Arable Market Report – 16 December 2024

Monday, 16 December 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Christmas publications

This is the last AHDB Arable Market Report of 2024; our next report will be on Monday 6 January 2025. So, we would like to take the chance to wish you a very happy Christmas and a prosperous 2025.

Grain market daily will be published as usual until Friday 20 December and then pause until Thursday 2 January 2025.

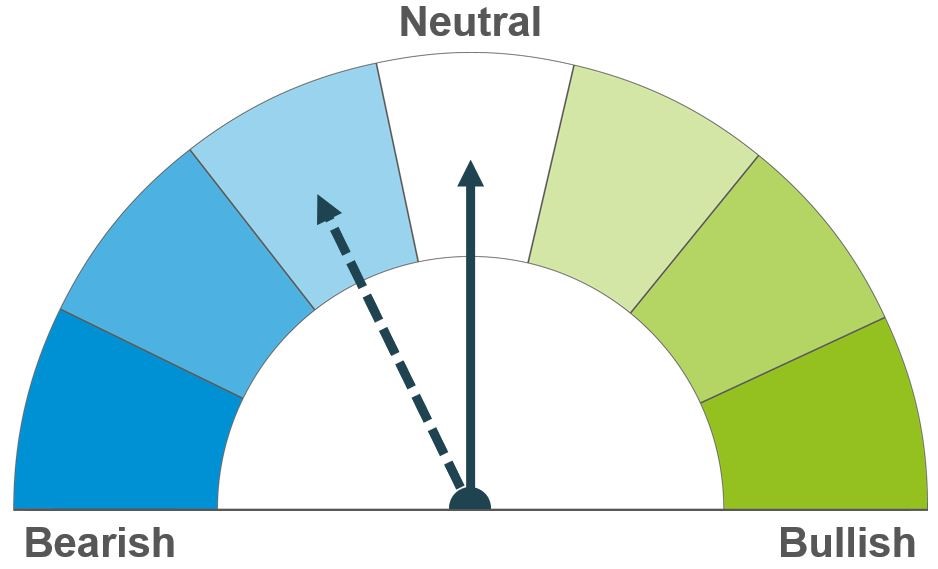

Wheat

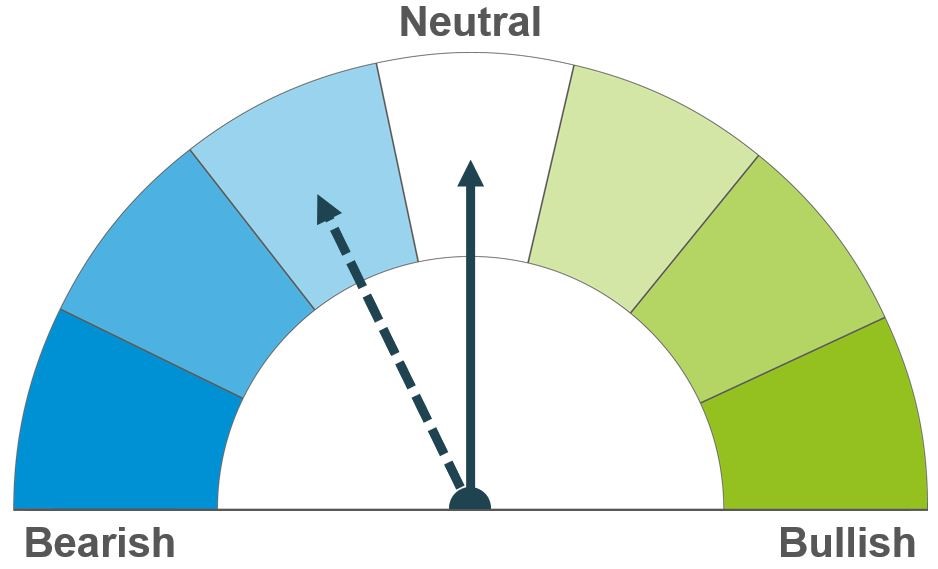

Maize

Barley

Expectations of slower Russian wheat exports counters pressure from Argentinian wheat supplies in the short-term. Longer term, reduced production estimates for the EU wheat harvest is offset by plentiful production in Australia.

