Christmas 2025: Lamb wins big, turkey tumbles and convenience is king

Tuesday, 13 January 2026

Christmas 2025 saw demand for meat, fish and poultry (MFP) grow despite ongoing price pressures. However, the real story was a dramatic divide in protein performance. Lamb sales soared, while turkey stumbled, and shoppers embraced festive convenience.

Overall, total grocery volumes were up 1.1%. Total MFP also performed well, although slightly behind the total market, with volumes up by 0.8% (Worldpanel by Numerator, 4 w/e 28 December 2025).

Festive red meat cuts performed well this Christmas, outperforming the total grocery market.

Festive cut volume and spend performance for Christmas 2025

| Cut of meat | Beef roasting | Pig meat roasting | Gammon | Lamb roasting | Whole turkey | Whole chicken |

| Volume % change year-on-year | +8.6% | +14.2% | +8.3% | +17.2% | -5.4% | +2.5% |

| Spend % change year-on-year | +6.9% | +14.8% | +10.5% | +16.2% | -6.5% | +7.0% |

Source: Worldpanel by Numerator, 2 w/e 28 December 2025.

Lamb: The festive hero

Lamb was the runaway success of the festive season, building on a strong performance throughout 2024 despite reduced demand throughout much of 2025.

In the prime two shopping weeks for Christmas (ending 28 December 2025), leg roasting drove overall lamb performance, with a 24.7% increase in volumes purchased.

Almost half of lamb volumes sold in the run-up to Christmas were on deal.

Targeted promotions were particularly effective as shoppers clearly responded to value-led deals and the promise of a festive centrepiece. As a result, almost 300,000 more shoppers purchased lamb leg roasting joints (2 w/e 28 December 2025).

Even with the heavy promotional support, lamb remained one of the more expensive proteins this Christmas.

Average price per kilo (£) for roasting cuts by proteins

| Cut of meat | Beef roasting | Lamb roasting | Pig meat roasting | Gammon | Whole chicken | Whole turkey |

| Average price per kilo | £11.19 | £10.31 | £6.18 | £6.89 | £3.38 | £4.95 |

| Average price % change year-on-year | -1.6% | -0.9% | +0.5% | +2.1% | +4.3% | -1.1% |

Source: Worldpanel by Numerator, 2 w/e 28 December 2025

Its success this year shows that shoppers are looking for more than just low prices. Therefore, we must continue to promote the taste, enjoyment and health benefits of eating red meat.

Pig meat: A reliable favourite

Pig meat also saw good performance with gammon, as we predicted prior to Christmas proving to once again be a festive favourite, particularly with shoppers aged 28–34 and over 65 who drove the 8.3% increase in volume.

Average volumes purchased per shopper reduced year-on-year. However, this was offset by an additional 484,000 shoppers who purchased gammon in the 2 w/e 28 December 2025.

Shoulder roasting joints performed especially well, which saw volumes purchased increase by 43.7%.

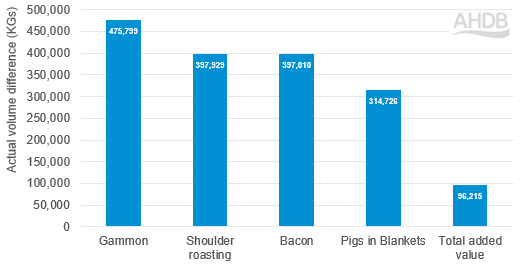

Top performing pig meat cuts at Christmas 2025 (Volume difference versus last Christmas (kg))

Source: Worldpanel by Numerator, 2 w/e 28 December 2025. Total added value includes ready-to-cook, sous vide and marinades.

Pigs in blankets were a festive staple. While sausages (+0.6%) and bacon (+7.5%) saw increased demand perhaps for those shoppers looking to make their own, premade pigs in blankets saw a 12.7% increase, equivalent to an additional 315,000 kilos, in the 2 w/e 28 December 2025.

This shows that convenience was still top of mind for many.

Beef: Spend up, volume down

Overall, total beef delivered a strong Christmas in terms of spend (+9.4%). However, less so on volume (-4.0%). We saw significant price rises throughout 2025 impacted beef demand throughout the year.

Despite this, roasting joints were a bright spot with volumes up 8.6% (2 w/e 28 December 2025).

Added value, particularly sous vide products, also saw bumper performance with volumes up overall by 10.5%, despite being on average £1.94/kg more expensive than the total beef category. Proof that consumers were willing to pay for convenience.

Turkey: Tradition under pressure

Turkey was the clear casualty this Christmas. Shoppers cut back on whole birds and primary cuts, and as a result, primary volumes declined by 12.0% year-on-year.

But once again, convenience proved popular with shoppers as ready-to-cook turkey offerings saw volumes purchased increase by 18.4%

Retailer dynamics

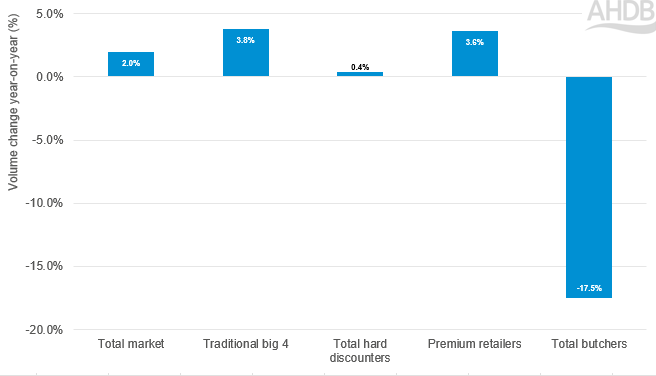

The traditional big four supermarkets and premium retailers outperformed the total market this Christmas.

Retailer performance changes year-on-year for MFP

Source: Worldpanel by Numerator, 2 w/e 28 December 2025

While the hard discounters saw some improved performance year-on-year, the traditional big 4 used promotions significantly more than the total market, which will have boost their performance for MFP.

Volumes of MFP sold on promotion by retailer (%)

| Type of retailer | Total market | Traditional 'big four' | Hard discounters | Premium retailers | Total butchers |

| Volumes of MFP sold on promotion | 31.4% | 39.1% | 15.1% | 21.8% | N/A |

Source: Worldpanel by Numerator, 2 w/e 28 December 2025

While premium retailers promoted less than the total market, overall, they saw strong MFP volume sales.

Premium products are often associated with Christmas as shoppers look for everyday indulgences to help with celebrations, and in fact throughout December, premium own label products were seen to be present into 92% of shoppers’ baskets (Worldpanel by Numerator, 4 w/e 28 December 2025).

Butchers’ performance was less positive this Christmas. Only lamb showed year-on-year gains, which were wiped out by reduced demand by all other proteins.

What can we learn for Christmas 2026?

Double‑down on easy festive solutions

Ready‑to‑cook and added‑value products proved shoppers still want the tradition of Christmas without the fuss.

Expand convenience options across all proteins.

Make promotions purposeful

Lamb’s success this year was no accident. Targeted deals on hero roasts can boost demand for certain products without eroding demand for others.

Look to leverage similar strategies for other proteins and cuts next Christmas.

Cater for every price point

Ensure that all price points are catered for. Added-value beef and overall lamb results show households will pay for more expensive products if the trade‑up is clear.

Refine ranges around premium roasts and celebratory cuts, supported by simple meal solutions with Christmas essentials to help every household celebrate in style.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors: