Processed red meats continue to play a part in in-home meals

Tuesday, 2 September 2025

Processed red meat consumption is supported by factors, such as convenience, ease of preparation, and perceived value for money. Despite this, in-home consumption occasions have declined over the past year, with health and nutrition trends a key factor.

Key findings

- In-home occasions for processed red meat declined -4.9% year-on-year with declines seen across ham, bacon, sausages and burgers

- Processed red meat continues to deliver at breakfast, lunch and evening meal occasions due to low cost and convenience benefits, with consumers fancying a change through exploring different accompaniments such as bagels and baguettes

- A growing awareness and concern for ultra-processed foods may be contributing to the decline in processed red meat. However, as the cost-of-living crisis persists, consumers continue to value processed red meat as an affordable and convenient solution for everyday meals

According to Worldpanel by Numerator UK, 59% of GB individuals were reported to consume processed red meat at least once a week over the past 12 months, equating to 5.1 billion occasions (Worldpanel by Numerator UK Usage, 52 w/e 23 February 2025). However, this is down from 5.4 billion occasions in 2024 (-4.9% YoY).

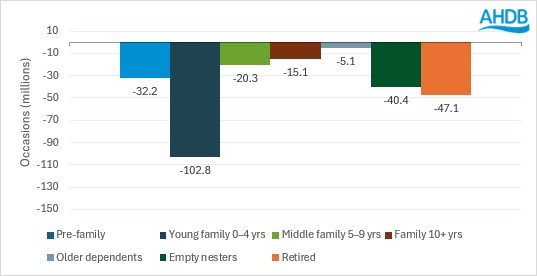

Figure 1. Year-on-year change in processed red meat occasions (millions)

Source: Worldpanel by Numerator UK Usage, 52 w/e 23 February 2025

This decline can be seen across all demographics, including older consumers such as retirees and older families who account for most processed red meat in-home occasions (56.1%). This highlights a category-wide shift rather than a demographic-specific trend (Worldpanel by Numerator UK Usage, 52 w/e 23 February 2025).

Cost and value for money

Processed red meat remains part of the repertoire for many, driven by its affordability and value for money. With 75% (+6%pt YoY) of consumers concerned about the cost of living and 38% planning meals and food spending more carefully (Sparkminds Ear to the Ground Tracker, 15 July 2025), budgets remain tight.

Processed red meat meals are typically cheaper than those containing primary meat but are more expensive than meals not containing any meat, positioning it as a middle ground option for price. For instance, Italian dishes made with processed meat, such as sausages, cost £1.98 on average, compared with £2.30 for those containing primary red meat, such as beef mince, and £1.39 for those without any meat (Worldpanel by Numerator UK Usage, 23 February 2025).

With cost-conscious consumers weighing up options, this underlines the importance of highlighting taste, enjoyment and treating to win favour over meat-free, despite their lower price point. Ensuring this message also aligns with flexitarian needs, especially those motivated by cost, will be important in maintaining relevance and appeal, as highlighted in our flexitarian article.

Convenience

Ease and familiarity also play a role. As average preparation times and scratch cooking fall to the lowest levels since the pandemic, processed red meat options are often seen as practical, quick to prepare and well-suited to everyday meals (Worldpanel by Numerator UK Usage, 52 w/e 29 December 2024). For instance, 57% of meat consumers say sausages are easy to cook with, and 54% say the same for bacon (AHDB/YouGov Consumer Tracker, May 2025). This underlines the importance for processed red meat to be positioned as a quick, convenient option.

Ultra-processed food (UPF) concerns

One of the factors that may have contributed to the decline of processed red meat consumption is the growing focus on avoiding ultra-processed foods (UPFs), currently the leading nutritional concern among UK consumers, as highlighted in our recent article.

Recent data from IGD shows that while 61% of shoppers have heard of UPFs and are confident that they know what UPFs are, a majority greatly underestimate the proportion of UPFs in their diet. Price, preparation time, habit, shelf life and family preferences are cited as key barriers to reducing UPFs intake (IGD ShopperVista, June 2025).