Despite headwinds from a large Brazilian maize crop forecast, increased demand of US maize for both exports and ethanol usage lightens the weight of global ending stocks.

Revised forecasts in Australia improves the availability outlook for barley however bullish drivers in the wider cereals complex lend support.

Global grain markets

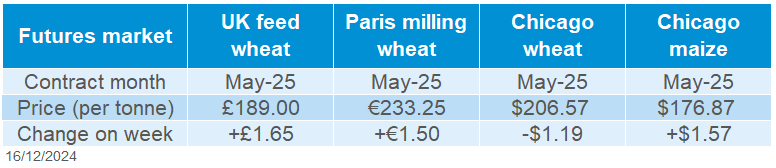

Global grain futures

Global grain markets were mixed last week (Friday-Friday), generally trading sideways. For the May-25 contract, Chicago wheat futures fell 0.6% across the week, however UK feed wheat and Paris milling wheat futures gained 0.9% and 0.7% respectively. Conversely to wheat, Chicago maize futures (May-25) rose 0.9% on the week.

The USDA’s World Agricultural Supply and Demand Estimates (WASDE) report for December was more bullish for maize than wheat. Global ending stocks for maize for the 2024/25 marketing year was cut by 7.7 Mt to 296.4 Mt mostly in response to an increase in US exports (+3.8 Mt) and usage for US ethanol (+50 million bushels, approx. 1.3 Mt). For wheat, notable revisions included a cut to EU wheat production by 1.3 Mt to 121.3 Mt and a modest downward revision to Russian wheat exports by 1.0 Mt to 47.0 Mt.

SovEcon forecasted that Russian wheat exports for December could range from 3.3 – 3.5 Mt, down from 4.1 Mt in November, although in line with the five-year average. SovEcon partly attributed the drop in export pace to reduced profitability, due to an increase in export taxes. Argus forecasted the 2025 Russian wheat crop at 81.5 Mt, up 0.2 Mt from its 2024 harvest estimate of 81.3 Mt.

Argentina’s Rosario grain exchange increased its 2024 wheat harvest estimate by 0.5 Mt to 19.3 Mt due to improved wheat conditions as the harvest is reported 58% complete. In review of the last 15 years, this would make the 2024 harvest the third largest, behind 2021 and 2019.

The Grain Industry Association of Western Australia raised estimates for wheat and barley production for the state from last month to 10.8 Mt (+0.5 Mt) and 5.1 Mt (+0.6 Mt) respectively due to better than anticipated yields. Eastern areas of Australia recorded significant rainfall last week which delayed harvest progress, however drier conditions have been forecasted.

Conab made relatively negligible amendments to its maize production forecast for Brazil, cutting it by 0.2 Mt to 119.6 Mt. Favourable weather conditions are supporting the planting pace (72.2% as at 08 Dec) and development of the first maize crop.

