Maize influence on UK feed wheat prices: Grain market daily

Thursday, 7 November 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £178.80/t yesterday, falling £0.40/t from Tuesday’s close. The May-25 contract also lost £0.40/t over the same period, to close at £192.55/t.

- While Paris milling wheat and maize futures gained yesterday with the euro weaking against the US dollar (USD), UK feed wheat futures slid. UK markets came under pressure from the strength of sterling, with the Bank of England adjusting interest rates downwards in todays update. Likewise, the Federal Reserve System in the US will also inform about its interest rate decisions today. The influence of currency volatility on commodities markets is large this week.

- Paris rapeseed futures (May-25) closed at €521.25/t yesterday, rising €10.75/t from Tuesday’s close. The Aug-25 contract gained €9.50/t over the same period, to close at €489.25/t.

- A strengthening in the vegetable oils complex and decreasing euro to USD supported Paris rapeseed futures prices. Chicago soyabean oil futures (Dec-24) gained 3.0% from Tuesday’s close. India, the world's biggest vegetable oil importer, sharply increased its Palm oil imports in October.

Maize influence on UK feed wheat prices

Recently UK feed wheat futures have been increasingly influenced by Paris maize futures. On Tuesday (5 November), Paris milling wheat futures (Mar-24) closed flat, but UK feed wheat (Mar-24) and Paris maize futures (Mar-24) rose by £1.00/t and £0.75/t respectively. UK feed wheat futures typically move in the same direction as Paris milling wheat, of course taking into account currency influence. The impact of maize prices on feed wheat is interesting to us for a few reasons: firstly, both represent a feed complex; secondly, maize prices are under pressure now due to harvest coming to an end in the US. However, in the EU, maize production and ending stocks are estimated to be lower on the year in 2024/25.

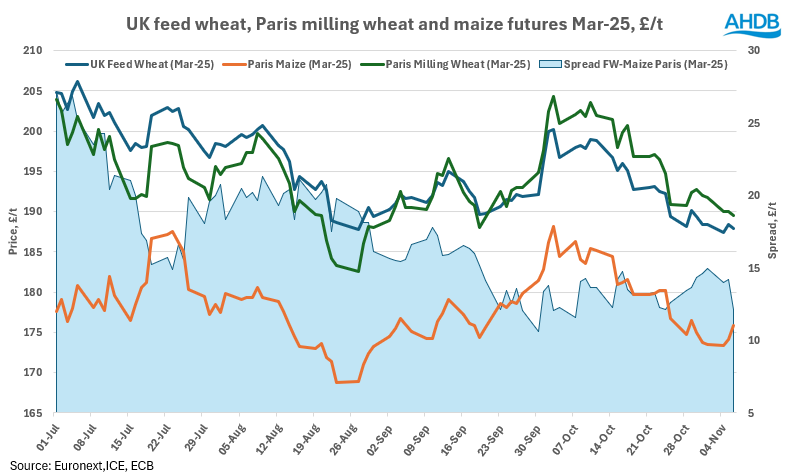

The spread between UK feed wheat and Paris maize futures (Mar-25) started the season at £27.16/t (1 July 2024), before starting to narrow later in July as the wheat harvest accelerated in the Northern Hemisphere. As at 6 November the spread was £12.14/t. The larger discount of maize to wheat led to stronger UK maize imports in July and August 2024. Today’s GB animal feed production data release shows 38.7 Kt of maize was used in September 2024 in animal feed production, 29.4% higher year on year. From July to September 2024, maize usage in GB animal feed production was 102.1 Kt (+25.7% to the same period in the previous year).

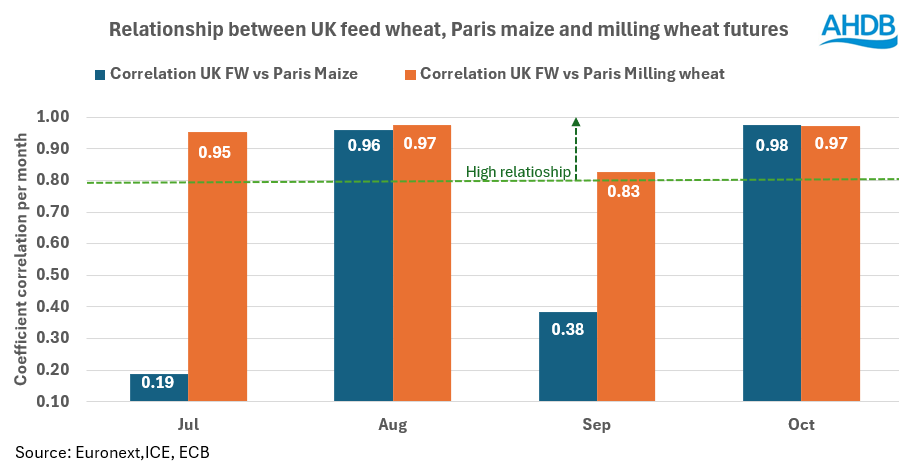

Correlation analysis for the months of July to October 2024 shows that UK feed wheat price movements are highly correlated with Paris milling wheat futures. However, in August and October we saw a very high correlation between Paris maize and UK feed wheat. In July 2024, Paris maize futures (Mar-25) were up 0.5 %, while UK feed futures (Mar-25) were down 3.1%. In September 2024, Paris maize futures (Mar-25) gained 4.0 %, UK feed futures (Mar-25) gained 1.0%. The correlation between UK feed wheat and Paris maize futures prices was low in July and September 2024.

Looking ahead

Recently, we have seen a downward trend in UK feed wheat futures prices, and one of the factors contributing to this decline, as shown by the correlation analysis, may be pressure from Paris maize futures. Of course, when analysing long periods, we can say that the relationship between milling wheat and feed wheat is quite high, but there are periods like October 2024, when the impact of maize on feed wheat was also very significant. The price relationship between feed wheat and maize will need to be monitored.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.