- Home

- News

- Organic production continues to decline, but the latest retail sales figures may provide some positivity

Organic production continues to decline, but the latest retail sales figures may provide some positivity

Wednesday, 12 June 2024

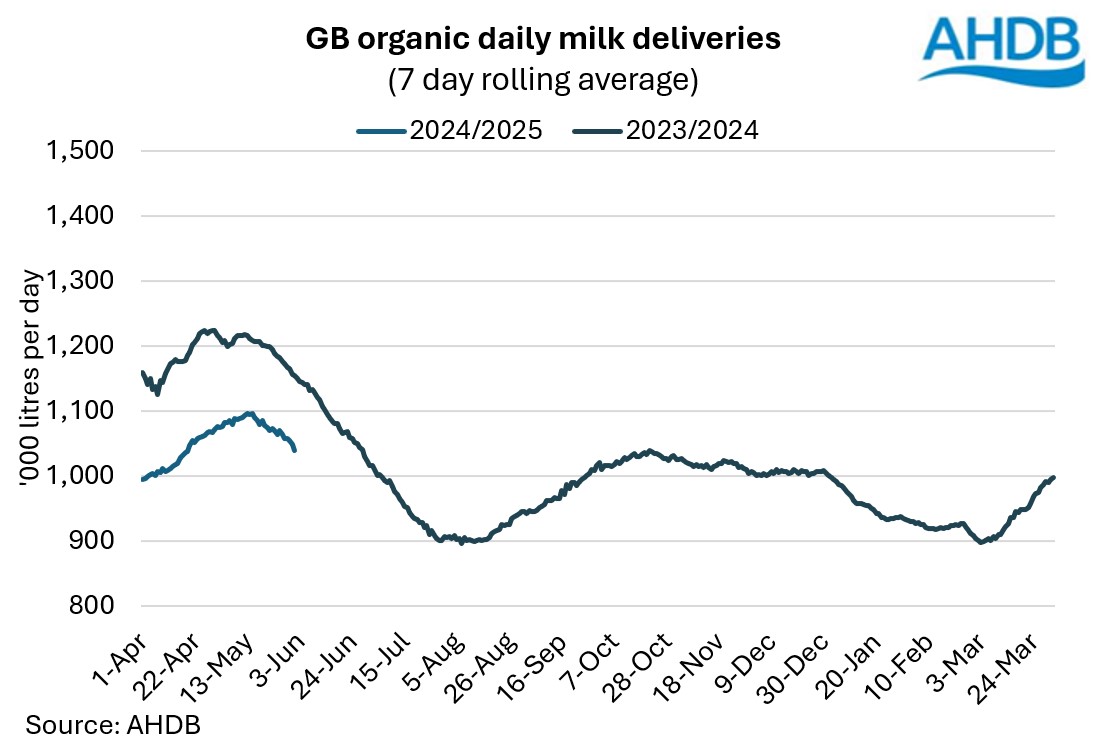

GB organic milk production averaged 1.1 million litres a day in May, down 9.7% compared to the same period last year. Production has declined significantly in recent years, primarily due to weakening consumer demand caused by the cost-of-living crisis. Over the 2023/24 milk year organic production was 14% down on 2022/23.

Many organic farmers have reverted to conventional production due to high costs and low availability of organic feed, which put pressure on profit margins. Whilst organic production does command a premium, some farmers felt the premium offered was not sufficient to encourage them to maintain production.

Retail demand picks up

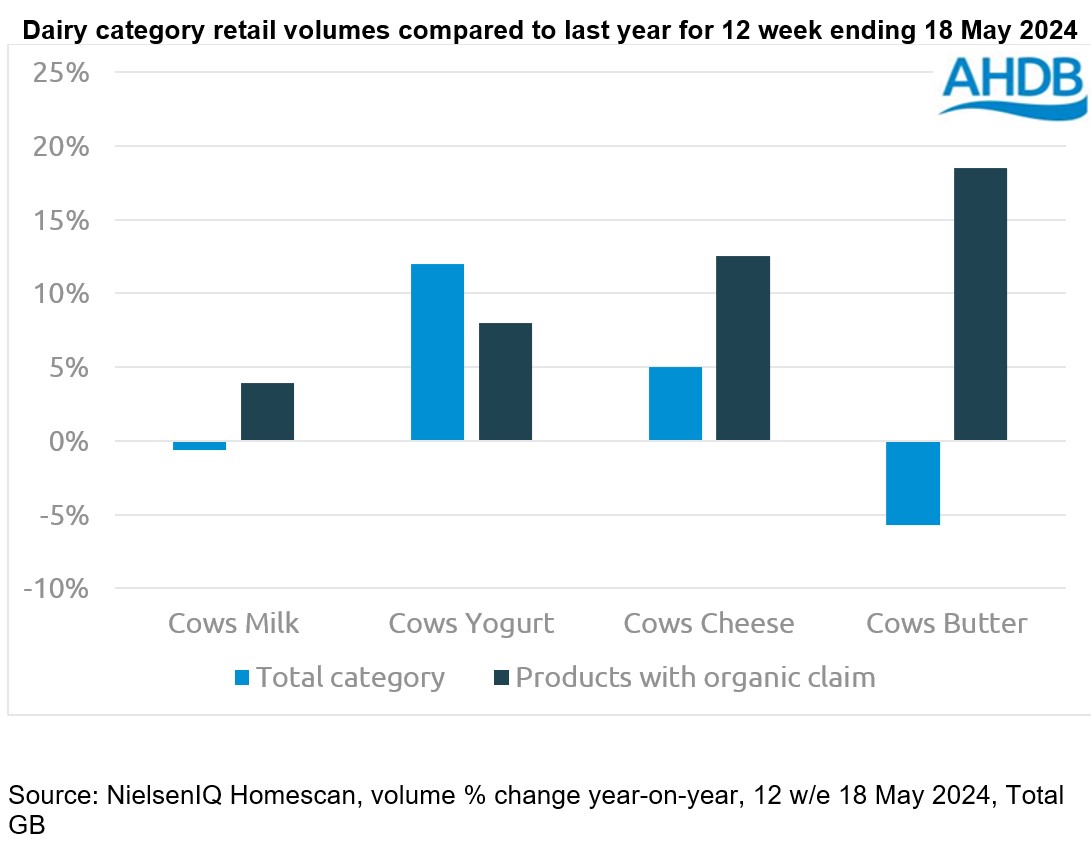

Organic dairy products make up a small proportion of overall category sales. The yogurt category has the highest proportion of organic product sales at 8% in volume terms, and this proportion falls to 3% for milk, 1% for butter and less than 1% for cheese (Source: NIQ Homescan, 12 w/e 18 May 2024, Total GB).

Volumes of retail sales for organic were in double digit decline last year but the latest figures from Nielsen, who track shopper purchases, may indicate the tide has started to turn. For the 12-week period ended 18 May sales of organic milk increased by nearly 4%, in contrast to a slight decline for the total cow’s milk category. The graph below shows that organic yogurt, cheese and butter were all in growth, with the latter two outperforming their total categories.

Implications for farmers

Improved demand for organic dairy products is good news for organic dairy farmers as it provides upward pressure to prices. However, consumer confidence, while increasing, is fragile and further economic shocks and uncertainty could put a dampener on the return of demand.

For farmers considering switching from conventional production to organic it will be important to understand the market you will be moving into, and how consumer demand impacts in across the economic cycle. Whilst positive, these retail results are for a short 12-week period. This is an area we will monitor moving forward.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.