Rising prices for beef in dining-out market forecast to impact consumer demand

Thursday, 31 July 2025

Rising beef prices have out-striped inflation, driven by a constrained supply. As a general rule, as prices rise, demand from consumers falls, and in this article, AHDB explores the potential impact of further beef price increases within the dining-out market, looking at both total beef and key beef dishes.

Key findings

- In November 2024, average prices for beef dishes out-of-home rose 12.8% year-on-year, the highest price increase in 2024 (Worldpanel by Numerator UK OOH, 52 w/e 3 November 2024)

- Consumers responded to these price increases by reducing the amount and frequency at which they purchased beef dishes or by turning away from beef dishes altogether

- Applying an equivalent 12.8% price increase to 52 w/e 20 April 2025 data, predictions show that average beef dish prices will rise +£0.84p, resulting in a -5% decline in the number of beef dishes sold out-of-home (Worldpanel by Numerator UK OOH), equating to an estimated loss of approx. 5,100 tonnes of beef, assuming an equal 5% decline on all beef offerings (forecast based on AHDB estimates from Worldpanel by Numerator UK OOH data)

In April 2025, consumer confidence fell to its lowest point since November 2023, driven by concerns around inflation, rising prices and global economics (GFK Consumer Confidence, April 2025)

Within the out-of-home market, this uncertainty has led to a -1.9% reduction year-on-year in the number of out-of-home occasions, including dining out, takeaways and buying to eat on the go (Worldpanel by Numerator UK OOH, 52 w/e 20 April 2025).

With 176.9m out-of-home occasions containing beef (Worldpanel by Numerator UK OOH, 12 w/e 20 April 2025), this protein is a key part of the market, representing 12% of spend and 7% of dishes across total out-of-home food (Worldpanel by Numerator UK OOH, 52 w/e 20 April 2025).

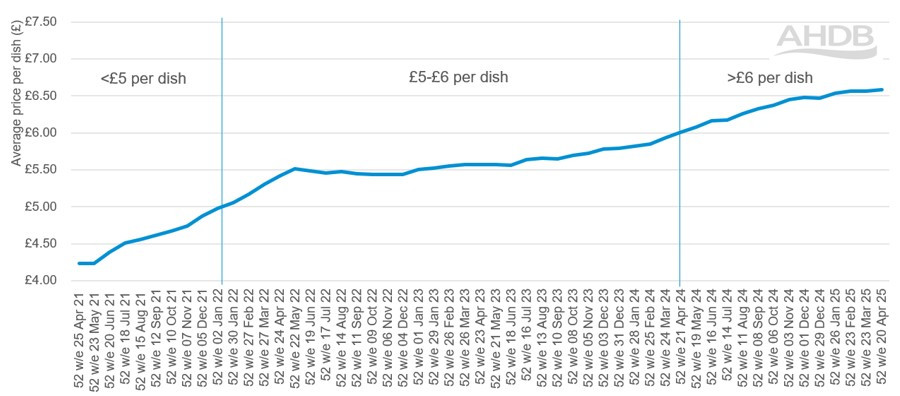

Over the past five years, average prices per dish for beef out-of-home have been steadily increasing, with prices now averaging over £6 per dish.

Average price per dish (£) for beef out-of-home dishes

Source: Worldpanel by Numerator UK OOH 52 w/e 25 April 2021 to 20 April 2025

How have consumers previously reacted to out-of-home beef price rises?

In November 2024, average prices for beef rose 12.8% year-on-year, the highest price increase in 2024, pushing average prices to £6.45 (Worldpanel by Numerator UK OOH 52 w/e 3 November 2024). This February, average prices increased again by 12.1% (Worldpanel by Numerator UK OOH 52 w/e 23 February 2025). With these price rises in play, we saw consumers reacting in three different ways:

- Consumers reduced the number of beef dishes they purchased within an occasion (e.g. a couple who typically visit a restaurant and order two beef steaks changed to ordering only one beef steak, with one person switching to a cheaper option on the menu, e.g. a cheaper protein like pork or a meat/fish/poultry-free option).

- Consumers reduced the frequency at which they purchased beef dishes (e.g. a family who typically purchase beef burgers from a quick service restaurant once every four weeks changed to purchasing once every six weeks).

- Consumers turned away from beef dishes altogether.

How do we predict consumers will react in the future for similar out-of-home beef price rises?

Understanding the patterns of consumer behaviour in the past allows us to predict potential behaviour changes as beef prices continue to rise. Note that there are many different factors that can impact purchase behaviour, including promotions and availability through menu changes. The predictions shown in this article are based on the assumption that all other factors remain equal.

Total beef

Based on a 12.8% price rise applied to 52 w/e 20 April 2025 data, predictions show that average beef dish prices will rise +£0.84p, taking the average price per dish to over £7 (Worldpanel by Numerator UK OOH).

As a result of this price increase, 230K consumers are predicted to turn away from beef dishes out-of-home altogether. Consumers who continue to purchase beef dishes are predicted to reduce the number of beef dishes by occasion by -0.1 dish per occasion on average and reduce the frequency of beef dish occasions by -1.2 occasions per year on average.

The consequence of these consumer behaviour changes would result in a -5% decline in the number of beef dishes sold out-of-home (Worldpanel by Numerator UK OOH). This would equate to an estimated loss of approximately 5,100 tonnes of beef, assuming an equal 5% decline on all beef offerings (forecast based on AHDB estimates from Worldpanel by Numerator UK OOH data).

Predictions for total beef

|

Prediction based on 12.8% price rise |

Price per dish |

Percentage of population shopping |

Average number of dishes per occasion |

Average number of occasions per year |

|

52 w/e 20 April 2025 |

£6.58 |

73.1 |

1.3 |

17.9 |

|

Prediction with price rise |

£7.42 |

72.4 |

1.2 |

16.7 |

|

Impact with price rise |

+£0.84p |

-230k consumers |

-0.1 dishes per occasion |

-1.2 occasions per year |

Source: Worldpanel by Numerator UK OOH

Channels and dishes

Four key channels are responsible for 88% of beef sold out-of-home: (i) quick-service restaurants, (ii) bakery, sandwich and salad outlets, (iii) pubs and bars, and (iv) full-service restaurants.

|

|

Quick-service restaurants |

Bakery, sandwich and salad |

Pubs and bars |

Full-service restaurants |

|

% of beef dishes |

51% |

17% |

13% |

7% |

Source: Worldpanel by Numerator UK OOH 12 w/e 20 April 2025

Burgers, pasties, steaks and beef meals account for 77% of beef dishes and are tightly linked to the different channels. Trends in the market indicate that these different beef dishes may be impacted in different ways as prices rise.

|

|

Quick-service restaurants |

Bakery, sandwich and salad |

Pubs and bars |

Full-service restaurants |

|

Share of dishes |

89% Burgers |

90% Pasty |

34% Burgers 14% Beef meals |

25% Burgers 25% Steak |

Source: Worldpanel by Numerator UK OOH 12 w/e 20 April 2025

Click on the drop-downs below to explore the detail for key beef out-of-home dishes.

Beef burgers are sold across multiple channels. Within fast food restaurants, historical trends suggest that when prices rise, consumers will reduce the frequency at which they purchase burgers, along with reducing the number of burgers purchased on each occasion. For pubs and bars, trends suggest that consumers will reduce the number of times they visit and purchase burgers, and for full-service restaurants, consumers are unlikely to pay the higher price for burgers within this setting. As such it is predicted that a 18.7% (+£0.84p) price rise (as seen in Nov 2024) would result in a -6.9% decline in burger dishes (Worldpanel by Numerator UK OOH), equating to an estimated decline of approx. 3,300 tonnes of beef (forecast based on AHDB estimates from Worldpanel by Numerator UK OOH data).

Consumers are seen to trade down to cheaper options when prices rise, advantaging channels like bakery, sandwich and salad outlets. This trading down has a positive impact on beef pasties, the key beef offering in this channel. It is predicted that an 8.1% (+£0.18p) price increase (as seen in Jan 2025) would result in a +5.8% growth in the number of beef pasty dishes sold out-of-home (Worldpanel by Numerator UK OOH). This would equate to an estimated growth of approximately 5.5 tonnes of beef (forecast based on AHDB estimates from Worldpanel by Numerator UK OOH data).

Steaks are key beef dishes in full-service restaurants, where the average price per dish is currently £21.44 (Worldpanel by Numerator UK OOH 52 w/e 20 April 2025). Historical trends suggest that consumers who are prepared to pay this higher price premium are likely to remain loyal to the dish despite further price increases; however, there are some consumers who will be squeezed out by further price increases. As such it is predicted that a 15.8% (+£2.91p) price rise (as seen in Jan 2025) would result in a -2.9% decline for beef steak dishes (Worldpanel by Numerator UK OOH), equating to an estimated decline of approximately 300 tonnes of beef (forecast based on AHDB estimates from Worldpanel by Numerator UK OOH data).

Finally, price rises for beef meals in pubs and bars (such as roasts, pasta lasagne/Bolognese, Indian curries) are likely to be impacted by consumers reducing the number of times they visit the venue and purchase these types of meals. It is predicted that a 12.6% (+£0.74p) price rise (as seen in Feb 2025) would result in a -5.5% decline in beef meal dishes (Worldpanel by Numerator UK OOH), equating to an estimated loss of approximately 100 tonnes of beef (forecast based on AHDB estimates from Worldpanel by Numerator UK OOH data).

In summary, consumers are responding to price rises of beef in different ways out-of-home: some are reducing their frequency, and others are trading down to beef dishes in cheaper channels or trading out of beef into a cheaper protein. The predictions shown in this article are based on the assumption that all other factors that drive consumer behaviour (e.g. promotions, menu changes) remain equal. Rising beef prices are likely to result in a decline in beef volumes sold out-of-home, but the impact will vary depending on channel and dish.

Recommendations

Foodservice operators could minimise inflationary sales losses by:

- Providing convenient value for money beef options in lower price channels, such as bakery, salad and sandwich outlets, to ensure beef remains accessible for all consumers – utilising promotional mechanics such as meal deals

- Offering promotions on premium beef dishes in full-service restaurants delivering to taste, experience and treating occasions. Loyalty rewards are one way to do this

The wider supply chain could minimise inflationary sales losses by:

- Communicating red meat quality, taste and reputational credentials on menus (find out more here) or via advertising. AHDB’s Let's Eat Balanced consumer campaign highlights the taste and nutritional benefits of British beef

- Working to ensuring robustness in domestic supplies as this will help to stabilise beef inflation for consumers and support demand across the range of beef cuts. This is an area where AHDB strives to support farmers to be more efficient, profitable and resilient, through our work in areas such as genetic evaluations, animal health and welfare, and knowledge exchange. In addition, we support profitability across the whole supply chain through domestic marketing, export market development and the provision of evidence and insight in areas such as market intelligence

Explore the full analysis and insights into the impact of rising beef prices within retail market in our recent article.

See the latest data and insights around foodservice on our Foodservice data | AHDB dashboard.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.