The future of milk

Thursday, 9 May 2019

Defending the liquid milk sector - innovate, defend or both?

Liquid milk is often positioned in the media as a category under attack, losing ground to plant-based alternatives. In reality, milk remains a British staple, with 98% of British households buying[i]. There has been a degree of occasion loss but the vast bulk of this is change in the types of ‘host’ food and drink occasions. By far the biggest driver of this is due to British people starting to lose their love for the traditional cuppa with a splash of milk. Milk volume sales are actually unchanged over a 5-year period, and per capita household purchasing has only declined by 3 litres per household in total over a 3-year period[ii].

Decline is unconscious

Consumer research by AHDB and Kantar in 2018 found that, where people have cut back on dairy, they are unlikely to be aware of it – we found only 15% of milk reducers (measured by genuine change in consumption over time) did it consciously, meaning that, for most, any decline seen is due to changing needs and habits.

Where the dairy industry doesn’t keep pace with changing need states, it is more vulnerable to new entrants.

Could branded milk be an answer to occasion loss?

Branded milk is an answer, but not the only answer. There is merit in encouraging innovation in dairy, and specifically the liquid milk sector. Milk has been dominated by value own-label product (representing 85% of the market[iii]) and has been historically used by retailers as a value-for-money staple, to tempt shoppers into store. The key point of difference for most has been the colour of the cap. Against this backdrop, the more interesting packaging and claims offered in the milk alternatives sector have started to look attractive to some novelty-seeking consumers. However, Kantar has found that 60% of dairy alternatives are consumed at the same time as a dairy product (for example, an almond latte with a cheese panini), implying that overt rejection of all dairy products is lower than sometimes assumed[iv].

Dairy milk innovation could be desirable as it could add value to the category, allow higher margins to suppliers and greater control over price and promotions. Additionally, there is scope to offer products that may overcome some of the barriers currently encountered, that may tempt consumers to alternatives. For example, lactose-free, pasture promise, or lower-fat milk that has the taste of higher fat.

This is helpful where the category is operating on a level playing field. However, in an environment in which the dairy sector has been under attack from detractors, there is also a clear need to underpin consumer perceptions of the category, create ‘brand dairy’ and provide a platform for dairy brands to operate from. If consumers question the basic product, or find it less relevant in their lives, then brands will also be less relevant.

What are the challenges that branded milk faces?

- Category size

- Branded milk is worth 17% by value, 13% by volume and is growing in value terms – up 5% year-on-year, according to Kantar Worldpanel. However, this growth is actually slightly behind the growth in value of private label milk. Market share has varied little over the past 5 years[v]

- Switching to alternatives

- Branded milk is no more ‘free-from’ proof than private label. People buying into branded milk are just as likely to switch out to an alternative

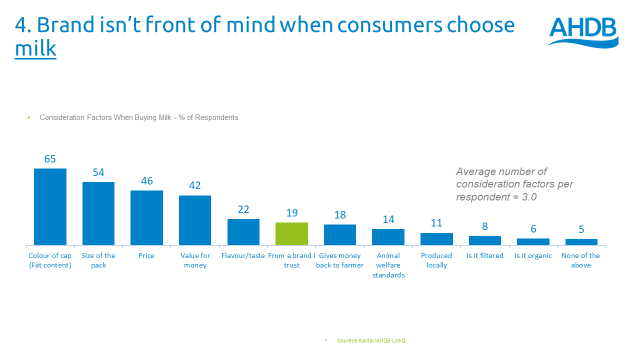

- Brand isn’t the core driver when people are buying milk

- In a recent study, we found that people who had genuinely reduced their milk consumption (as opposed to just claim they had) were more value-driven, and less likely to consider brand when choosing milk.

So, how can the dairy sector protect itself from these negative voices?

Case study: The Department for Dairy Related Scrumptious Affairs

In a strategic piece of work, we identified a missing voice in the dairy sector. While individual brands might advertise for butter, yogurt or cheese brands, nobody was talking about brand dairy, apart from the detractors. We identified that most consumers love dairy products, in all their many forms, they just needed reminding of that. The campaign was jointly funded by AHDB and Dairy UK, on behalf of dairy processors, to reassure and emotionally re-engage younger consumers.

The campaign ran in 2018, and again in 2019, and was successful in underpinning consumer perceptions of dairy. We found that people exposed to the campaign were significantly more positive about dairy. In 2018, we also found that the target audience was 12% less likely to claim they would replace their dairy consumption with alternatives.

Where next?

While brands can add value and choice to the milk category, there is still a need for the industry to protect itself against volume loss. Up to now, this loss has been due to unconscious consumer decisions based on host foods, rather than a particular drive to dairy alternatives. However, reminding consumers how much they love dairy products will help protect the industry from future erosion. As well as the consumer campaign, it is critical that the entire industry plays a role in building trust and retaining consumers, by ensuring that excellent welfare and environmental standards continue, across the board.

By successfully underpinning perceptions of dairy, the campaign is providing a stronger foundation on which to build more robust dairy brands and innovation, on behalf of the entire dairy industry. By doing this work, future dairy entrepreneurs will have an easier time getting their products to market, with the best possible chance of a successful launch.

Note:

AHDB publishes a range of data on the performance of milk and other dairy products in the retail sector. These can be accessed here https://ahdb.org.uk/retail-and-consumer-insight

[i] Kantar Worldpanel, 52we, 4 Nov 2018

[ii] Kantar Worldpanel, 52we, 4 Nov 2018

[iii] Kantar Worldpanel, 52we, 4 Nov 2018

[iv] Kantar Worldpanel Usage, 52 we Aug 2018

[v] Kantar Worldpanel, 52we, 4 Nov 2018