026 forecast shown in the hashed blue bar. Year-on-year percentage changes are shown for each year.

Trade

Imports

UK sheep meat imports grew through 2025, driven mostly by increased volumes of Australian product. Total imports between January and November (inclusive) reached 74,200 tonnes (product weight including fresh, frozen, processed and offal), up 3% year-on-year. The value of these imports totalled £418.1 million, up 30% year-on-year due to globally firm sheep prices.

New Zealand remained the UK’s dominant supplier, but volumes were limited by weaker domestic demand and constrained exportable supply.

Australia, however, significantly expanded shipments, with volumes to the UK up by 31% on the year, supported by improved tariff-free access and diversion from weaker Asian markets.

By contrast, Irish imports fell 12% to 5,800 tonnes, hampered by tighter supply.

For 2026, we forecast the UK sheep meat imports to increase further, with volumes forecast to grow by approximately 4% year-on-year.

New Zealand and Australia will continue to make up the majority of shipments. Improved market access under free trade agreements is expected to support trade. However, volume growth may be capped by constrained supply from the region, which is expected to keep prices firm.

New Zealand’s lamb production is in long-term contraction amid land conversion and stronger cattle margins, yet improved lambing conditions may bring slight growth this year.

Despite a contracting ewe flock, New Zealand remains well-positioned for the UK market through strong market access, favourable retailer specifications and large trade quotas, although the latter remain well under-utilised.

Australian lamb production, meanwhile, has expanded in recent years but is forecast to contract slightly in 2026. This is as producers restock following widespread drought.

Exports

UK sheep meat exports performed strongly in 2025.

Between January and November, the UK shipped 85,700 tonnes of sheep meat (product weight including fresh, frozen, processed and offal) up 12% on the year. This was the highest volume shipped in six years.

Much of this growth was driven by increased shipments into Europe – particularly France and Belgium – as demand for imported lamb remained resilient.

Strong lamb prices pushed the total value of sheep meat exports to £609.6 million, a 15% increase versus 2025 and another record year.

Looking ahead, European demand is set to remain robust. The EU breeding flock continues to shrink, tightening domestic supply at a time when consumption has proven resilient. Consequentially, the EU’s structural reliance on imported lamb is expected to increase.

The UK is well-placed to benefit as a nearby, established supplier. However, shippable volumes may be constrained by domestic production.

Exports have become an increasingly important outlet for UK processors, partly because of the strength in European markets and partly because of long-term reductions in domestic lamb consumption. Thus, a larger proportion of UK production is expected to be diverted to external markets.

Taking these factors together, we forecast UK sheep meat exports to grow by around 1% in 2026. Volumes may be weighted toward the first half of the year given expectations of a larger hogget carryover.

Consumption

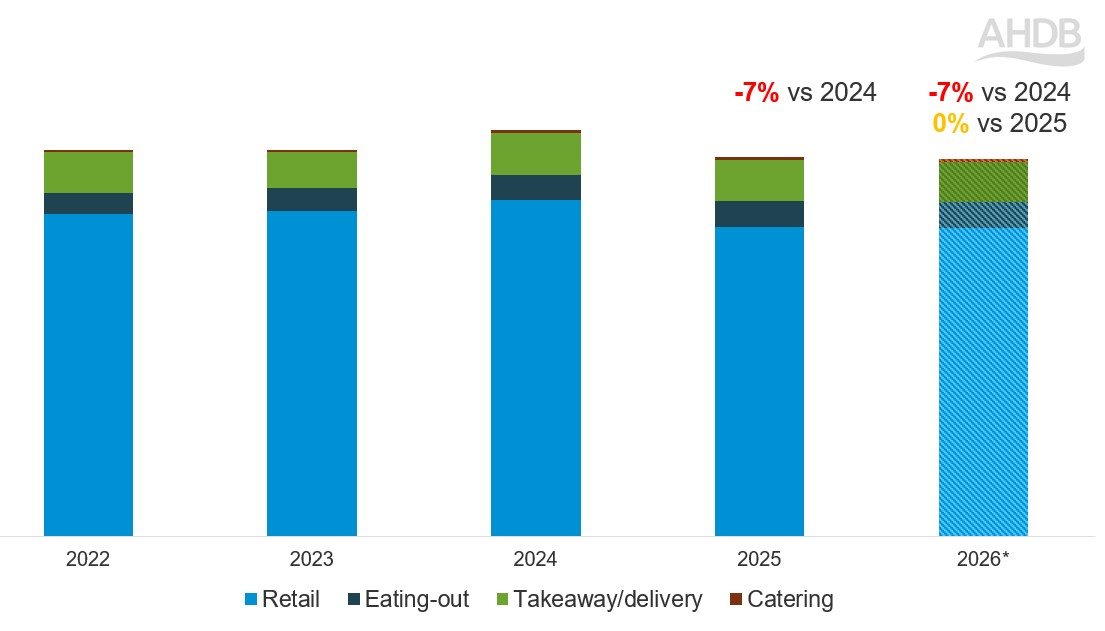

In 2025, total lamb volumes were down 7% year-on-year, driven by an 8% decline in retail volumes (Worldpanel by Numerator, 52 w/e 28 December 2025), as the higher price of lamb priced some shoppers out of the category.

