Evolution of the booming food delivery market

Monday, 25 February 2019

The foodservice market is growing year on year, driven largely by food delivery, which is evolving to adopt new technology and business models. The sector has seen double digit growth in the last year as new players enter the market and expand the offering.

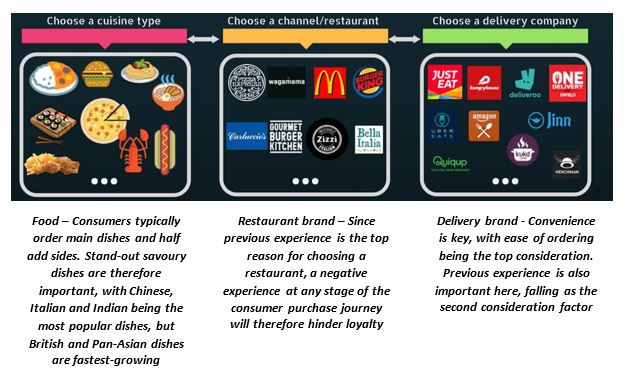

- As the pool of delivery options widens, delivery restaurants and channels must continuously innovate dishes to stand out against increased variety.

- Consumers are experimenting more with world cuisines, but also embracing the increased availability of British food delivery.

- Delivery operators (for example, Just Eat, Deliveroo) and restaurant brands that partner with them can lose loyal customers through a single bad experience. Therefore all touchpoints, from making the decision to have a takeaway to consumption, must meet expectations.

- The customer purchase journey is based around convenience – this must be a clear focus for all parties involved at every stage of the process.

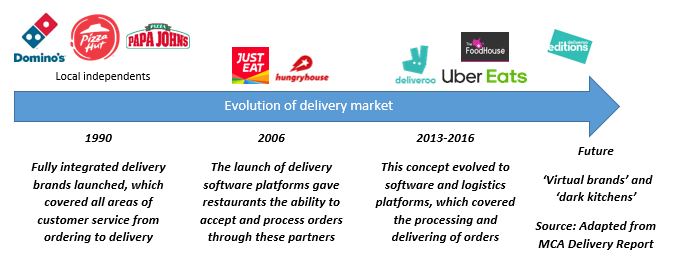

Food delivery market evolution

According to the MCA Foodservice Delivery Report 2018, food delivery was worth £8.1 billion in 2018 – up +13.4% year-on-year – and contributed to 8% of the foodservice market. Sixty percent of UK adults are active* delivery users who, on average, order two times per month and spend £9.47 per head per order. In total, this equates to 851m meals ordered in 2018, with no signs of slowing. MCA predicts that the market will be worth £9.8 bn by 2021.

Delivery is a dynamic market, experiencing high levels of growth versus other areas of foodservice. This is attributed to an increasing need for convenience, as well as technological developments that are expanding the pool of players.

Delivery platforms

Just Eat, the biggest delivery platform, acts as an intermediary between restaurants and customers. It started with a focus on local independents, but has grown to include an estimated 29,000 restaurants, including brands and fast food chains such as Harvester, GBK and Burger King. Deliveroo, which provides restaurants with dedicated couriers, has collected 10,000 participating restaurants in the six years since it entered the market.

The future also looks bright for the delivery market with the recent introduction of ‘virtual brands’ and ‘dark kitchens’. Virtual brands are online brands that have been introduced by existing physical restaurants, but under a new positioning, with no link to the affiliate. This provides extra revenue for the existing brand, low costs for the new brand and a new concept for consumers. An example of this is Blazing Bird, a chicken-based delivery concept that operates from Las Iguanas restaurants. Dark kitchens cook purely for delivery, with no consumer restaurant. Multiple businesses can operate from the same kitchen. Deliveroo Editions offers purpose-built kitchen space in areas with high demand so that brands can expand their reach without opening new restaurants.

Technological developments also seem likely, with companies trailing delivery robots in parts of Europe.

How can brands and operators keep up with this momentum?

According to the MCA Foodservice Delivery Report 2018, there are 4 stages to the consumer purchase journey. To stay ahead of the game, brands and operators must focus on ensuring the best experience at all stages:

Step 1 – Deciding what to have

Step 2 – Ordering

Increasing demand for convenience means that the importance of a mobile app for ordering is also increasing. However, online and phone options remain the main ordering methods for certain consumer demographics. The use of promotional offers when ordering is increasing and is a mechanism to encourage people to try something new.

Step 3 - Delivery

The average delivery time is 30 minutes and while some can take longer, it is key that consumers understand what a realistic time for their delivery is. Late delivery is currently the number one frustration for consumers. Consumers’ experience with the delivery driver can also positively or negatively reflect on the restaurant and/or delivery brand.

Step 4 – Consumption

Food quality and taste are the most important criteria for a takeaway delivery experience. Once delivered, several aspects can hinder this, including the appearance, temperature and spillages. If your brand is not responsible for the delivery stage, it is still your responsibility to monitor. Any bad experience can reflect badly on a brand.

The food delivery market refers to prepared, ready-to-eat food that is delivered to people’s home for consumption (not collected in person).

*active users are users who use takeaway delivery more than once per six months