Arable Market Report - 20 May 2024

Monday, 20 May 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

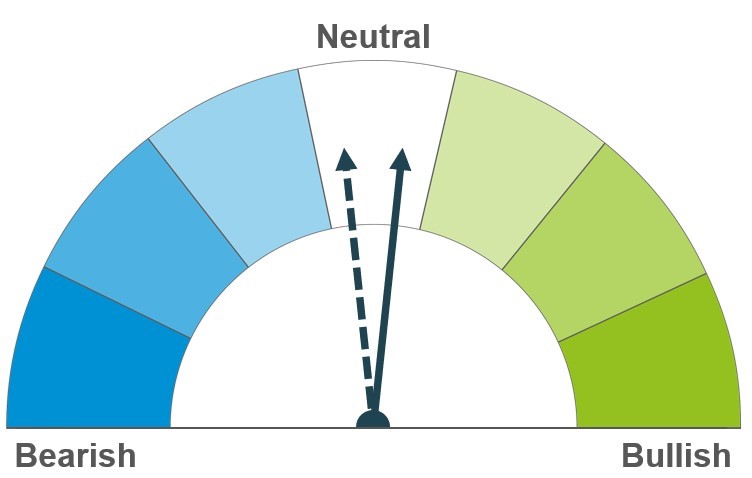

Wheat

Maize

Barley

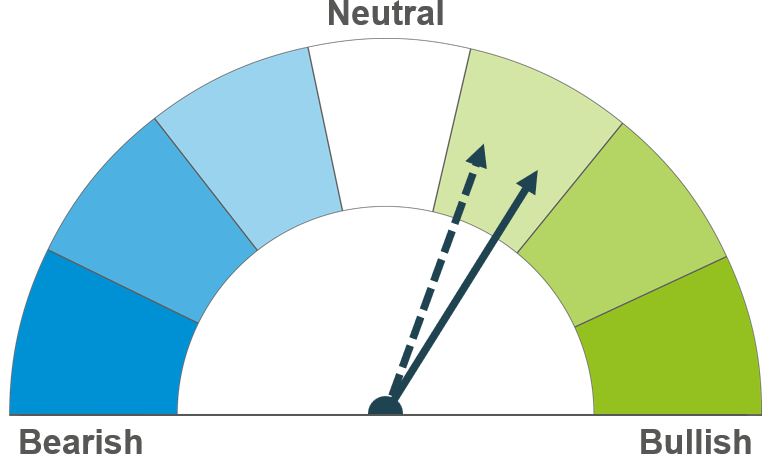

Markets remain reactive to weather concerns in Russia, with minimal rain due over the coming week. Forecasts of tightening stocks in major exporting countries could also support prices longer term.

Planting progression in Europe and the US is a watchpoint at the moment. Heavy maize supplies are expected longer-term, though further concern over wheat could push further demand onto maize

The condition of barley crops across the Northern Hemisphere is a watchpoint. Larger crops are currently forecast for 2024/25, though this is expected to be matched by increased demand.

Global grain markets

Global grain futures

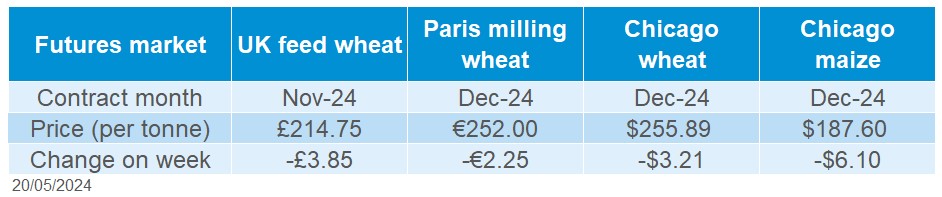

Global grain markets were pressured last week as weather concerns in Russia eased slightly, and crop conditions in the US remained stable. Chicago wheat futures (Dec-24) ended the week down 1.2%. Paris milling wheat futures (Dec-24) were down 0.9% over the same period.

Markets remain reactive to any news on the Russian wheat crop following May frosts in central regions, and dryness in southern parts of the country. On Wednesday, SovEcon reduced its estimate of the 2024 wheat crop to 85.7 Mt from its previous estimate of 89.6 Mt on the back of frost damage. However, forecasts of rain in southern areas eased concerns towards the end of last week. Minimal rain is due in some of the key wheat producing areas over the next seven days, something to watch out for.

In the USDA’s latest crop progress report released last Monday, US winter wheat conditions held firm. As at 12 May, 50% of the crop was in good or excellent condition, unchanged on the week and up from 29% a year earlier. US maize plantings are also progressing, at 49% complete, though are behind the five-year average pace of 54% complete.

Following periods of wet weather, western European crop conditions also remain in focus. On Friday, FranceAgriMer released an update of French crop conditions for week ending 13 May. For soft wheat, 64% of the crop was rated in good or excellent condition, unchanged on the week, but down from 93% a year earlier. The rating for winter barley was also unchanged and at a four-year low, at 66% in good or excellent condition. Spring barley held at 74%, a two-year low. Maize plantings are also progressing in France, now 72% complete, but well behind the five-year average of 91%. Plantings could be hindered by wet weather forecasts over the coming week.

UK focus

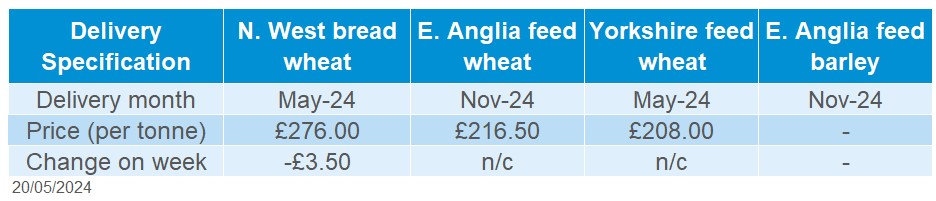

Delivered cereals

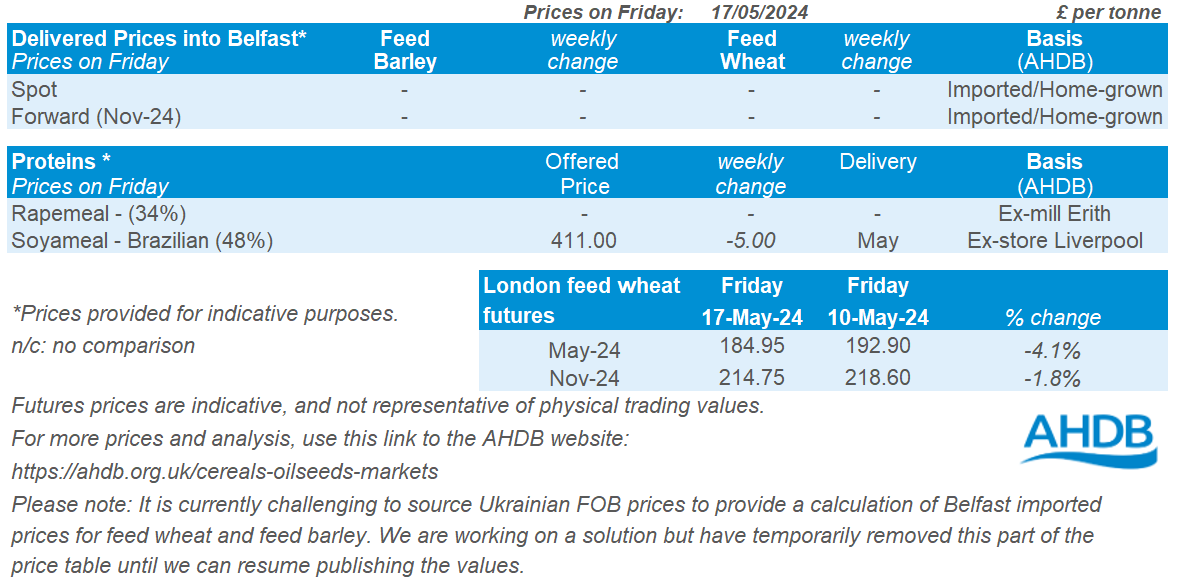

Domestic wheat futures followed global price movements down last week. UK feed wheat futures (Nov-24) closed on Friday at £214.75/t, down £3.85/t on the week. The Paris milling wheat futures price for Dec-24 dropped by €2.25/t to close at €252.00/t on Friday.

The UK feed wheat futures fell marginally more (percentage wise) than the global markets due to a recovery in sterling against the US dollar and euro.

The UK’s delivered prices showed mixed movements last week (Thursday to Thursday). Feed wheat delivered into East Anglia for May delivery was quoted at £198.50/t, up £3.00/t on the week. The November delivered feed wheat price into East Anglia was quoted at £216.50/t with no weekly comparison. Bread wheat delivered into the North West for May delivery was quoted at £276.00/t, down £3.50/t.

Oilseeds

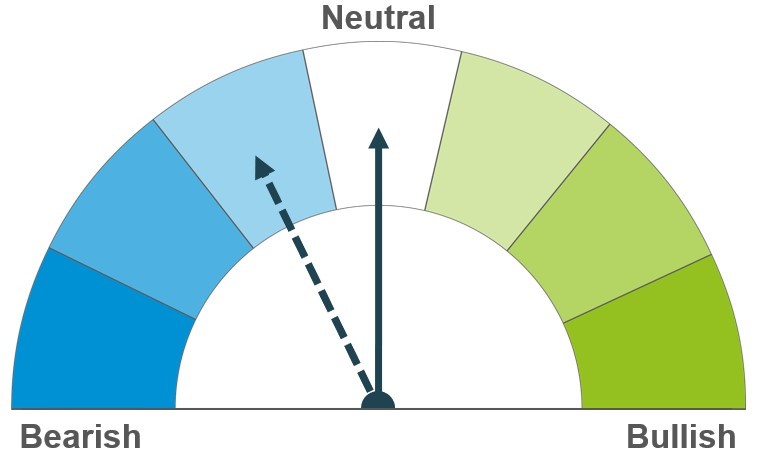

Rapeseed

Soyabeans

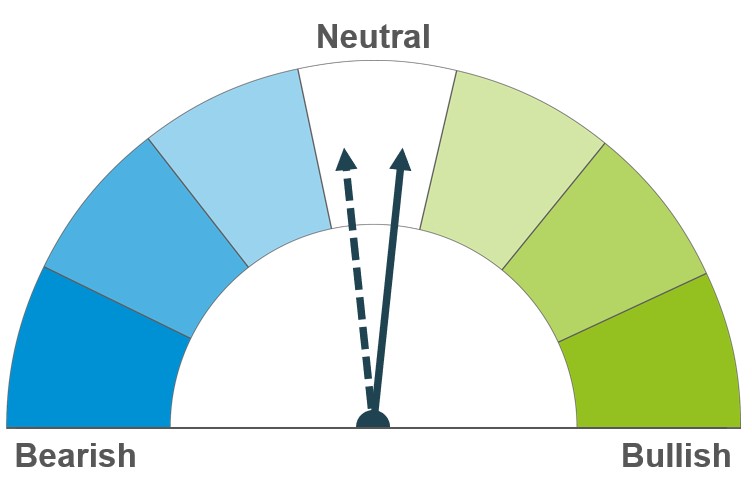

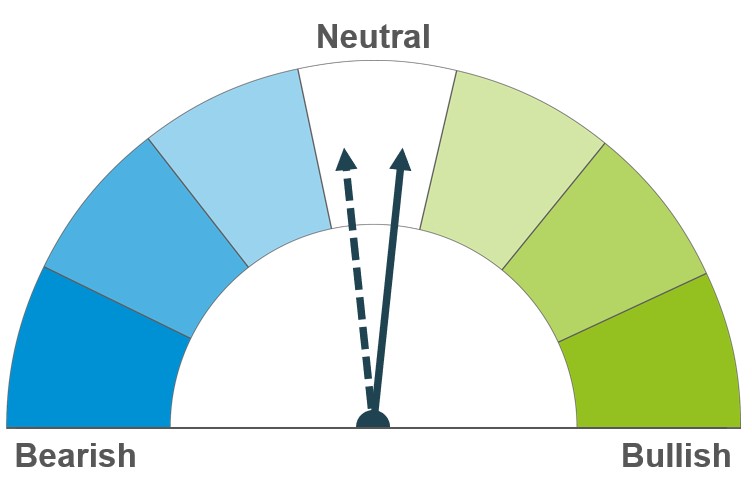

The potential for a draw-down in global rapeseed stocks in 2024/25 offers modest support for the short -and longer-term outlook, compared to soyabeans.

