Consumer concerns around ultra-processed foods gaining traction

Thursday, 29 May 2025

The conversation around ultra-processed foods (UPFs) is growing in the UK, with 94% of consumers stating that they had heard about UPFs and 64% of those aware showing a negative sentiment to the topic (Sparkminds Ear to the Ground Tracker, 25 March 2025).

According to the UK Food Standards Agency, there is currently no formal definition of a UPF in the UK.

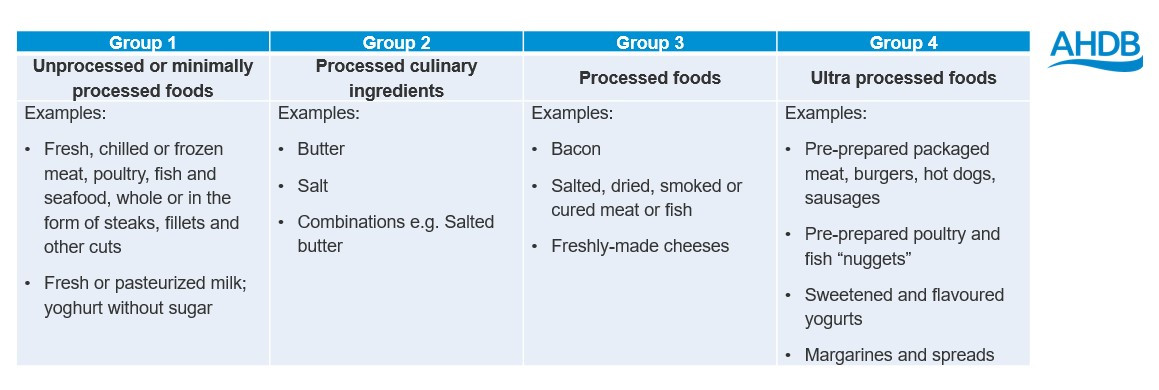

The most commonly used definition globally is based on the NOVA classification system where foods are grouped based on the extent of their industrial processing and inclusion of synthesised ingredients.

In this classification, UPFs are said to be industrial formulations made from substances extracted from foods (oils, fats, sugar, starch and proteins), food constituents (hydrogenated fats and modified starch) or synthesised ingredients (flavour enhancers, colours, food additives) – all used to make the product hyper-palatable.

The Food Standards Agency suggests that a practical way to identify a UPF is to check if it contains ingredients that are never or rarely used in kitchens (e.g. additives, emulsifiers, stabilisers).

NOVA Food Classification System with examples from meat and dairy

Source: Center for Epidemiological Studies in Health and Nutrition, School of Public Health, University of Sao Paulo, Brazil.

Meat products like sausages and burgers are typically considered as UPFs based on the extra added ingredients found in a large proportion of the commercially available options.

Sausages and burgers that contain 100% meat would be considered as minimally processed.

One in three GB households are very concerned about Ultra Processed Foods (Kantar Nutrition Service, 23 February 2025), and 72% of consumers agree that too many foods have added ingredients making them unhealthy (IGD, Shopper Vista, April 2025).

In December last year, 39% of consumers stated that they were already trying to reduce the amount of processed food they eat, with a further 27% saying they were intending to reduce during 2025 (IGD, Shopper Vista, December 2024).

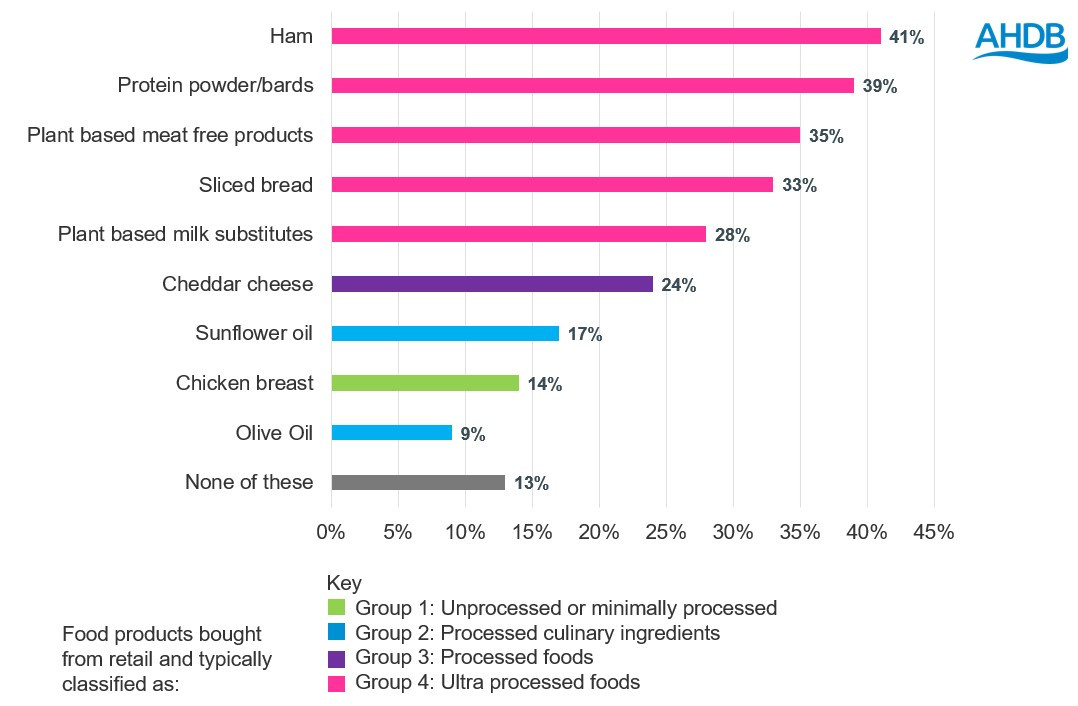

In a survey in 2024, 2089 consumers were given a list of food products and asked to say whether or not they considered them as ultra-processed.

The results showed that there were mixed perceptions of what was ultra-processed, with foods such as ham and protein bars most likely to be considered ultra-processed from the list of foods presented (AHDB/Blue Marble Trust Survey 2024).

% of consumers who believe the product is ultra-processed

Source: AHDB/Blue Marble Trust Survey 2024

How might this impact red meat and dairy?

