Predicting beef demand as retail prices rise

Thursday, 31 July 2025

This article has been updated with August data:

Beef retail demand continues to suffer as inflation soars

Retail beef inflation has been rising steadily through 2025, driven by a constrained supply. As restrictions on supply are likely to remain for the foreseeable future, AHDB and QMS have jointly funded research with Worldpanel by Numerator UK to estimate the impact of further inflation rises on beef volumes.

Key points:

- Retail beef inflation reached 9.1% in May 2025, leading to a loss of -3,300 tonnes of beef in a 12-week period (Worldpanel by Numerator UK, 12 w/e 18 May 2025)

- In the past three years, beef inflation has reached a high of 16% in October 2022. If this level of inflation is seen again, it is estimated that there will be a loss of 12,500 tonnes of retail beef in a 12-week period (Worldpanel by Numerator UK, levers of growth estimations)

- Volume declines will be driven by consumers buying less beef, buying less types of cuts or switching out to cheaper proteins (primarily chicken and pork). Consumers are also managing their spend by switching to cheaper offerings (e.g. trading down from premium to standard tier) while spending more on promotions

Current beef performance

Retail beef inflation reached 9.1% in May 2025, leading to a decline in total beef volumes of -2.5%, equating to a loss of -3,300 tonnes of beef (Worldpanel by Numerator UK, 12 w/e 18 May 2025).

This volume loss arose because of three different consumer behaviours: buying less types of beef cuts, buying less volume of the same cuts and stopping buying beef. Those who stopped buying beef switched to pork sausages, gammon roasting joints or chicken products (breast, diced, wings/legs/thighs).

Contributions to volume decline for total beef

|

|

Shoppers buying less cuts |

Shoppers buying less volume of the same cuts |

Shoppers stopping buying beef |

Population growth |

|

Tonnes of beef |

-2,058 |

-1,082 |

-1,046 |

+820 |

|

% change year-on-year |

-1.5% |

-0.8% |

-0.8% |

+0.6% |

|

Example |

A family typically buys steak, mince and roasting joint but moved to just buying mince |

A couple usually buys 750g mince but moved to buying 500g instead |

A family switched to buying a cheaper protein or stopped buying meat altogether |

|

Source: Worldpanel by Numerator UK, 12 w/e 18 May 2025

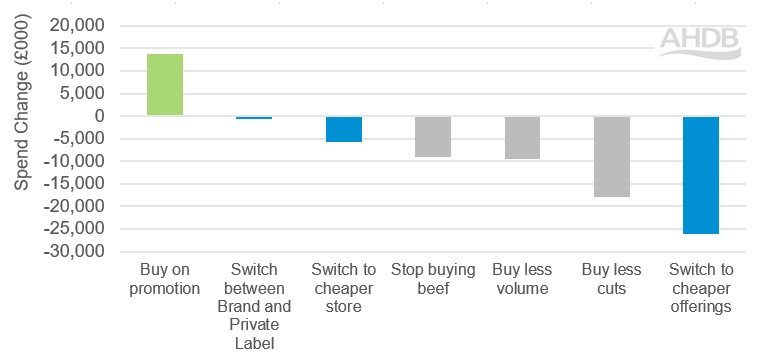

Alongside reducing volumes of beef, consumers also used other mechanisms to manage their spend. This includes spending more on promotion or switching to cheaper offerings (e.g. moving from 5%-fat mince to 20%-fat mince, trading down private label tiers, or buying in bulk) to save money. Switching to cheaper stores is seen to a limited extent - this behaviour change tends to be a last resort for consumers as inflation rises further (Worldpanel by Numerator UK, 12 w/e 18 May 2025). As yet, there is no evidence of consumers turning to frozen beef or economy-tier beef.

Levers driving total beef spend change (£000)

Source: Worldpanel by Numerator UK, 12 w/e 18 May 2025, Total Beef spend change (£000)

Predicting consumer behaviour as inflation rises

In the past three years, beef inflation reached a high of 16% in October 2022 (Worldpanel by Numerator UK, 12 w/e 9 October 2022). At this time, high inflation was seen across proteins, driven primarily by higher fuel prices.

