Beef inflation slows and demand stabilises

Monday, 1 December 2025

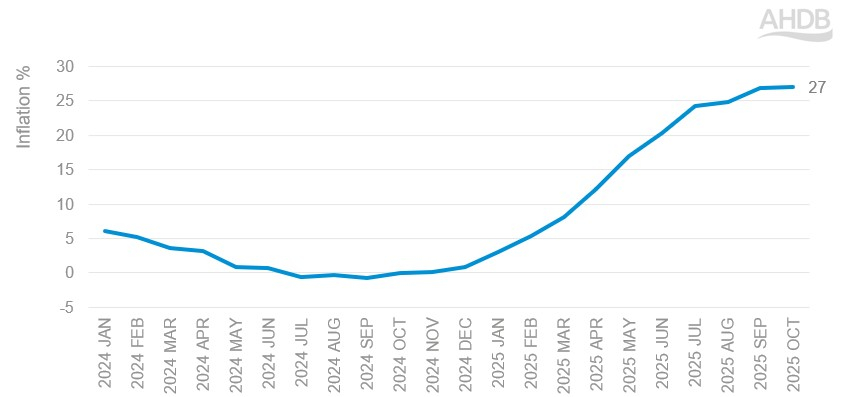

According to the Office for National Statistics (ONS), beef and veal inflation hit 27% in October 2025, just 0.1% higher than September. This signals a potential slow-down in the rate of beef retail price rises.

AHDB and QMS jointly funded research with Worldpanel by Numerator UK to estimate the impact of inflation rises on beef volumes. This article updates our insights following the latest data.

Figure 1. Consumer price inflation: Beef and veal

Source: ONS, CPI, beef and veal

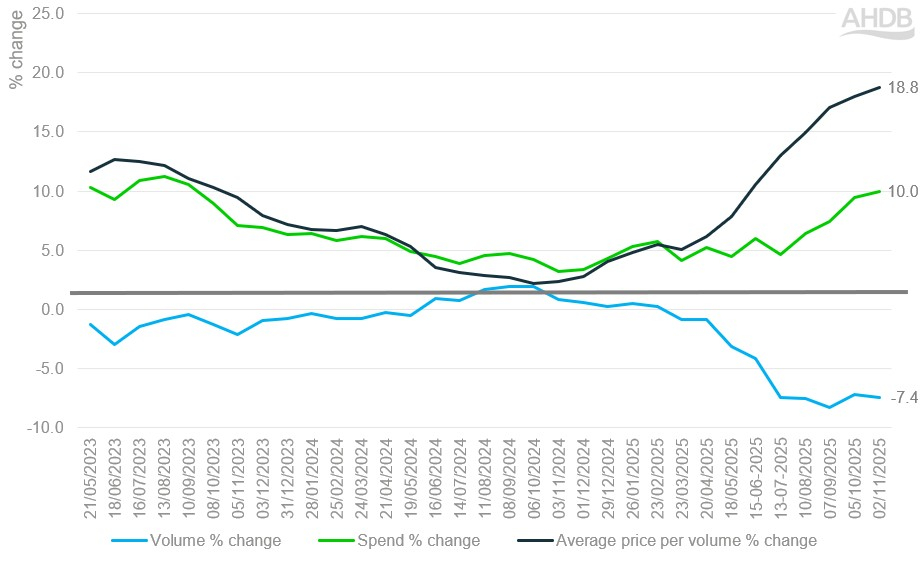

For total beef in retail, the average price per kilo has increased +18.8% year-on-year, resulting in a -7.4% volume decline, equivalent to -9,670 tonnes (Worldpanel by Numerator UK, 12 w/e 2 November 2025).

Despite average prices rising, compared with the previous period, total beef volumes have grown by 4.2%, suggesting that consumers who continue to buy beef may now be adapting to the new price levels (Worldpanel by Numerator UK, 12 w/e 2 November 2025 vs 12 w/e 4 October 2025).

Figure 2. Tracking volume, spend and average price per volume % change year-on-year

Source: Worldpanel by Numerator UK, 12 w/e from 21 May 2023 to 2 November 2025

The stabilisation in volumes has been supported by recent volume growth in convenient beef offerings, such as ready to cook (+8.4%), sous vide (+7.6%) and ready meals (+1.5%), tapping into the trend for easy and quick cooking solutions (Worldpanel by Numerator UK, 12 w/e 2 November 2025, year-on-year % change).

We also see volume growth for diced beef (+89%) and stewing beef (+109.8%) versus the last period (Worldpanel by Numerator UK, 12 w/e 2 November 2025 vs 12 w/e 4 October 2025). The recent cold weather may have encouraged consumers to turn to more wintery dishes that use these cuts such as casseroles and stews.