UK focus

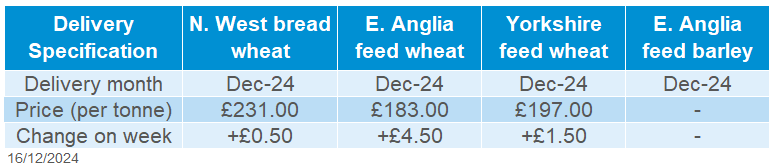

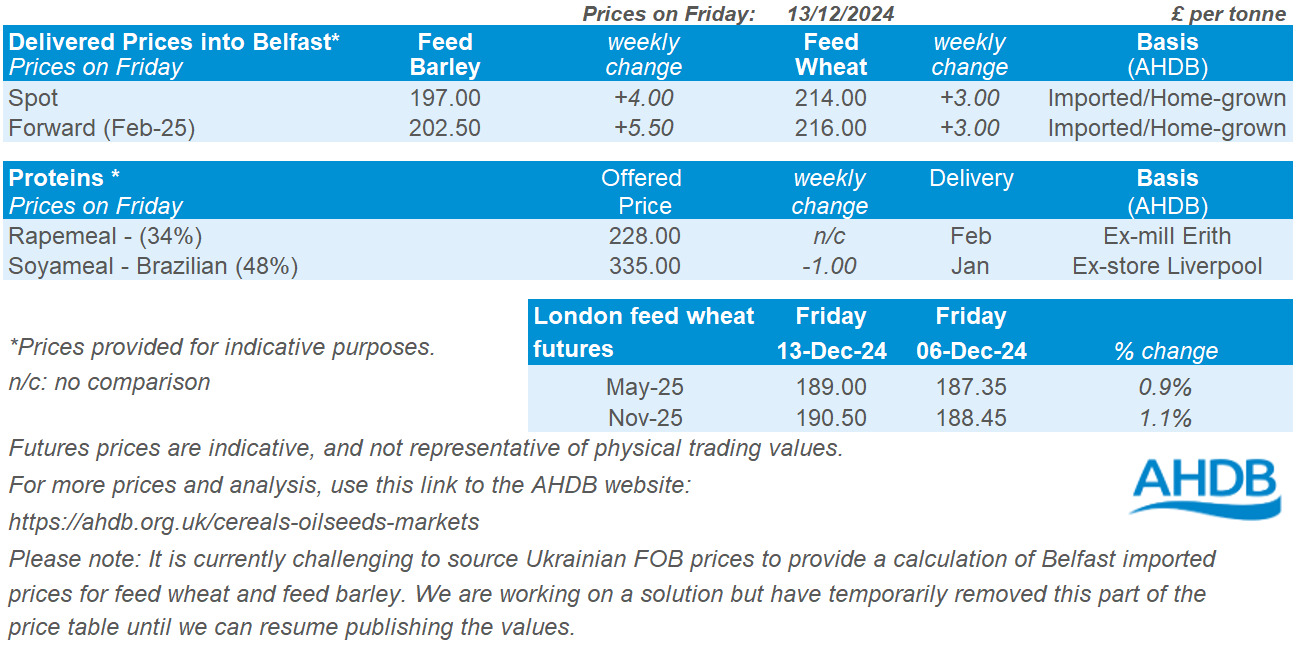

Delivered cereals

UK feed wheat futures (May-25) gained £1.65/t over the week (Friday-Friday), to close at £189.00. The Nov-25 contract closed at £190.50/t, gaining £2.05/t over the same period. UK feed wheat futures tracked global wheat markets, although strengthening in sterling earlier in the week capped gains.

Domestic delivered wheat prices fell across the week (Thursday-Thursday). Feed wheat delivered into East Anglia for December delivery was quoted at £183.00/t, up £4.50/t from last week. Bread wheat delivered to the North West for December delivery was quoted at £231.00/t, up £0.50/t, while February delivery also rose £0.50/t on the week to £234.50/t.

UK trade data for October showed wheat (inc. durum) imports totalled 253 Kt, bringing total imports since the start of the marketing year to 1.14 Mt; this exceeds the five-year average for this time period by 80%. Maize imports for October rebounded 78% on the month to 229 Kt, summing 876 Kt season-to-date (Jul-Oct); up 19% on the five-year average for this period.

Defra released final UK production estimates for 2024 harvest. Overall, the final Defra production figures for harvest 2024 saw relatively minimal change from AHDB’s provisional estimates made in October. For production, wheat was estimated at 11.1 Mt (-20% YoY), total barley at 7.1 Mt (+2% YoY), oats at 986 Kt (+19% YoY), and oilseed rape at 824 Kt (-32% YoY).

Following Defra’s release of full 2024 UK area, yield and production data, we have finalised the results of our Early Bird Survey (EBS), including publishing regional information. The headline forecasts for wheat, barley, oats and oilseed rape are little changed from last month’s provisional results. The largest change for these crops is for oilseed rape (+5 Kha) and all these changes reflect the incorporation of the finalised 2024 areas.

Oilseeds

Rapeseed

Soyabeans

Limited supply provides some support for rapeseed prices in the short term. However, expectations of a record soyabean crop in South America weighs on the oilseed complex longer term.

Soyabean markets find some support from the wider vegetable oils complex. However, larger estimates of the soyabean crop in South America weighs on the longer-term outlook.

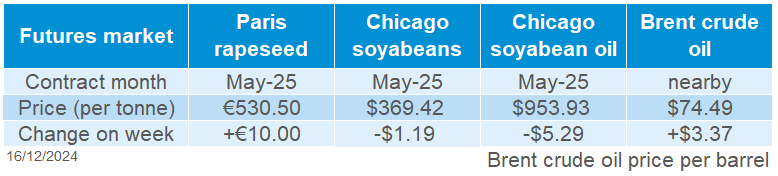

Global oilseed markets

Global oilseed futures

Chicago soyabean futures (May-25) fell 0.3% across the week (Friday-Friday). Since the beginning of November, soyabean futures have been volatile, but have remained in a narrow range, trying to find a direction for further price movement. The main supporting factor is strength in vegetable oil markets. On the other hand, forecasts of a large soyabean crop in South America limited any attempts at growth.

Vegetable oil prices show palm oil is currently trading at a significant premium to other oils. Comparing vegetable oil spot deliveries into north-western Europe, palm oil was more than 30% higher than soyabean oil last week. This is an atypical situation due to lower production and high export demand for palm oil in Indonesia and Malaysia, with soyabean oil prices under pressure from heavy supplies from Argentina and the US. Last week (Friday–Friday) Malaysian palm oil futures (MDEX) May-25 fell 2.2%. Heavy rains forecast for Malaysia in December could impact palm oil harvest and support prices in the short term.

Net US soyabean export sales from 28 November to 05 December totalled 1.2 Mt, down 49% from the previous week. Last Tuesday, the USDA’s WASDE report showed that the season average soybean price was forecast at $10.20 per bushel, down $0.60 from last month and higher than current nearest futures levels. Chicago soybean speculators reduced their net short position in the week ending 10 December.

The Brazilian Association of Vegetable Oil Industries (ABIOVE) forecasts a record soyabean crop of 168.7 Mt in 2025 (+1 Mt compared to November forecast), up 10% from last year.

According to the USDA’s latest December WASDE report, Argentina’s 2024/25 soybean production is forecast at 52.0 Mt, up 2% from last month, 8% from last year and the highest level in 6 years. Soyabean planting in Argentina was halfway complete at the beginning of September.

The USDA’s global sunflower seed production figure for this season remained relatively unchanged, with higher production for Ukraine and Russia largely offset by a smaller crop for the European Union (USDA). Ukrainian sunflower seed oil prices remained relatively consistent throughout the month. Though the Argentinian sunflower seed harvest could put pressure on the market soon, with harvest expected to start in the coming weeks.

Rapeseed focus

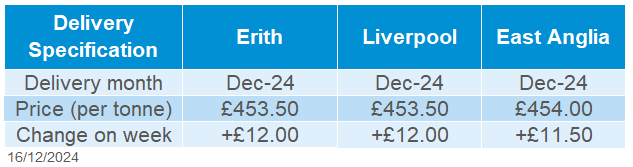

UK delivered oilseed prices

Paris rapeseed futures (May-25) gained €10.00/t (1.9%) across the week (Friday-Friday) to close at €530.50/t. The Nov-25 contract gained €5.50/t to close at €474.75/t. Old crop contracts gained more than new crop last week with trade activity gradually decreasing for major rapeseed exporters (Ukraine, Australia, Canada) to the EU. Also, medium-longer term, Australian new crop will add some additional supply and therefore is weighing on prices.

Rapeseed delivered to Erith for December 2024 delivery rose £12.00/t across the week (Friday-Friday), quoted at £453.50/t. Delivered prices for the 2025 crop (Aug-25) rose by £8.50/t, quoted at £404.00/t.

According to the USDA’s latest December report world rapeseed production estimates are 4 % lower than for the 2023/34 marketing year. Compared to November’s estimates, Canadian rapeseed production was revised down by 1.2 Mt mainly due to lower yields.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.