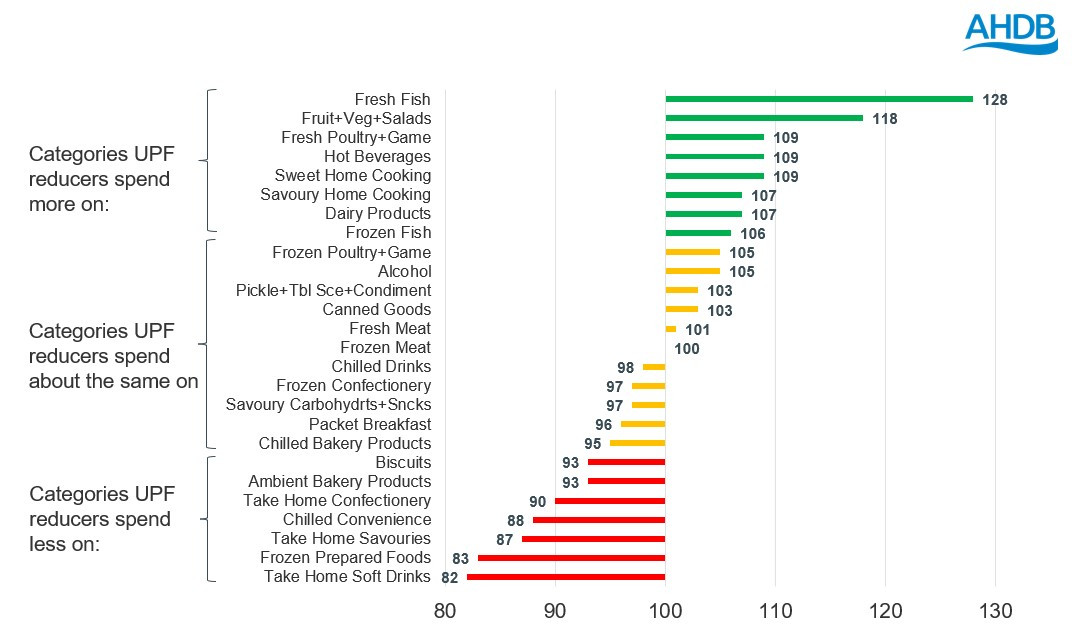

Shoppers who are actively trying to reduce how much UPF they buy are seen to spend more on fresh products, like fresh fish, fresh poultry and dairy, and less on convenience or snacking products like confectionary, biscuits and soft drinks.

These shoppers are seen to spend a similar amount on fresh or frozen meat compared to shoppers unconcerned about UPFs (Kantar Nutrition Service, 23 February 2025).

Index: Share of total food and drink budget for shoppers trying to reduce UPF vs shoppers not trying to reduce UPF

Source: Kantar Nutrition Service, 23 February 2025

Influence of UPF attitudes on retail sales

In retail sales, there are multiple factors that contribute to consumer purchases, including price, promotions, availability in shops, family or friend recommendations, personal motivations (e.g. wanting to eat healthier), media stories and even the British weather. As such, trends in sales cannot be directly attributed to UPF attitudes.

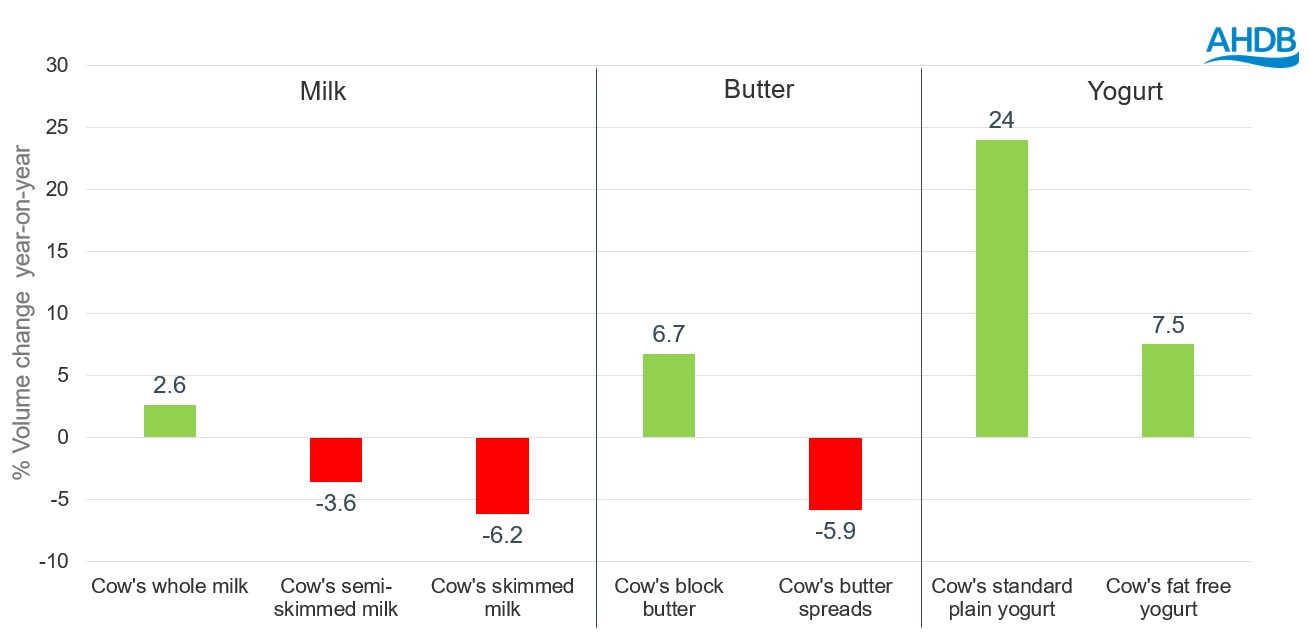

Within dairy, there is evidence that consumers are choosing to buy dairy products that may be perceived to be less processed. For example, whole milk volumes have grown year-on-year, while semi-skimmed and skimmed milk have declined.

