Some organic categories start to recover as consumer confidence increases

Monday, 16 September 2024

The premium price point of organic in supermarkets inevitably resulted in more prevalent volume declines for the sector in the peak of the cost of living (COL) crisis, as reported last year for red meat and dairy. However, in recent months we have seen consumer confidence start to rebound, with financial pressures easing for some. Therefore, have we seen a positive impact on organic?

According to research agency Two Ears One Mouth, 71% of consumers are currently concerned about the COL crisis. While this is high, it is down 15 percentage points versus this time last year (August 2023). Nearly half (47%) of consumers were claiming in August 2023 that they coped with this by planning their meal and food spend more carefully. Roll forward to August 2024 and this has dropped to 39%. So, if the tide is turning for some in terms of financial worries, are we seeing the start of a recovery for premium organic red meat and dairy?

Organic meat, fish and poultry (MFP)

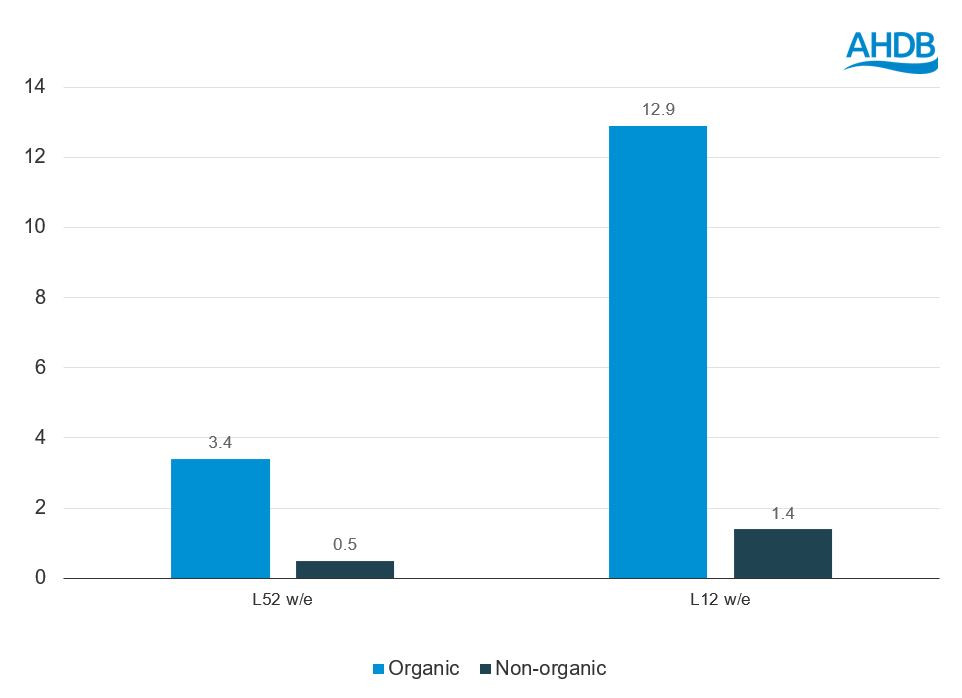

Organic MFP makes up just 0.2% of total MFP volumes, so it remains small. However, its performance in the last year has outstripped that of non-organic MFP and accelerated to double-digit growth of 12.9% in the latest quarter (Kantar, 12 w/e 4 August 2024).