Click on the drop downs to explore more about specific processed red meats.

Most of sliced cooked meat occasions are ham (91%), totalling at 2 billion occasions over the past year, down 7.6% year-on-year (Worldpanel by Numerator UK Usage, 52 w/e 23 February 2025). Sandwiches make up 73.1% of all ham occasions, primarily eaten at lunchtime, while 26.9% are focused on centrepiece meals, where ham is paired with categories such as eggs and vegetables, as well as in pasta dishes, omelettes and salads.

A key factor in the decline of sliced cooked meats is the overall decrease in sandwich occasions (-4.4% year-on-year), driven by the return to work and consumers enjoying a wider repertoire at lunchtime, such as soup and Italian dishes (Worldpanel by Numerator UK Usage, 52 w/e 29 December 2024).

However, within sandwiches, bagels and baguettes saw year-on-year increases of 4.6 million and 4.2 million occasions respectively, driven by consumers who “fancied a change” (Worldpanel by Numerator UK Usage, 52 w/e 23 February 2025). Both bagels and baguettes were particularly chosen for this need when processed red meat was included, underlining the opportunity to highlight the versatility of sliced cooked meats.

Bacon was present in 1.4 billion in-home occasions last year, down 5.4% year-on-year (Worldpanel by Numerator UK Usage, 52 w/e 23 February 2025). Bacon is usually chosen for its ability to cater to various needs such as enjoyment and practicality and is seen as filling and easy/quick to prepare. However, 55% of consumers agree that bacon should be eaten in moderation, with 48% showing specific concerns around bacon being fatty (AHDB/YouGov Consumer Tracker, May 2025).

Bacon is the leading processed red meat consumed at breakfast, either in a fry up with eggs and beans or in sandwiches, including bagels and baguettes. Outside of breakfast, bacon also features in main meal occasions, such as roast dinners and pasta dishes, and is typically paired with accompaniments such as vegetables, eggs, bread and table sauces. Showcasing bacon as an ingredient within a wider range of dishes would help to widen its appeal beyond breakfast.

Sausages were present in 1.3 billion in-home occasions, but this has declined 1.7% year-on-year (Worldpanel by Numerator Usage, 52 w/e 23 February 2025). Pork sausages continue to dominate, making up the majority (93%) of these occasions. Sausages are commonly consumed for enjoyment, taste and treating reasons and are seen as easy to prepare. However, 55% of consumers also think sausages should be eaten in moderation, with 45% perceiving sausages as fatty (AHDB/YouGov Consumer Tracker, May 2025).

Sausages are typically featured in centrepiece meals, which account for 87.7% of in-home sausage occasions (Worldpanel by Numerator, 52 w/e 23 February 2025). Sausages also featured in sandwiches, fry-ups, pasta dishes and stews/casseroles.

As we head into winter, consider positioning sausages as a solution for consumers’ need for enjoyment, speed and ease, such as being part of one-pot or air-fryer meals.

Burgers and grills were present in 442 million in-home occasions, down 3.8% year-on-year (Worldpanel by Numerator UK Usage, 52 w/e 23 February 2025), 88% of which were beef burgers. The majority of burger occasions (84.7%) are featured in typical burger meals, paired with salads, cheese and vegetables. Burgers offer family-centric meals which deliver to enjoyment and taste needs and typically over-trade in the summer, driven by warmer weather and barbecue occasions (Worldpanel by Numerator UK, 16 w/e 1 September 2024). Showcasing burgers for family occasions in the autumn and winter, or as premium dine-in treats for couples could help to expand the seasonal performance of this offering.

Key opportunities

- Signpost processed red meats as quick and easy to prepare solutions for everyday family meals

- Feature processed red meat within a wide range of dishes beyond traditional routes to demonstrate the versatility of these offerings to consumers

- Highlight the enjoyment and taste credentials of processed red meats and showcase combinations with trending accompaniments such as bagels and baguettes for consumers fancying a change

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: