Arable Market Report – 11 November 2024

Monday, 11 November 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

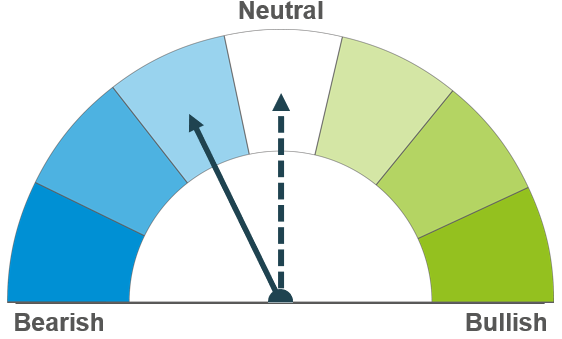

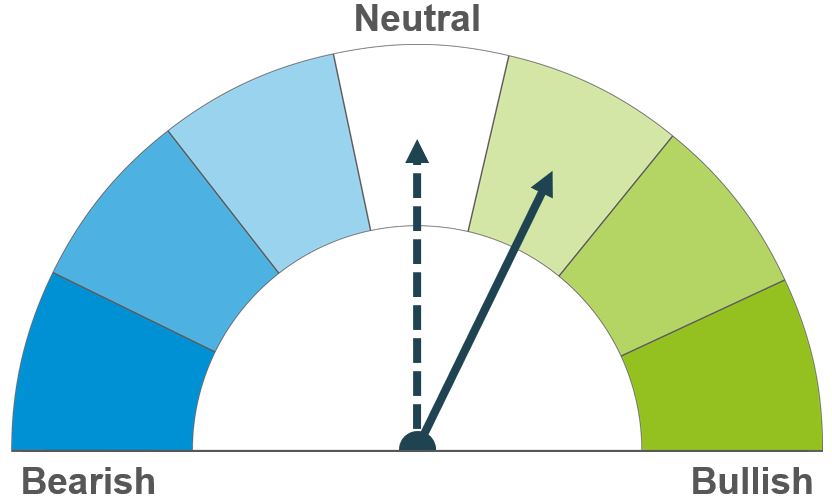

Wheat

Steady EU wheat exports and forecasts of favourable weather in the Black Sea region could pressure prices short term. However, US winter wheat crop conditions and lower production in Russia and Argentina could keep prices supported longer term.

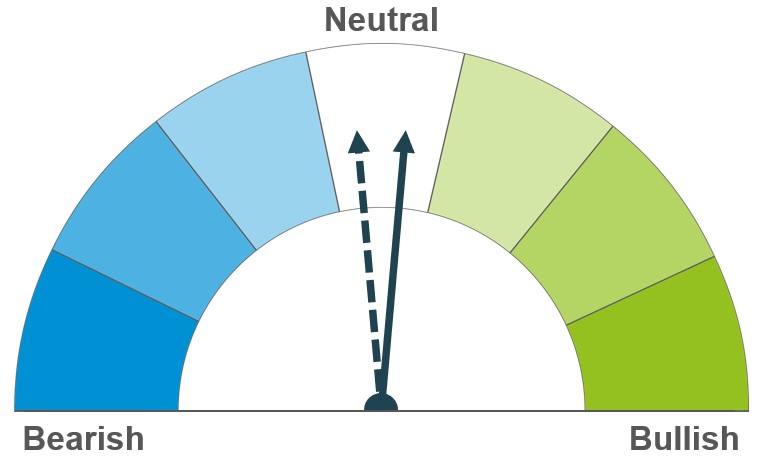

Maize

Competitive and therefore firm US exports provide near-term support, while comfortable global supply forecasts limit price rises long term.

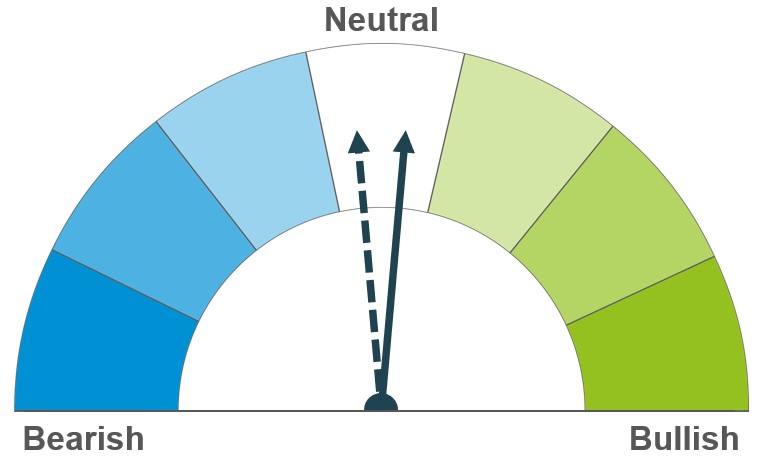

Barley

Recent strength in the maize market should support barley, but weak demand from major importers limits price gains.

Global grain markets

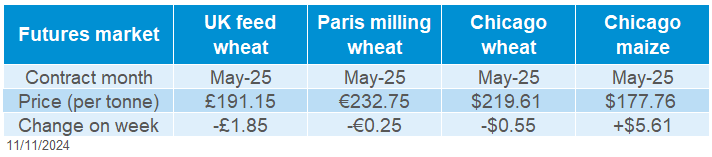

Global grain futures

Global grain prices were mixed last week (Friday-Friday). Paris milling wheat futures (Dec-24) fell 0.6%, while maize futures (Mar-25) rose 2.2%. Chicago wheat and maize futures (Dec-24) were up 0.8% and 4.0% respectively. Paris milling wheat futures were pressured by slower EU export pace. In the US, wheat prices were supported by a poor US winter wheat condition rating. Maize closed higher as sales of US maize remain strong, with last week’s data exceeding analyst expectations.

On Friday, the USDA released its monthly World Agricultural Supply and Demand Estimates (WASDE). For maize and wheat, most changes were generally in line with analyst expectations. Kazakhstan’s wheat production was raised by 2.0 Mt to 18.0 Mt based on the harvest result. This is the third-largest crop on record for Kazakhstan and the upward revision offsets wheat production reductions for Argentina, Brazil, Russia (-0.5 Mt per country from October estimates). Argentina’s wheat production for the 2024/25 marketing year is forecast at 17.5 Mt, down 3% from last month due to dryness during flowering.

Paris milling wheat is under pressure from competitive Black Sea exports and more favourable weather for winter crops in Ukraine. At the start of last week, Egypt GASC's purchased 290 Kt of wheat (120 Kt of Romanian wheat, 120 Kt of Ukrainian wheat and 50 Kt of Bulgarian wheat), with Ukraine pricing as the cheapest origin in the tender.

In last Thursday’s USDA Weekly Export Sales report, maize sales from 25 – 31 October totalled 2.77 Mt for 2024/25, up 18% from the previous week. Brazil's government published maize export data showing 6.41 Mt for the month of October 2024, lower than 8.45 Mt in October 2023. Brazil has a tighter exportable surplus amid strong domestic demand for ethanol and feed. Meanwhile, FranceAgriMer reported that 58% of the French maize crop had been harvested by 4 November (93% in 2023 and 89% on five-year average). Speculators trimmed their net short position in Chicago Board of Trade maize futures for the week ending 05 November.

FranceAgriMer also estimated that 78% of the winter barley crop had been sown by 4 November (80% in 2023 and 87% on five-year average). In the USDA’s November WASDE report, world barley production was lowered 1.1 Mt to 141.8 Mt mainly due to lower production in Russia.

UK focus

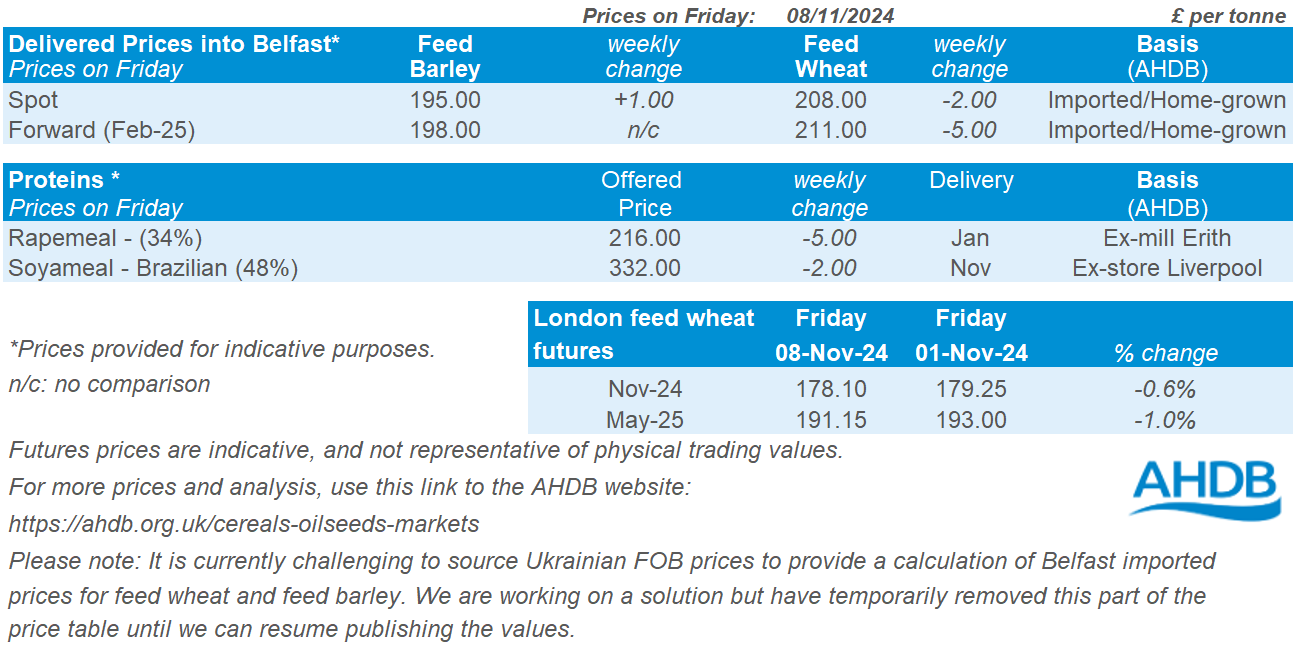

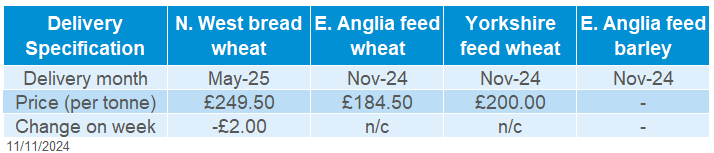

Delivered cereals

UK feed wheat futures (Nov-24) fell 0.6% on the week (Friday – Friday) to close at £178.10/t, while the May-25 contract closed at £191.15/t, down 1.0% over the same period. UK feed wheat futures were under pressure from Paris milling wheat futures and the strengthening of sterling against the euro, while maize prices limited downwards pressure.

For the latest UK delivered wheat prices, feed wheat delivered into Avonrange for November delivery was quoted at £187.50/t and £200.00/t for May delivery, down on the week by £1.50/t and £0.50/t respectively. Bread wheat delivered into Northamptonshire for November delivery was quoted at £230.50/t, increasing by £0.50/t on the week.

On Thursday (07 Nov), AHDB’s UK human and industrial cereal usage for September was released. From July to September 2024 UK flour millers (including for bioethanol and starch) used 1.1 Mt of domestic wheat (-17.5% for the same period last year) and milled 395.5 Kt of imported wheat (45.1% greater than the same period last year).

GB animal feed production data shows 38.7 Kt of maize was used in September 2024 in animal feed production, 29.4% higher year on year. From July to September 2024, maize usage in GB animal feed production was 102.1 Kt (25.7% greater than the same period last year).

Results of the 2024 AHDB Cereal Quality Survey are due to be released on Tuesday 12 November.

Oilseeds

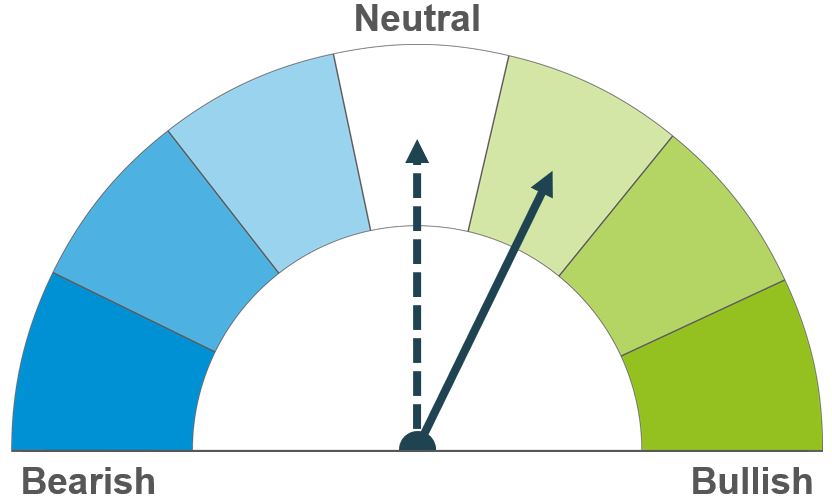

Rapeseed

A bullish outlook for both palm and soyabean oils offers support short term. However the potential for ample supply of soyabeans in the new year could keep a lid on prices longer term.

Soyabeans

The outcome of the US election could spur increased Chinese soyabean purchasing, as well as support the soyabean oil market. Favourable planting conditions in Southern America limit gains longer term.

Global oilseed markets

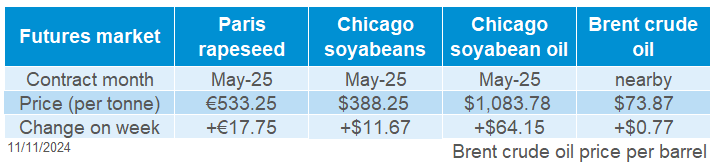

Global oilseed futures

Global oilseed markets were well supported last week (Friday-Friday), with the notable strength in vegetable oils continuing. Despite favourable conditions in South America aiding the soybean planting campaign, the outcome of the US election, continued rally in the vegetable oils market, and the USDA’s WASDE report, supported the oilseed complex.

Last week, Donald Trump was elected the 47th president of the US and will be inaugurated as president on 20 January 2025. Donald Trump mentioned he would raise tariffs on US imports of Chinese goods by at least 60%, which sparked speculation of a renewed trade war with China. However, raising tariffs on Chinese imports could reduce the competitiveness of used cooking oil from China (the largest origin), which competes with soyabean oil as a biofuel feedstock.

In South America, Brazil’s soyabean planting progression reached 53.5% (as at 03 Nov), with Mato Grosso (Brazil’s largest soyabean growing state) at 79.5% complete, both in line with progression this time last year. Planting pace has accelerated as optimal rainfall improved soil moisture levels and several states have reported good crop development (Conab). In Argentina, soybean planting was 7.9% complete (as at 06 Nov), and although estimated planted area was revised down 2% to 18.6 Mt, this is still 11% greater than the five-year average (Buenos Aires Grain Exchange).

Palm oil markets remain well supported following strong demand from India which reported a 59% rise in palm oil imports on the month to October, as refiners looked to replenish low stocks due to elevated demand from festivities. Industry experts expect Malaysian benchmark palm oil futures to continue to trade above 5,000 Malaysian ringgit per tonne (approx. £882/t as at 08 Nov) until June 2025, far exceeding prices seen for the last two years.

For the latest USDA WASDE report, the average trade estimate forecasted that global ending stocks of soyabeans would fall by 0.6 Mt to 134.1 Mt. However, the USDA has forecast ending stocks at 131.7 Mt, due to lower ending stocks in the US, Brazil, and Argentina. A sharp downward revision to US soyabean yield led to a 2.6% decrease for US soyabean production to 121.4 Mt; the main contributing factor to lower global stocks.

Rapeseed focus

UK delivered oilseed prices

The rally in Paris rapeseed futures continued last week as the May-25 contract gained €17.75/t over the week (Friday-Friday) to close at €533.25/t. As reported above, the continued strength of the vegetable oilseeds complex, particularly palm oil and soyabean oil, is continuing to lift the rapeseed market. Canadian rapeseed, which has recently been pricing for export to the EU, could see improved demand from the US biofuels sector if US imports of used cooking oil from China become subject to raised tariffs.

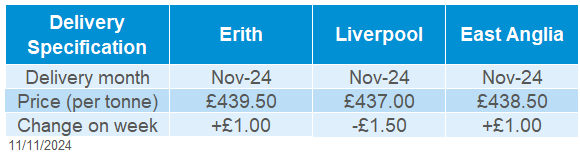

The delivered rapeseed price into Erith for November was quoted at £439.50/t on Friday, up £1.00/t from last week. For May delivery to the same location, the price was quoted at £449.00/t, rising £0.50/t over the same period. The weekly price change varies to Paris rapeseed futures partly due to the time the survey was carried out (Friday morning) and a rise in the strength of sterling against the euro.

LSEG reviewed its rapeseed production forecasts for Australia and the EU. For Australia, 2024/25 production was forecast down 4% from its previous forecast to 5.34 Mt (10% less than last year) due to unfavourable growing conditions. For the EU, production for 2025/26 is unchanged from the previous forecast at 18.62 Mt (up 9% on the year), with recent drier weather across western Europe supporting planting conditions.

UkrAgroConsult reported that Ukraine’s rapeseed exports for October dropped 29% from September, with expectations that the majority of rapeseed is exported by the end of the calendar year. As of 07 November, 1.07 MHa of rapeseed has been sown in Ukraine, 96% of the forecasted area, and up 2 percentage points from last week (UkrAgroConsult).

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.