Year-on-year volume % change – MFP

Source: Kantar, w/e 4 August 2024

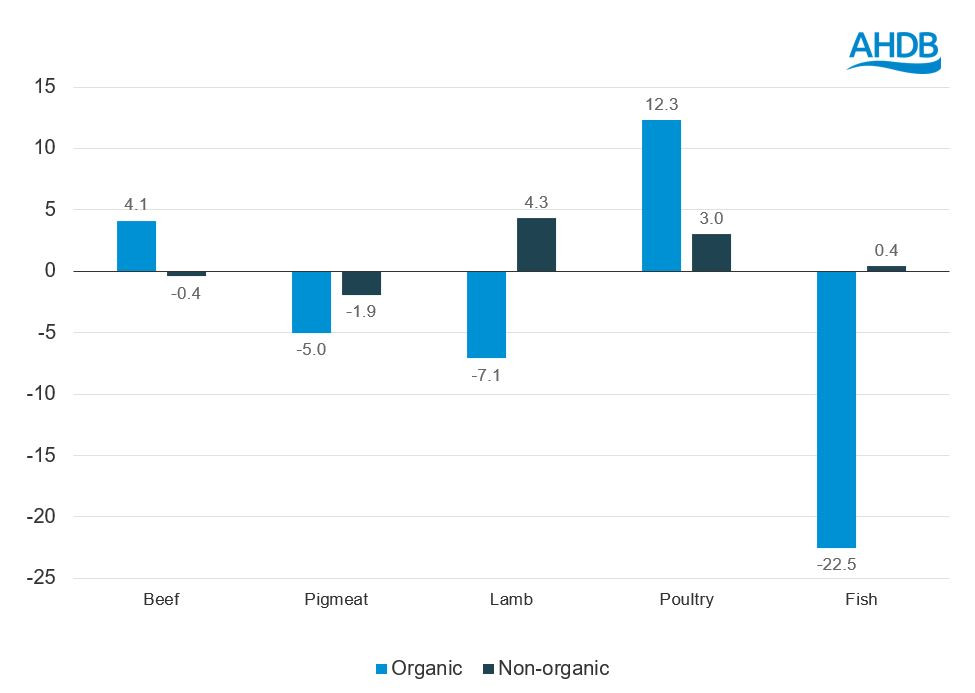

Delving in to the various proteins highlights that the organic volume growth in the last 52 weeks has come from beef and poultry only, while organic pig meat, lamb and fish continue to see negative performance. Within beef, the growth of 4.1% for organic is the opposite trend to non-organic, which has declined -0.4% (Kantar, 52 w/e 4 August 2024).

Year-on-year volume % change – proteins

Source: Kantar, 52 w/e 4 August 2024

Within beef, it appears to be several cuts driving this growth, including roasting joints, steaks, mince, stewing and burgers, although they all remain very small parts of the market. Contributing most significantly to the growth (although coming from a low base) is organic beef roasting joints which appear to have been supported by price promotions, as they have seen average price decrease, whereas non-organic beef roasting joints have seen price increases. This resulted in a narrowing of the price differential between the two options, likely encouraging some trade up to the organic option.

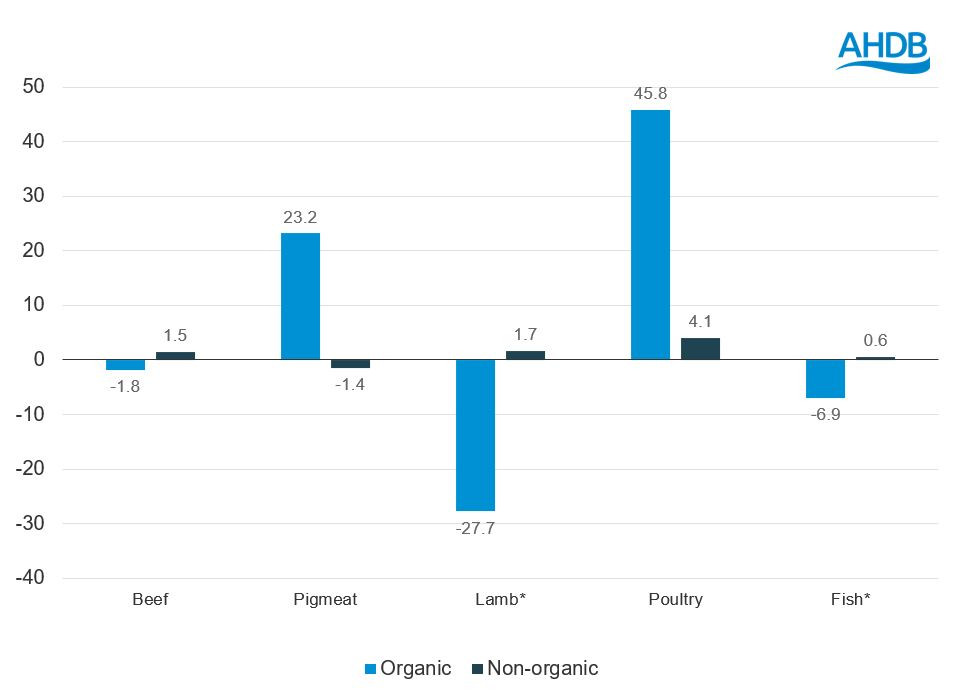

However, when we look at the last quarter, only organic beef is in volume decline of -1.8% (Kantar, 12 w/e 4 August 2024). Instead, we see the accelerated growth for total organic MFP coming from pig meat and poultry.

Year-on-year volume % change – proteins

Source: Kantar, 12 w/e 04 August 2024 *Warning low base for organic

Pig meat has the lowest organic share of the MFP category, at only 0.1% for the 52 w/e 4 August 2024, but its positive performance in the last 12 weeks has come from organic sliced cooked pork (dominated by ham), which over-indexes in terms of share at 0.4%. While still at a price premium, the price of organic sliced cooked pork dropped (Kantar, 12 w/e 4 August 2024). Again, this decrease in average price through promotions will have helped encourage trade up and has resulted in new buyers entering the organic sliced cooked pork category in the last quarter.

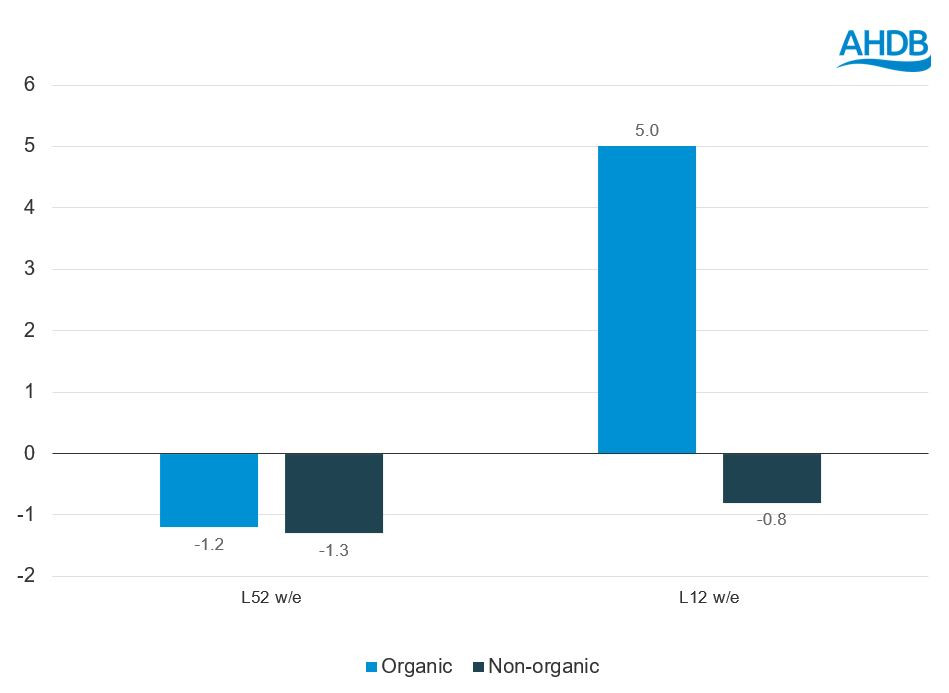

Organic dairy

In June, we reported a positive shift of nearly 4% volumes for organic cow’s milk in retail, which would have come as good news for organic dairy farmers. While positive, these results were for a short 12-week period ending 18 May 2024 and therefore we have continued to monitor this. The good news is, another eight weeks on, the 12 w/e performance for organic milk has accelerated to 5.0% (NIQ Homescan, 12 w/e 13 July 2024), while non-organic milk has declined, indicating that the organic recovery is continuing.

Year-on-year volume % change – cow’s milk

Source: NIQ Homescan, 12 w/e 13 July 2024

It is important to note that organic milk is still a small proportion of overall category volumes (3%) and, longer term, the picture is still down year-on-year as the COL crisis had such an adverse impact. So, while this remains a positive sign for the organic sector, we will continue to monitor this area closely.

Other areas of organic dairy which are showing signs of recovery are yogurts and butters, spreads and margarine (BSM). The yogurt category has the highest proportion of organic product sales at 8% in volume terms, falling to 1% or less for BSM, cheese and cream (NIQ Homescan, 12 w/e 13 July 2024). Positively for the category, yogurt has gone back into volume growth of 2.0% in the last 12 weeks, without seeing retail prices drop like the non-organic yogurt category.

The tide also seems to have turned for organic BSM, being in double-digit growth in the last 12 weeks. This will have been helped by price reductions of 11.5%, narrowing the price differential to non-organic and enticing consumers to trade up.

Year-on-year volume % change – yogurt and BSM

Source: NIQ Homescan, 12 w/e 13 July 2024

Cheese is a dairy category that has been quite resilient and organic cheese, which is stable in terms of volumes year-on-year, has grown 2.9% in the last 12 weeks (NIQ Homescan, 12 w/e 13 July 2024). This is, however, a more muted performance than non-organic, growing at +4.6%. Lastly, organic cream is an area that is struggling in the short and long term, seeing volumes down -7.0% in the last 12 weeks.

The future

This is good news for organic farmers after a very turbulent few years. The insights show that narrowing the price differential of some meat and dairy cuts and products compared with non-organic, such as beef roasting and BSM, encourages some consumers to take the leap to the more premium product – a strategy that can help the category in the short term. This will be particularly important for organic categories that are yet to see a recovery, such as lamb and cream.

A challenge for the sector is that while demand was low, some farmers converted back to conventional farming, leading to reduced supplies. In the case of dairy, 123 million litres per annum, or 25%, have been lost since the 2020/21 milk year. The path back to organic status takes time and farmers will want to feel sure of the direction of travel before committing to return to, or gain, organic status. Organic dairy processors are actively recruiting currently, and the organic milk price is proving attractive once more for those farmers who would suit the system. AHDB will monitor the market situation closely.

Longer term, as consumer confidence hopefully continues to increase, the organic category needs to think of value beyond just price and it will then be a prime time to communicate quality credentials. However, we must remember that consumer confidence is fragile and further economic shocks and uncertainty could put a dampener on the organic demand recovery.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.