In comparison, total out-of-home volumes remained flat year-on-year (AHDB estimates based on Worldpanel by Numerator OOH, 52 w/e 28 December 2025). Dining out volumes increased by 5% year-on-year as many restaurants added more premium mains to menus. Meanwhile, takeaway volumes declined by 3% year-on-year, as fewer consumers choose this convenience option.

For further information and latest trends for lamb, visit our lamb retail dashboard.

For 2026, we expect consumer confidence to remain muted as high food inflation and frozen tax thresholds add pressure to household incomes, as detailed in our economic outlook. This squeeze on finances will likely impact shoppers’ standard of living, with many continuing to use savvy shopping methods to ensure they are getting the best value for money.

Therefore, we forecast total lamb volumes will be flat (0%) in 2026.

Figure 3. Actual and forecast volumes of lamb sold in the UK

Source: AHDB volume estimates for UK based on Worldpanel by Numerator UK retail and OOH data

*2026 figures are AHDB estimates

The stacked bar chart in Figure 3 shows volumes in 000 kg for lamb sales in UK split by retail (light blue bar), eating out (dark blue bar), takeaway/delivery (green bar) and catering (brown bar). Actual volumes are shown for 2022 through to 2025. AHDB estimated volumes are shown for 2026. Over the 5-year period, retail is consistently the largest component. In 2025, total lamb volumes were down by 7% versus 2024. AHDB estimates that volume sales in 2026 will be steady versus 2025.

In retail, the growing importance of promotions for lamb will continue through 2026, as consumers see lamb as more of a treat or for a special occasion, especially around Easter, Ramadan, Eid and Christmas. Lamb roasting joints are a favourite choice for such occasions when family and friends typically get together.

In terms of more routine lamb purchases, we predict that lamb steak and lamb burger volumes will benefit, as consumers switch from similar beef cuts due to the price increases experienced in 2025. In addition, we expect traditional, more affordable lamb dishes like shepherd’s pie, hotpot and curry to continue to drive in-home occasions.

That said, lamb’s premium price point means overall lamb retail volumes will be challenged, as many households will opt for lower cost proteins for their everyday, midweek meals. As lamb is usually chosen for its taste and enjoyment, we believe lamb is well-suited to more treaty, dine-in meals.

In this respect, we expect the momentum behind Added Value category products and quick, easy-to-cook meals to carry through into 2026 as consumers continue to prioritise convenience. These products are especially well placed to perform strongly at weekends, offering a more affordable alternative to eating out.

For out-of-home we expect total volumes to decline as some consumers restrict occasions in this channel. We do expect to see a peak in takeaway sales around the World Cup in June/July, as the appeal for post-match kebabs takes hold.

In terms of dining out specifically, we predict volumes could increase as consumers look to treat themselves with cuts of lamb they are less likely to cook at home. Lamb dishes may also benefit from the ‘World Cup effect’, as supporters may treat themselves to a pre-match meal.

How might the lamb outlook be improved?

The lamb outlook might be further boosted, if the industry:

- Provide recipe inspiration and reassurance to consumers who are unfamiliar with how to cook lamb

- Maximise promotional support in-store around key events and festivals, and encourage shoppers to purchase through promotions, meal deals and secondary displays

- Ensure lamb is merchandised clearly in-store with the right messaging, on pack and in foodservice

- Within out-of-home, keep lamb on menus to appeal to those consumers looking for a superior dining experience

- Aim to further build consumer trust in British farming by demonstrating farming values around animal welfare, environmental stewardship and specialist skills

AHDB has a range of marketing activities planned for the year, including the Let’s Eat Balanced campaign. Please visit our marketing pages for more information.

For more insight around consumer demand, visit our retail and consumer pages.

Price considerations

The market fundamentals discussed above would suggest a generally supportive environment for lamb prices in 2026. However, expected supply patterns may mean prices are weakened early in the year.

The UK lamb market remains incredibly sensitive to forage conditions, weather patterns and associated impacts on disease burden, and increasingly market conditions beyond our borders.

Sign up to receive the latest analysis and forecasts from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.