UK maize imports start 2024/25 at record pace: Grain market daily

Friday, 18 October 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £185.25/t yesterday, falling £1.10/t from Wednesday’s close. The May-25 contract lost £0.85/t over the same period, to close at £200.00/t.

- While Chicago and Paris wheat futures (Dec-24) gained yesterday as the market monitored Russian wheat export values, UK feed wheat futures slid. The UK futures came under pressure from a recovery in the strength of sterling, plus technical pressure from the 20-day moving average.

- Paris rapeseed futures (Nov-24) closed at €496.00/t yesterday, rising €4.00/t from Wednesday’s close. The May-25 contract gained €3.25/t over the same period, to close at €499.00/t.

- A strengthening in the vegetable oils complex supported rapeseed prices; Chicago soyabean oil futures (Dec-24) gained 2.2% from Wednesday’s close. Plus, the euro weakened yesterday as the European Central Bank cut interest rates by 0.25 percentage points to 3.25%, supporting Paris rapeseed futures.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

UK maize imports start 2024/25 at record pace

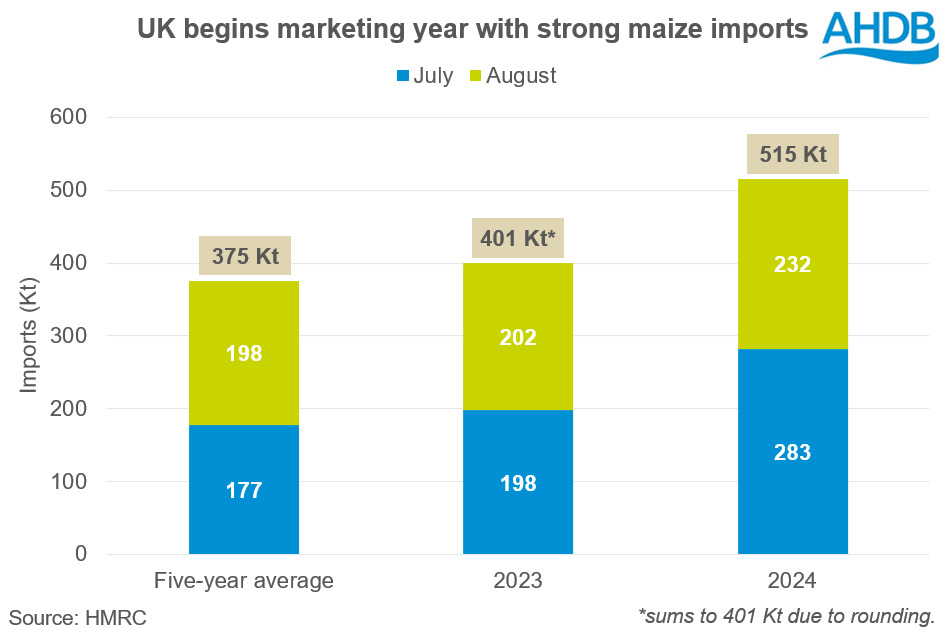

The latest UK trade data shows maize imports at 515 Kt for July and August, 28% greater than last year and 37% more than the five-year average. The sum of July and August imports are also the largest since at least 2000 (electronic records).

Wheat imports have also begun the marketing year strongly. The rise of grain imports has been encouraged due to the expected sharp fall in domestic wheat production (shown in English data out last week and UK data on Tuesday).

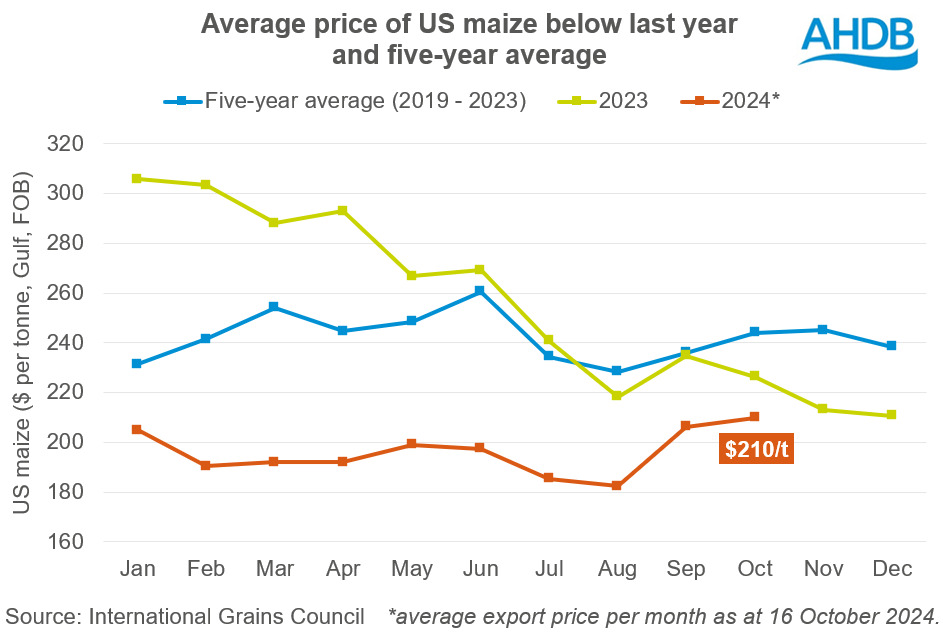

A slide in global maize prices is also an important factor. Maize prices came under pressure as the second largest US maize crop on record developed in favourable conditions during the summer and is being harvested at an above average pace.

Prices from the US, usually the largest global exporter of maize, clearly show the global trend. While US maize for export (FOB) had begun the year at $205/t (January average), prices dropped below $200/t during the spring and summer months. This was as anticipation of plentiful global supply developed in response to expectations of the second largest US maize harvest.

The crop continued to be reported in above average conditions during its development and the average price fell as low as $182/t for August, when the US Pro Farmer Crop Tour also reassured the market of an ample US maize crop. However, recently, maize prices have lifted after Eastern European and Ukrainian maize yields suffered from a heatwave. Plus, they tracked gains in the wheat market in response to dryness in key wheat-producing regions.

Looking ahead

For the UK, lower domestic cereals production is likely to continue to encourage above average grain imports. Whole and flaked maize for GB compound animal feed usage recorded a yearly rise of 23% for July and August. This was the greatest rise across all other feed types suggesting that maize has already become more competitive in the feed ration and rations can often remain consistent through livestock life stages for monogastric.

Also, industrial grain users, including the Ensus biofuel plant, and some grain distillers have the option to use maize, as well as wheat.

As maize prices remain competitive against rival cereals on the global stage, this could also support import demand for maize. But the price relationship between wheat and maize will need to be monitored.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.