Uncertainty about the impact of flooding in Brazil on the 2023/24 crop, contrasts with weaker demand short-term. However, the projections for larger global soyabean crops in 2024/25 continue to weigh on the longer-term outlook.

Global oilseed markets

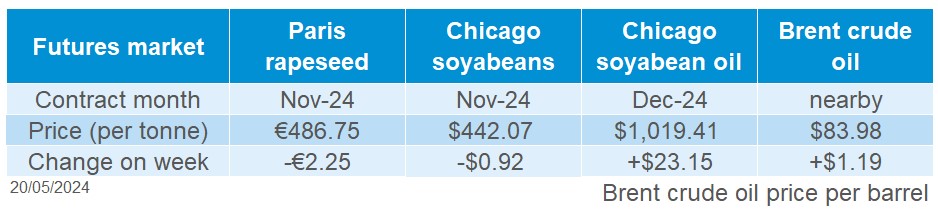

Global oilseed futures

The global oilseeds market fluctuated last week and ended the week slightly lower. New crop Chicago soyabean futures (Nov-24) lost $0.92/t (0.2%) to settle at $442.07/t on Friday.

Concerns about the impact of flooding in Brazil and buying by speculative traders supported prices at the start and end of the week. On Friday, the state agency for Rio Grande do Sol reported that soyabean harvesting was 85% complete, up from 78% a week earlier. However, the agency cautioned that quality was sharply lower than before the heavy rain and that part of the remaining area might be abandoned.

Meanwhile, despite earlier speculation which had supported prices, a list of increased US tariffs, released mid-week, did not include Chinese used cooking oil. This weighed on prices mid-week, along with a larger Brazilian 2034/24 soyabean crop forecast, and poorer demand for US soyabeans.

Brazilian government agency, Conab increased its soyabean production estimate by 1.16 Mt to 147.7 Mt. However, there’s still a wide range in estimates for the crop between various forecasters meaning that uncertainty in the short-term outlook persists.

National Oilseed Processors Association (NOPA) reported that US soyabean crushing fell to a seven-month low in April. Plus, while it’s still relatively early, US export sales for the 2024 crop also remain sluggish compared to recent years. Just 0.89 Mt are committed so far for export in 2024/25, the slowest pace since ahead of the 2005/06 season. With a larger US crop expected in 2024, signs of poorer demand were negative for soyabean prices.

This morning, data showed a surge in China’s imports of soybeans from Brazil and the US, which could offer support to oilseed prices. China’s import of soyabean totalled 8.57 Mt in April, up from 5.54 Mt in March (LSEG).

Rapeseed focus

UK delivered oilseed prices

Paris Nov-24 rapeseed futures were pressured over the week (Friday-Friday), decreasing €2.25/t to close at €486.75/t. Rapeseed generally tracked soyabean futures price movements last week.

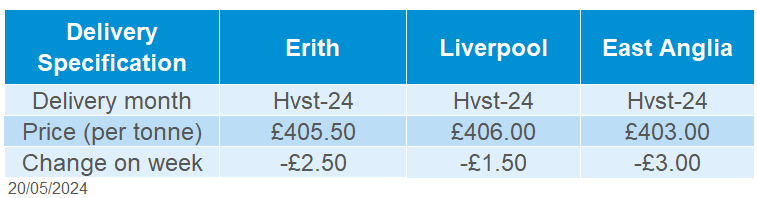

Rapeseed delivered into Erith for harvest (Aug-24) delivery was quoted at £405.00/t on Friday, down £2.50/t over the week (Friday-Friday). Similarly, the new crop (Nov-24) price delivered into Erith was quoted at £415.50/t, down £2.50/t for the same period.

While the market declined last week, globally, the rapeseed market remains supported by the projected decline in global production for the 2024/2025 season. In addition, there are weather concerns in parts of Australia which could affect production of canola (rapeseed).

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.