By applying the shopper behaviours seen in October 2022 to the current situation, we predict that a beef inflation of 16% would lead to a decline in total beef volumes of

-12,500 tonnes over a period of 12 weeks, driven primarily by shoppers buying less types of cuts and buying less volume of their usual cuts.

Estimated 12-week contribution to year-on-year volume change if inflation reaches 16%

|

|

Shoppers buying less cuts |

Shoppers buying less volume of the same cuts |

Shoppers stopping buying beef |

Population growth |

|

Tonnes of beef |

-5,988 |

-5,743 |

-835 |

+944 |

|

% change year-on-year |

-4.5% |

-4.3% |

-0.6% |

+0.6% |

|

Example |

A family typically buys steak, mince and roasting joint but moved to just buying mince |

A couple usually buys 750g mince but moved to buying 500g instead |

A family switched to buying a cheaper protein or stopped buying meat altogether |

|

Source: Worldpanel by Numerator UK, Total Beef, estimated 12-week contribution to year-on-year volume change (tonnes) if inflation reaches 16%

Recommendations:

To minimise the impact of retail price inflation:

- Ensure there is sufficient breadth of choice in pack size and quality so that beef remains accessible for all consumers

- Consider multibuy deals on mince to encourage stability for this everyday staple. Demonstrate the taste and versatility credentials of beef mince, inspiring meals that are family friendly, filling and reduce waste with batch cooking

- Deliver promotions on premium beef cuts to help consumers trade up to more premium offerings such as restaurant quality dine-in deals. Make the most of seasonal events to promote seasonal cuts, e.g. beef roasting joints for Christmas

- Communicate the unique benefits of beef cuts that are not easily replaced by other proteins such as beef burgers and steaks. AHDB’s Let's Eat Balanced consumer campaign highlights the taste and nutritional benefits of British beef

- Work to ensuring robustness in domestic supplies as this will help to stabilise beef inflation for consumers and support demand across the range of beef cuts. This is an area where AHDB strives to support farmers to be more efficient, profitable and resilient, through our work in areas such as genetic evaluations, animal health and welfare, and knowledge exchange. In addition, we support profitability across the whole supply chain through domestic marketing, export market development and the provision of evidence and insight in areas such as market intelligence

Explore the full analysis and insights into the impact of rising beef prices within the out-of-home market in our recent article.

See the latest data and insights around food service on our Retail data | AHDB dashboard.

Click on the drop-downs below to explore the detail for key beef cuts.

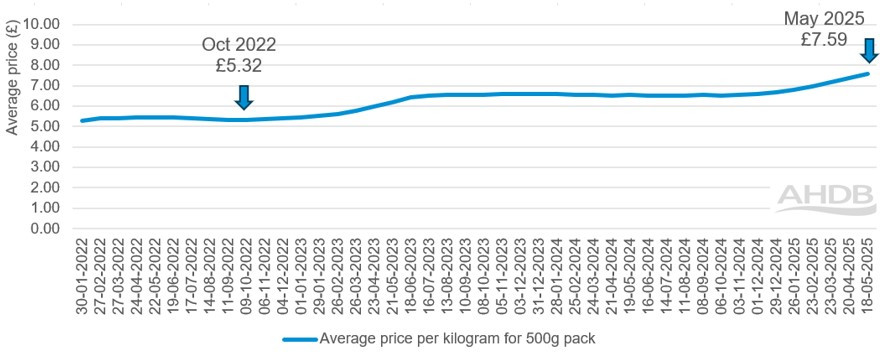

Beef mince inflation reached 14% in May 2025 (Worldpanel by Numerator UK, 12 w/e 18 May 2025). In the past beef mince has been able to weather rises in inflation, often seen as a cheaper and versatile beef option for family-friendly meals. In October 2022, when beef inflation was at 16%, mince only saw a -0.3% drop in penetration and gained volumes through shoppers switching from roasting joints and steaks (Worldpanel by Numerator UK, 12 w/e 9 October 2022).

In 2025 the situation is very different. The average price per kilogram for a 500 g pack in May 2025 has risen to £7.59, a 43% price increase compared to October 2022 (Worldpanel by Numerator UK, 12 w/e 18 May 2025).

Average price per kilo for 500g pack of beef mince

Source: Worldpanel by Numerator UK, 12 w/e from 30 January 2022 to 18 May 2025, Average price per kilogram for 500g pack of beef mince

With this higher average price, we see more shoppers stopping buying mince (a -3.9% decline in penetration) and switching primarily to chicken breast, now an affordable alternative (average price £6.85 per kg). This has led to a -1.8% decline in beef mince volumes (Worldpanel by Numerator UK, 12 w/e 18 May 2025). These higher prices may have broken a psychological threshold above which shoppers start to reconsider the cost to value equation for mince.

Interestingly we do not see a high level of switching from beef mince to pork or chicken mince, suggesting that consumers are not only switching the source of protein but also adapting the types of meals they consume.

If beef mince inflation continues to rise, we predict steeper volume declines further advantaging chicken and potentially pork.

Steak inflation reached 18% in May 2025, leading to a -4% decline in volumes, driven by consumers buying less volume of steak or stopping buying steak (Worldpanel by Numerator UK, 12 w/e 18 May 2025).

Although shopper penetration has fallen -3.7% year-on-year, a similar level to that seen in October 2022, a different pattern of switching is seen. In October 2022, a large proportion of consumers switched from beef steak to beef mince. With the higher prices of beef mince this year, we see consumers switching from beef steak either to primary chicken (breast, wings, legs, thighs) or pork steaks (Worldpanel by Numerator UK, 12 w/e 18 May 2025).

If beef steak inflation continues to rise, we predict steeper volume declines advantaging both chicken and pork.

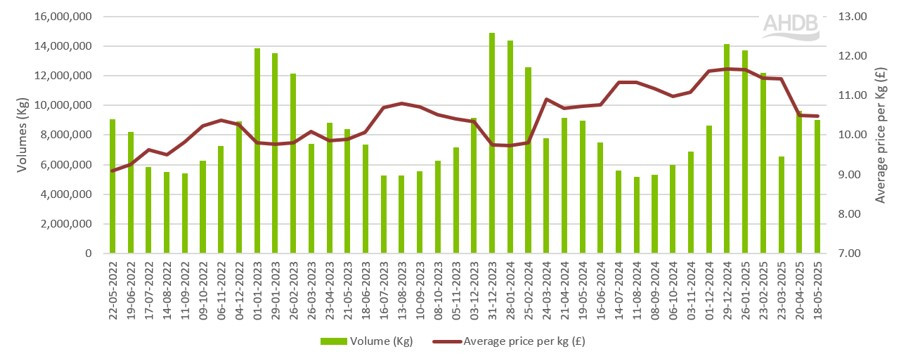

Beef roasting joint volumes are highly seasonal, peaking at Christmas, with a secondary smaller peak at Easter. Average prices have been steadily rising over the past three years, reaching £11.67 in December 2024 (Worldpanel by Numerator UK, 12 w/e 29 December 2024). Volumes sold over Christmas 2024 declined -5.1% versus Christmas 2023, but they were +1.9% ahead of volumes for Christmas 2022, suggesting that this cut is able to maintain volumes at seasonal peaks despite rising prices.

Volume and average price changes over time for beef roasting joints

Source: Worldpanel by Numerator UK, 12 w/e from 22 May 2022 to 18 May 2025, beef roasting joints volumes (Kg) and average price per kg (£)

For Christmas 2024, a higher proportion of promotions were focused on premium roasting joints (+3.9%), resulting in a +3.3% higher share of total beef joints sold in the premium tier (Worldpanel by Numerator UK, 12 w/e 29 December 2024).

Since Christmas, beef roasting joint inflation has fallen to 4% and volumes are +1.6% versus the same period last year (Worldpanel by Numerator UK, 12 w/e 18 May 2025).

If constraints in beef supply continue, it is possible that beef roasting joint inflation will rise to a greater extent for Christmas 2025, which may result in consumers switching to cheaper Christmas joints, such as whole chickens.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.