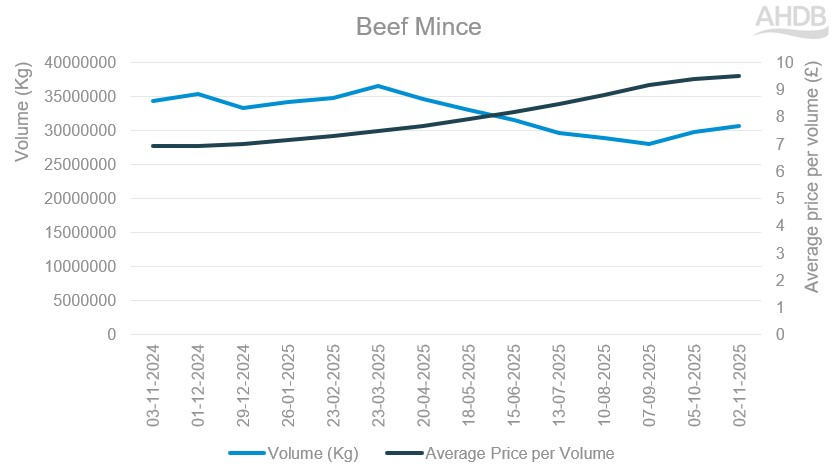

Beef mince

Focusing on mince, latest period data shows a 37.1% increase in average price per kilo year-on-year, with a corresponding -10.7% decline in volume (Worldpanel by Numerator UK, 12 w/e 2 November 2025). Volumes fell steadily as prices increased, but have stabilised in recent periods.

Figure 3. Beef mince: Volume and average price per kilo

Source: Worldpanel by Numerator UK, 12 w/e 3 November 2024 to 2 November 2025

A large proportion of beef mince volume losses are a result of consumers switching to cheaper proteins, primarily chicken (whole bird, breast, wings, legs and thighs), pork sausages and fish.

Some switching into other protein mince offerings is also seen, with pork mince volumes growing +36.6% year-on-year, and chicken mince growing +65.6% (Worldpanel by Numerator UK, 12 w/e 2 November 2025). This suggests that some consumers are looking for cheaper substitutes for cooking their family favourites such as spaghetti bolognese or chilli con carne.

For those consumers choosing to continue buying beef mince, we see a range of different budget saving tactics at play. Some consumers have chosen to buy smaller pack sizes with 250g packs growing at +11.6%, saving consumers £1.77 on average compared to a 500g pack. Others have chosen to buy higher fat content beef mince, with 20% fat packs growing in volumes +9.1% year on year, saving consumers £2.00 on average per pack versus 5% fat packs. Finally, some consumers have chosen to purchase frozen beef mince rather than chilled offerings, with frozen beef mince volumes growing +6.1% year-on-year (Worldpanel by Numerator UK, 12 w/e 2 November 2025).

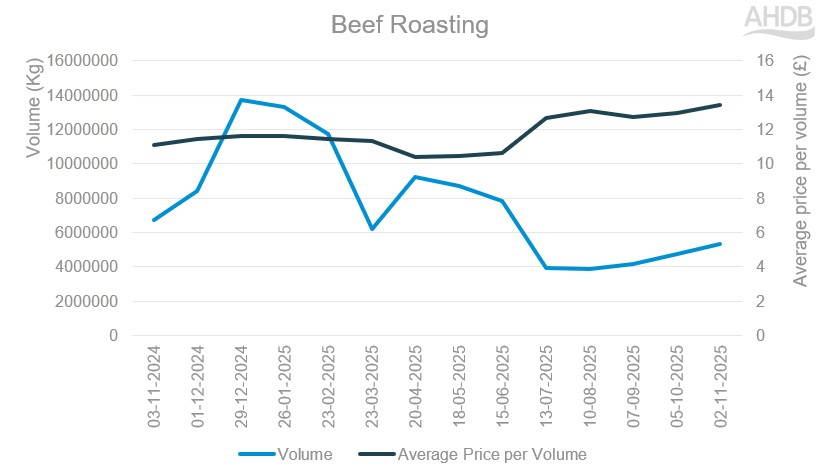

Beef roasting joints

For beef roasting joints, the latest period data (12 w/e 2 November 2025) shows a 21.3% increase in average price per volume, with a corresponding -21.2% decline in volume (Worldpanel by Numerator UK).

Trends over time show that beef roasting joints peak in volumes around Christmas and Easter, and the latest period data shows a +37.0% increase in volumes versus the last period, indicating that consumers are starting to reconsider beef roasting joints in the run-up to Christmas despite higher prices (Worldpanel by Numerator UK, 12 w/e 2 November 2025 vs 12 w/e 4 October 2025).

Promotions on beef roasting joints have started to hit the shelves and might help encourage consumers to reconsider this beef cut.

Figure 4. Beef roasting: Volume and average price per volume

Source: Worldpanel by Numerator UK, 12 w/e 3 November 2024 to 2 November 2025

Recommendations

- Ensure there is a wide range of pack sizes and quality options to keep British beef accessible for all consumers irrespective of budget

- Continue to celebrate the benefits of British beef as a trusted and sustainable choice for UK shoppers. AHDB’s Let's Eat Balanced consumer campaign highlights the great taste and nutritional benefits of British beef

- Makes sure winter seasonal beef cuts such as diced and stewing are available on shelves for casseroles and stews

- In the run-up to Christmas, promote seasonal cuts such as beef roasting joints and more convenient solutions, such as ready-to-cook or sous-vide beef

- In the longer-term, work to ensure robustness in domestic supplies as this will help to stabilise beef inflation for consumers and support demand across the range of beef cuts. This is an area where AHDB supports farmers to be more efficient, profitable and resilient through our work in areas such as genetic evaluations, animal health and welfare, and knowledge exchange. In addition, we support profitability across the whole supply chain through domestic marketing, export market development and the provision of evidence and insight in areas such as market intelligence

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.