- Home

- Beef market outlook

Beef market outlook

February 2026

Key points

- UK beef production is forecast at 883,000 tonnes for 2026, a 1% fall year-on-year as cattle numbers remain tight

- With continuing high price inflation influencing consumer behaviour, we forecast total beef volume sales across retail and foodservice to be -1% versus 2025 (which represents a -6% decline versus 2024)

- Imports are projected to fall by 1% year-on-year, as contractions in Irish cattle supplies and a smaller price differential to the UK limit volumes from our majority supplier. We anticipate growth in import volumes from Australia and New Zealand

- Exports are likely to fall in line with production, down 1% on 2025 levels, with some potential for growth in volumes to the EU and USA

- Farmgate cattle prices are expected to remain supported throughout 2026, with supplies limited and consumer confidence stabilising

Overview

2025 saw record high cattle prices, with shortness in supply driving strong price growth at a farmgate level in the early part of the year. Following a period of correction, the market steadied somewhat, albeit at a historically high level. Beef production closed the year 3.5% lower than 2024, as cattle numbers contracted.

Domestic consumption volumes fell in 2025, driven by declines in retail. Beef inflation rose steeply as the year progressed, and as rising prices moved through the supply chain; ultimately this reduced the volumes that consumers purchased. Consumers used various mechanisms to manage spend, such as reducing pack sizes or purchasing a smaller range of beef products.

In 2026 we anticipate that supply tightness will continue to underpin the market. Cattle inventories remain smaller year-on-year, meaning there is a limited pipeline of cattle. Furthermore, we anticipate continued contraction in the suckler breeding herd, reducing the future supply base and limiting cattle numbers for the next two years.

We anticipate that consumer confidence will remain muted in the coming year as high food price inflation and frozen tax thresholds add pressure to household incomes. This is likely to result in further, albeit smaller, reductions in beef volumes purchased.

Supply

Prime cattle slaughter

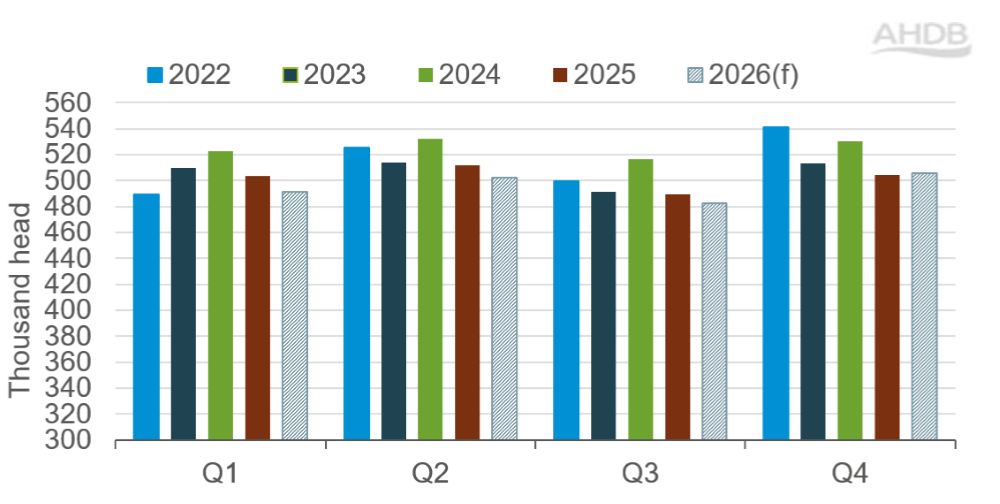

Prime cattle slaughter fell significantly in 2025, totalling 2.01 million head, a 4.4% decline year-on-year (YoY). All categories saw reductions, with the steepest decline in steer slaughter (5.6% YoY). Both heifer and young bull slaughter fell by smaller magnitudes. The combination of long-term herd contraction and strong kill rates in 2024 limited cattle availability throughout the year.

Looking ahead, we expect that prime cattle slaughter will total 1.98 million head in 2026, a 1.3% fall on 2025 levels. This takes into account cattle inventory data that suggests the pipeline of cattle has continued to contract annually.

Factoring in typical kill patterns, we anticipate that larger annual reductions in prime slaughter will be seen in Q1 and Q2, with numbers in the latter half of the year more stable on 2025 levels.

Figure 1. Actual and forecast (f) UK prime cattle slaughter

Source: Defra, AHDB. Forecasts in hashed bars

The bar chart in Figure 1 shows trends in quarterly UK prime cattle slaughter from 2022 to 2026. The chart contains actual figures for 2022 to 2025 from Defra, with AHDB forecasts for 2026 in the hashed bars. UK prime cattle slaughter is forecast to fall year on year in Q1, Q2 and Q3 of 2026 with a slight uplift in Q4.

Cow slaughter

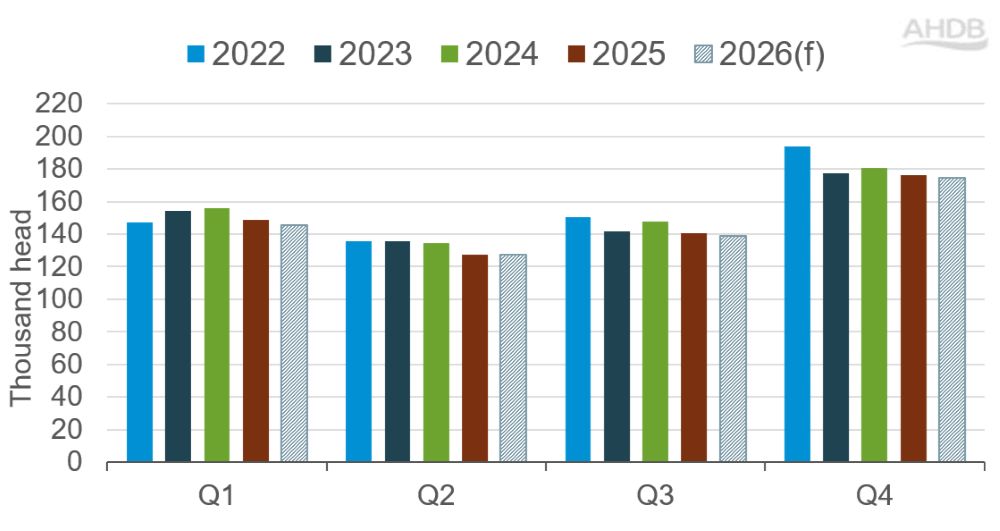

In 2025, cow slaughter fell by 4.2% year on year to total 593,000 head. We saw consistent annual falls in the first three quarters of the year, down about 5% on the year prior, before some growth in cow kill in Q4 that coincided with falls in the dairy market.

For 2026 we forecast cow slaughter will total 586,000 head, a 1.1% reduction versus 2025.

Figure 2. Actual and forecast UK cow slaughter

Source: Defra, AHDB forecasts in hashed bars

The bar chart in Figure 2 shows trends in quarterly UK cow slaughter from 2022 to 2026. The chart contains actual figures for 2022 to 2025 from Defra, with AHDB forecasts for 2026 in the hashed bars. UK cow slaughter is forecast to fall year-on-year in 2026.

Cow slaughter may be lifted by increased contribution from the dairy herd. As milk prices have fallen rapidly, some dairy producers may increase culling rates to maximise efficiency, therefore increasing cow kill.

On the other hand, suckler cow slaughter rates may ease. With consistently strong beef prices and reasonable prospects for the coming year, we may see greater levels of retention in the suckler herd.

While rebuilding may stabilise production in the longer-term, it would limit heifer slaughter and further tighten prime supply in the short term.

Beef production

Beef production fell by 3.5% YoY in 2025, to total 894,000 tonnes. While cattle numbers fell more strongly, growth in carcase weights limited production declines somewhat.

Prime cattle carcase weights averaged 346.5 kg in 2025, up 3.5 kg (1%) on the year before. Stronger growth was seen in the second half of the year, likely influenced by producers leveraging favourable feed prices to maximise growth.

In 2026, we expect beef production to total 883,000 tonnes. This is a 1.3% fall against 2025, and it assumes lower slaughter and steady carcase weights.

Figure 3. Actual and forecast (f) UK beef production, with year-on-year change

UK beef production, with year-on-year change.jpg)

Source: AHDB

The bar chart in Figure 3 shows trends in UK beef production from 2022 to 2026, with year-on-year changes. The chart contains actual figures for 2022 to 2025 from Defra, with the AHDB forecast for 2026 in the hashed bar. UK beef production is forecast to fall year on year in 2026.

Trade

Imports

Despite lower domestic production, overall beef imports fell in 2025.

Total imports (including fresh, frozen, processed and offal) fell by 3% year-on-year in 2025 (Jan-Nov), totalling 273,000 tonnes (product weight).

Lower imports from Ireland drove the decline, with Irish imports back 12% YoY over the 11-month period. Contraction in Irish supply and a narrowing gap between GB and Irish farmgate prices contributed to reduced volumes in the second half of the year. These trends are both anticipated to continue into 2026.

Ireland accounted for 62% of total beef imports in 2025 (Jan-Nov), losing market share on the year prior to other suppliers including Brazil, Poland, Australia and New Zealand. These suppliers were likely able to offer more competitively priced product and were less affected by supply challenges.

Figure 4. UK total beef imports* YTD (Jan-Nov) by supplier

by supplier.jpg)

Source: UK HMRC via Trade Data Monitor

* Total beef imports include fresh, frozen, processed and offal

The stacked bar chart in Figure 4 shows trends in UK beef imports from key suppliers from 2022 to 2025. The chart shows a year-on-year decline from 2024 to 2025, with the greatest reduction in Ireland. The chart also shows year-on-year growth for Australia and New Zealand from 2024 to 2025.

In 2026, we forecast that beef imports will fall by a further 1% year-on-year.

We anticipate lower import volumes from the UK’s majority supplier, Ireland, as their domestic supply challenges limit product availability for export. It is likely that we will see greater import volumes from other suppliers such as Poland, New Zealand and Australia among favourable market conditions.

Exports

Lower beef production limited UK export volumes in 2025, with total beef exports (fresh, frozen, processed and offal) for Jan-Nov totalling 129,000 tonnes (product weight), back by 4% YoY.

Exports to the EU, our largest export destination, were down by 1% annually for the period (Jan-Nov). However, performance was more mixed between the different countries in the bloc, with some volume growth to Ireland and France counteracted by declines in product shipped to the Netherlands and Germany.

Further afield, export volumes grew to West African destinations, including Ghana, Senegal and Côte d’Ivoire, which consisted mainly of offal products. Frozen beef volumes to Hong Kong fell year-on-year.

Meanwhile, we saw growth in frozen product shipped to Canada; however volumes of offal to the same destination declined significantly.

We expect that UK beef exports will fall by 1% year-on-year in 2026.

Lower UK production is likely to somewhat limit volumes available for export; however a tighter EU price spread could improve UK export prospects to the continent.

Cattle price outlook

Continued reduction in UK cattle availability is expected to sustain strong competition for stock, keeping farmgate prices supported through 2026.

Forecasts point to a firm global beef marketplace in 2026 as production growth slows in key producing regions and demand persists in the Northern hemisphere, notably the USA.

However, market commentators suggest that Chinese import demand remains relatively soft, which may cause Southern hemisphere suppliers to look to the UK and EU to diversify export portfolios with higher value markets. Tightness in supply will likely amplify competition for beef globally, lending support to prices.

Throughout 2025, however, we saw consumers react to rising beef prices by reducing their purchase volumes, which tempered price growth at a farmgate level to some degree.

Beef price inflation remains high, and any further price increases passed through to the consumer may have a dampening effect on demand. This would provide some counterweight to price growth at a producer level.

Market balance table

Table 1 presents a summary of actuals and forecasts for production, imports, exports and consumption for both 2026 and 2027.

Table 1. Actual and forecast supplies of beef and veal in the UK (thousand tonnes)

| 2023 | 2024 | 2025 | 2026(f) | 2027 (f) | ||

|---|---|---|---|---|---|---|

| Production | 898 | 927 | 894 | 883 | 871 | |

| Imports | 346 | 364 | 355 | 351 | 355 | |

| Fresh/frozen | 282 | 304 | 300 | 297 | 300 | |

| Processed | 64 | 60 | 55 | 54) | 55 | |

| Exports | 132 | 143 | 142 | 141 | 138 | |

| Total consumption* | 1,112 | 1,149 | 1,107 | 1,094 | 1,088 | |

Source: Defra, HMRC compiled by Trade Data Monitor LLC, AHDB

* Carcase weight equivalent, calculated from production, trade, and including changes in stocks.

Consumption

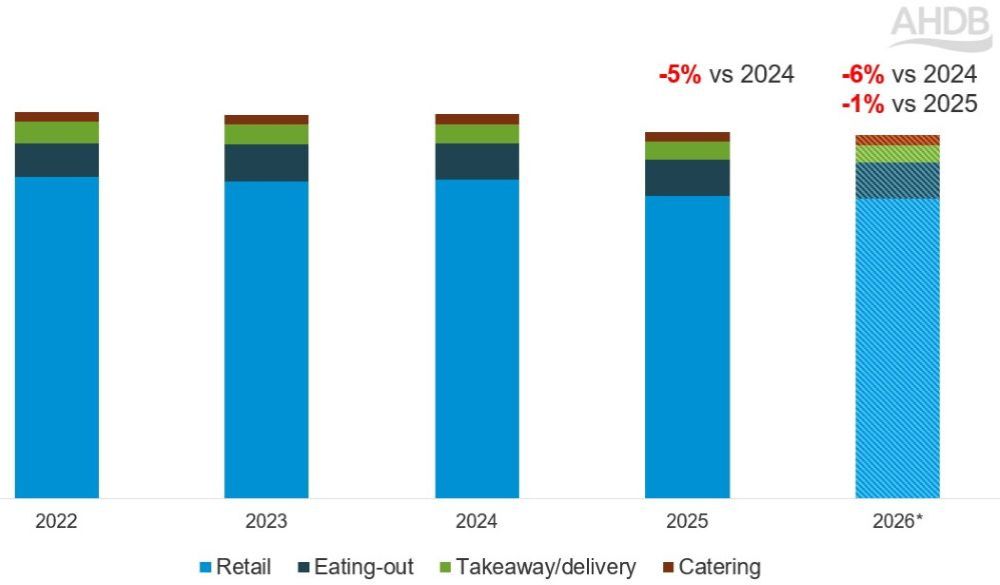

In 2025, total UK beef volumes were down -5% year-on-year, driven by a -5% decline in retail volumes (Worldpanel by Numerator UK, 52 w/e 28 December 2025) together with a -4% decline in out-of-home (OOH) volumes (AHDB estimates based on Worldpanel by Numerator UK OOH, 52 w/e 28 December 2025).

Beef inflation was seen to rise steeply through 2025, ending the year at 27% (Office for National Statistics). Consumers initially reacted to the rising beef prices by switching to cheaper proteins such as chicken or pork, or buying lower volumes of beef. Towards the end of the year we observed a stabilisation in retail beef volumes; this suggests that consumers who were continuing to buy beef were adapting to the new price levels.

For 2026, we expect consumer confidence to remain muted as high food inflation and frozen tax thresholds add pressure to household incomes, as detailed in our economic outlook. This squeeze on finances will likely impact shoppers’ standard of living, with many continuing to use savvy shopping methods to ensure they are getting the best value for money.

With continuing high beef inflation, we forecast total beef volumes in 2026 to be -1% versus 2025 (a -6% decline versus 2024).

For further information and latest trends for beef, visit our GB household beef purchases dashboard.

Figure 5. Actual and forecast volumes of beef sold in the UK

Source: AHDB

* AHDB estimate as of Jan 2026

The stacked bar chart (Figure 5) shows volumes in 000 kg for beef sales in UK split by retail (light blue bar), eating-out (dark blue bar), takeaway/delivery (green bar) and catering (brown bar). Actual volumes are shown for 2022 through to 2025. AHDB estimated volumes are shown for 2026. Over the 5-year period, retail is consistently the largest component. In 2025, total beef volumes were in decline -5% versus 2024. AHDB estimates that volumes for 2026 will be -1% in decline versus 2025 and -6% in decline versus 2024.

In retail, everyday cuts like mince are expected to continue to underpin beef volumes as consumers focus on easy to cook, family-friendly meals that avoid waste, such as spaghetti bolognese or cottage pie. More adventurous cooking with beef is likely to be put on hold by risk-averse consumers nervous about experimenting with more expensive cuts.

Beef roasting joints will continue to lend themselves more heavily to special occasions including Easter and Christmas, and will benefit from promotional activity at these times.

Beef steaks will continue to see declines in volumes as consumers turn to more budget-friendly options. Uplift may be seen from promotional activity around Valentine’s Day, where the focus on premium dine-at-home meals at an affordable price will help to rival dining-out experiences.

With squeezed budgets, consumers will be focusing on value for money, seeking out offerings that deliver on quality and convenience. With this in mind, added value options such as ready-to-cook, marinades and sous vide will perform well, offering an easy to cook dine-at-home experience at an affordable price.

With 85% of consumers saying that diet is important to their health (YouGov/AHDB Pulse survey, November 2025) and rising concerns around ultra-processed foods, consumers are likely to focus on lean primary beef cuts rather than processed options.

In the out-of-home market, consumers are likely to focus on cheaper channels (such as bakery, salad and sandwich outlets) or cheaper dishes (such as beef pasties) for everyday consumption.

Beef burgers, which represented 48% of out-of-home beef volumes in 2025, were seen to decline in volume by -3.4% year-on-year (AHDB estimated volumes based on Worldpanel by Numerator OOH, 52 w/e 28 December 2025).

Although volumes declined, the number of packs sold was seen to grow by +0.3%, driven by consumers turning to lower price, smaller volume burgers such as cheeseburgers (Worldpanel by Numerator OOH, 52 w/e 28 December 2025). In 2026 we expect the movement towards smaller, lower priced burgers to continue.

Within full-service restaurants and quick-service restaurants, higher beef prices may impact the availability of beef dishes on menus, leading to fewer beef options for consumers. Continuing to bring innovative value-led offerings to menus will remain important to encourage spend and maintain perception around taste and enjoyment for beef.

Meal planning around the World Cup football matches will potentially uplift out-of-home beef volumes, with consumers choosing to either dine-in at venues such as pubs and bars or order takeaways prior to match kick-off. Takeaways may also benefit from post-match snacking.

How might the beef outlook be improved?

The beef outlook might be further boosted, if the industry:

- Ensure there is a wide range of pack sizes and quality options to keep British beef accessible for all consumers irrespective of budget

- Encourage tasty and versatile beef dishes which play on value for money, utilising cheaper cuts such as mince. Inspire meals that are family friendly, filling and reduce waste with batch cooking

- Focus on capturing up-trading to more premium offerings through inspirational dinners such as restaurant quality dine-in deals

- Encourage consumers with the right messaging in-store, online, on packs and in foodservice

- Continue to celebrate the benefits of British beef as a nutritional and sustainable choice for UK shoppers. AHDB’s Let's Eat Balanced consumer campaign highlights the great taste and nutritional benefits of British beef

- In the longer term, look to maintain and build consumer trust, demonstrating where farming values (animal welfare, environmental stewardship and expertise) are shared with consumers

AHDB has a range of marketing activities planned for the year, including the Let’s Eat Balanced campaign. Please visit our marketing pages for more information.

For more insight around consumer demand, visit our retail and consumer pages.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.