Similarly, a volume growth has been seen for cow’s block butter, contrasting with a volume decline for cow’s butter spreads.

Within yogurts, standard plain yogurts are seeing strong volume growth, while fat-free yogurts, which may be perceived to be more processed, are growing at a slower rate (NIQ, 52 w/e 19 April 2025).

% volume change year-on-year

Source: NIQ 52 w/e 19 April 2025

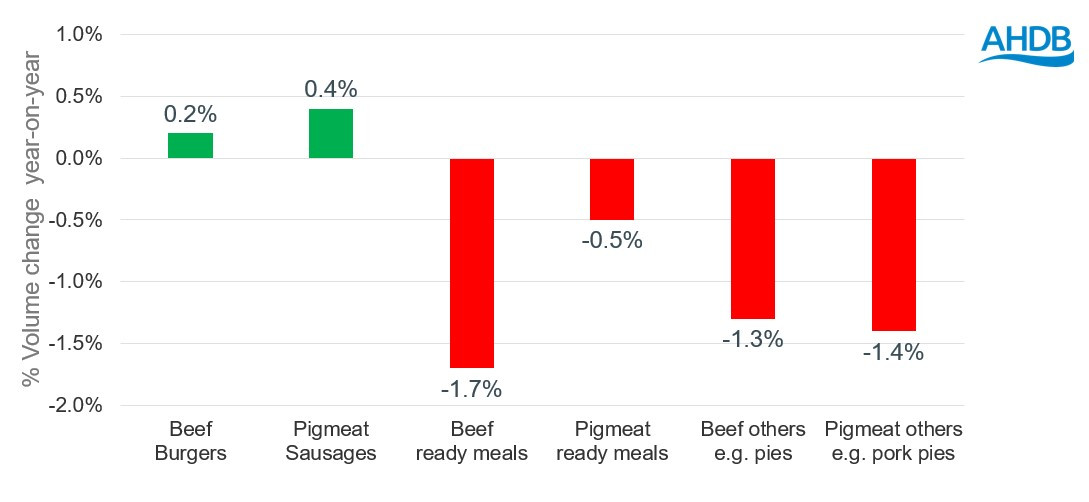

Within red meat the picture is more complex.

High-volume traditional processed offerings such as pigmeat sausages and beef burgers show modest volume growth year-on-year (+0.4% and +0.2%, respectively, Kantar 52 we 20 April 2025).

With 82% of consumers remaining concerned about the cost-of-living crisis (Sparkminds Ear to the Ground Tracker, 23 April 2025), these products offer value for money and are family friendly, delivering to taste and excitement needs desired from these products, potentially outweighing concerns around UPFs.

Ready meals and other offerings such as beef pies and pork pies are seen to be in decline for both pigmeat and beef, potentially showing a gradual shift towards less processed offerings.

% volume change year-on-year

Source: Kantar 52 w/e 20 April 2025

Finally, added value offerings of marinades and sous vide show strong growth for red meats (+10.3% and +12.7%, respectively, Kantar 52 we 20 April 2025).

Some of the offerings sold in these categories would be classed as UPF under the NOVA system and some would be classed as processed dependent on the ingredients used.

Marinade and sous vide products offer consumers a way to premiumise primary meat offerings that delivers for both taste and convenience needs and may not yet be under scrutiny by consumers from a UPF perspective.

Over the next few months AHDB will be diving deeper into at home usage of processed meat and further researching the key consumer needs that drive consumer decisions.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: