Higher global wheat prices widen the gap over maize: Grain market daily

Wednesday, 9 October 2024

Market commentary

- UK feed wheat futures (Nov-24) closed yesterday at £188.80/t, up £0.55/t from Monday’s close. The May-25 contract rose £0.20/t over the same period, ending the session at £202.95/t.

- The UK futures tracked Chicago wheat and Paris milling wheat futures which were both up yesterday. Support for prices came from an attack on a grain port in Ukraine and weather risks in Russia, which helps to ease the pressure from higher Black Sea exports. The commodity market is looking ahead to the USDA’s World Agricultural Supply and Demand Estimates (WASDE) due out on Friday.

- Paris rapeseed futures (Nov-24) ended yesterday at €484.50/t, down €6.00/t from Monday’s close. The May-25 contract closed at €492.75/t, also down €6.50/t over the session.

- European rapeseed prices followed crude oil and soyabeans futures down yesterday. Harvest pressure from the US and forecasts of beneficial rains in Brazil weighed on prices.

Higher global wheat prices widen the gap over maize

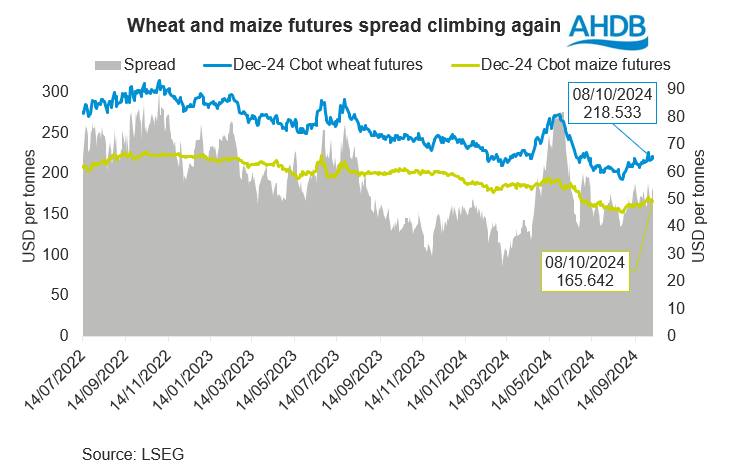

A major indicator in grain markets is the spread between wheat and maize prices. Recently, global wheat prices have risen to levels not seen since mid-June. On 2 October, Chicago wheat futures (Dec-24) rose 14.7% to $226.1/t, up from an all-time low of $192.9/t on 26 August. During the same period, Chicago maize futures (Dec-24) rose more slowly, by 18.11/t. This expanded the spread by $15.1/t, from $40.7/t to $55.8/t.

The surge in wheat prices was driven by a mix of factors, including ongoing droughts in key producing countries, export restrictions, geopolitical tension in Ukraine and the Middle East, and higher global demand.

As at yesterday’s close, Dec-24 Chicago wheat and Dec-24 Chicago maize futures settled at $218.5/t and $165.6/t respectively. However, the spread remains at $52.9/t, which is $9.3/t higher than this time last year.

Can the spread widen further?

At the moment, a combination of weather risks and robust global demand is supporting wheat prices. However, competitive exports from the Black Sea have long capped price rises. Weather forecasts indicate a dry week ahead in the Russian and US winter wheat belts, while heavy rain is expected France.

The USDA’s World Agricultural Supply and Demand Estimates (WASDE) is set to be released this Friday, 11 October. This report will provide insights into global production forecasts, consumption, and trade. Any significant information from the report could influence market sentiment and prices moving forward. Something to closely monitor as markets adjust ahead of the report.

Has the spread reached a Limit?

The current market uncertainties make it difficult to predict whether the spread has reached its limit. In the past, the price gap between Dec-24 Chicago wheat and maize futures has risen above $90/t. However, since both grains can be used interchangeably in many ways, this often helps to regulate the spread, allowing buyers to switch based on price.

Impact on UK feed demand

The UK feed industry tracks movements between wheat and maize prices to optimize feed formulation. A higher premium for wheat over maize could lead to increased demand for maize as a substitute in animal feed.

Looking ahead, the harsh realities of adverse weather could lead to further cuts in wheat production estimates in key producing countries, potentially widening the gap.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.